Get the free DISTRESSED BUSINESS TAX CREDIT

Show details

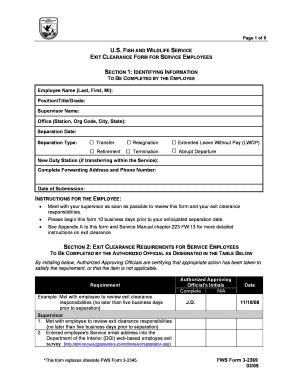

TYPE OF BUSINESS Retail Wholesale Service Manufacture Other WORKSHEET GUIDANCE 1 of 1 To complete this worksheet you will need Your Philadelphia Business Income Receipts and if applicable the Net Profits Tax returns for 2014 2015 and 2016. BUSINESS LOCATION Line 10 times 100 Line 14 of Line 7 times. 2 20 Line 15 or 20 000. When filing enter this amount on BIRT Schedule SC Line 8. You cannot take this credit SEPTA Commonwealth of Pennsylvania United States of America When did construction...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign distressed business tax credit

Edit your distressed business tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your distressed business tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing distressed business tax credit online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit distressed business tax credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out distressed business tax credit

How to fill out distressed business tax credit

01

Step 1: Gather all necessary documents such as financial statements, tax returns, and any relevant business records.

02

Step 2: Determine if your business qualifies for distressed business tax credit. Check the eligibility criteria provided by the tax authorities.

03

Step 3: Complete the application form for the tax credit. Make sure to provide accurate and detailed information about your business and its financial situation.

04

Step 4: Attach all the required documents to support your application, including proof of business distress and financial hardship.

05

Step 5: Review your application for any mistakes or omissions. Make necessary corrections before submitting it to the tax authorities.

06

Step 6: Submit your completed application along with the supporting documents to the designated tax office.

07

Step 7: Wait for the tax authorities to review your application. Be prepared to provide any additional information or clarifications if requested.

08

Step 8: If your application is approved, you will receive the distressed business tax credit. Follow any instructions provided by the tax authorities to claim the credit on your tax return.

Who needs distressed business tax credit?

01

Small businesses facing financial distress due to unforeseen circumstances may need the distressed business tax credit.

02

Businesses that have experienced a significant decline in revenues, increased expenses, or other hardships may be eligible for the tax credit.

03

Entrepreneurs who are struggling to keep their businesses afloat and need financial assistance to recover from the distressing situation can benefit from the tax credit.

04

Businesses in industries heavily impacted by economic downturns or natural disasters may also qualify for the distressed business tax credit.

05

It is advisable to consult with a tax professional or the local tax authorities to determine if your business qualifies for the tax credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get distressed business tax credit?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the distressed business tax credit. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in distressed business tax credit?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your distressed business tax credit to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in distressed business tax credit without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your distressed business tax credit, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is distressed business tax credit?

Distressed business tax credit is a credit provided to businesses that are experiencing financial distress.

Who is required to file distressed business tax credit?

Businesses that meet the eligibility criteria for distressed business tax credit are required to file the credit.

How to fill out distressed business tax credit?

Distressed business tax credit can be filled out by providing relevant financial information and supporting documentation.

What is the purpose of distressed business tax credit?

The purpose of distressed business tax credit is to provide financial relief to businesses facing economic challenges.

What information must be reported on distressed business tax credit?

Information such as financial statements, operating costs, and details of the financial distress must be reported on distressed business tax credit.

Fill out your distressed business tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Distressed Business Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.