Get the free INSTRUCTIONS FOR RETURNED CHECKS

Show details

MONROE COUNTY PROSECUTOR IS OFFICE James L. Peters, Prosecutor Jamie A. Riley, Assistant Prosecutor Kim Whit acre, Legal Assistant Becky Huffman, Legal Assistant Lynn Booker, Victim Advocate 101 N.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for returned checks

Edit your instructions for returned checks form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for returned checks form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit instructions for returned checks online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit instructions for returned checks. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

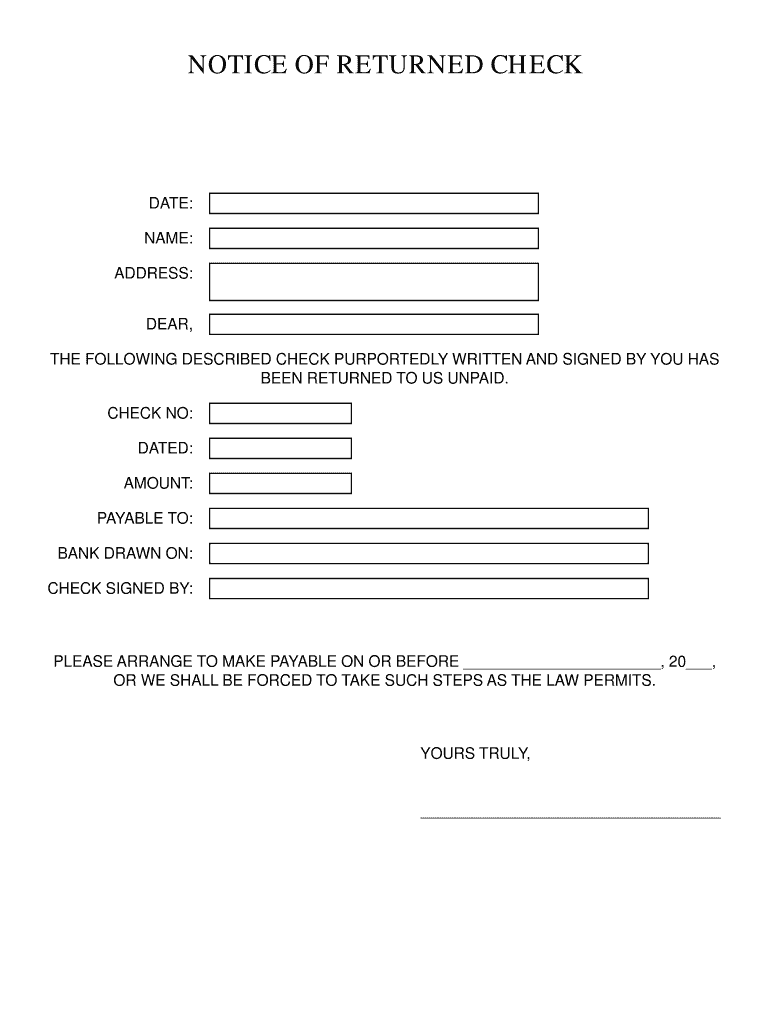

How to fill out instructions for returned checks

How to fill out instructions for returned checks:

01

Start by entering the date at the top of the instructions form. This will ensure that the information is properly documented.

02

Beneath the date, provide your contact information such as your name, address, and phone number. This will help the recipient of the instructions to easily reach out to you if necessary.

03

Indicate the recipient's contact information, including their name, address, and phone number. This is important for the recipient to accurately identify the intended party.

04

Next, specify the purpose of the instructions. In this case, indicate that the instructions are for returned checks. Be clear and concise in explaining the purpose to avoid any confusion.

05

Provide the necessary details regarding the returned checks. This may include the check numbers, dates, and amounts for each returned check. List them individually to maintain organization.

06

Specify the reason for the return. This can be due to insufficient funds, an invalid account, or any other reason provided by the bank or financial institution.

07

Include any additional information or instructions that may be required. For example, if the recipient needs to take any action or submit any documentation, clearly state these requirements.

08

Finally, sign and date the instructions form. This verifies that the information provided is accurate and complete.

Who needs instructions for returned checks:

01

Individuals who have received a returned check due to insufficient funds or other issues.

02

Business owners or managers who handle financial transactions and encounter returned checks.

03

Financial institutions or banks that need to inform their customers about returned checks and provide specific instructions for resolving the issue.

Overall, instructions for returned checks are essential for accurately communicating the necessary actions to be taken in response to a returned check and help resolve the situation promptly and efficiently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the instructions for returned checks in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your instructions for returned checks in seconds.

How do I edit instructions for returned checks on an iOS device?

Create, modify, and share instructions for returned checks using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete instructions for returned checks on an Android device?

On an Android device, use the pdfFiller mobile app to finish your instructions for returned checks. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is instructions for returned checks?

Instructions for returned checks provide guidance on how to handle and process checks that have been returned by the bank due to insufficient funds or other reasons.

Who is required to file instructions for returned checks?

Any individual or organization that receives returned checks is required to file instructions for returned checks.

How to fill out instructions for returned checks?

Instructions for returned checks can be filled out by providing details of the returned check, such as the check number, date, amount, reason for return, and any additional comments or actions to be taken.

What is the purpose of instructions for returned checks?

The purpose of instructions for returned checks is to ensure that proper procedures are followed in handling returned checks, including notifying the payee, resubmitting the check, or taking other appropriate actions.

What information must be reported on instructions for returned checks?

Information that must be reported on instructions for returned checks includes the check number, date, amount, reason for return, and any actions or comments related to the returned check.

Fill out your instructions for returned checks online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Returned Checks is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.