Get the free SA r & IRD

Show details

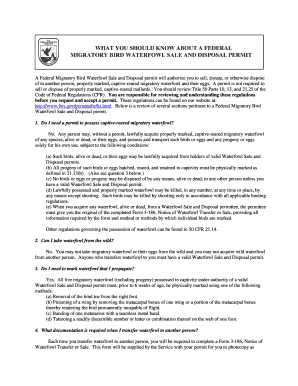

Tun.sg EARLY BIRD TEAM DISCOUNT 5 OFF GROUP OF 3 OR MORE 10 OFF 7 OFF RESERVE A SPACE NOW VENUE ACCOMODATION The Lalit Mumbai Sahar Airport Road Mumbai Maharashtra 400059 India 91 22 6699 2222 http //www. thelalit.com/hotels-in-mumbai/ Yes I/We Will attend I would like to purchase the course documentation at sgd 500 per set. Re EAR gis LY te B SA r IRD VE pa S up y by PE to 2 C SG 1 Ju IAL D l 72 y 20 HAZOP Training for Team Leaders 1 - 3 September 2015 Mumbai Layer of Protection Analysis...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sa r amp ird

Edit your sa r amp ird form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sa r amp ird form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sa r amp ird online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sa r amp ird. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sa r amp ird

How to fill out sa r amp ird

01

Step 1: Gather all the necessary documents such as income statements, tax forms, and identification documents.

02

Step 2: Obtain the SA R&IRD form from the relevant tax authority.

03

Step 3: Read the instructions provided with the form to understand the requirements.

04

Step 4: Begin filling out the form by entering personal details like name, address, and contact information.

05

Step 5: Provide accurate information about your income, including salary, investments, and any other sources of earnings.

06

Step 6: Attach supporting documents as per the list provided in the form instructions.

07

Step 7: Double-check all the entries to ensure accuracy and completeness.

08

Step 8: Sign and date the form, acknowledging the truthfulness of the information provided.

09

Step 9: Submit the filled SA R&IRD form along with the necessary documents to the designated tax office.

10

Step 10: Keep copies of the filled form and supporting documents for your records.

Who needs sa r amp ird?

01

Individuals who earn income in the respective tax jurisdiction need to fill out SA R&IRD.

02

Employed individuals, self-employed individuals, and those with various sources of income should complete SA R&IRD.

03

Companies, partnerships, and other business entities must also file SA R&IRD for tax purposes.

04

Any individual or entity required by law to pay taxes and report income should fill out SA R&IRD.

05

It is recommended to consult with a tax professional or refer to the specific tax regulations to determine if SA R&IRD is necessary in a particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my sa r amp ird in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your sa r amp ird right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit sa r amp ird on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share sa r amp ird from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete sa r amp ird on an Android device?

Use the pdfFiller Android app to finish your sa r amp ird and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is sa r amp ird?

SAR stands for Suspicious Activity Report and IRD stands for Interest Reporting Document. SAR amp IRD refers to the reporting of suspicious activities and interest information to regulatory authorities.

Who is required to file sa r amp ird?

Financial institutions, including banks, credit unions, and other financial service providers, are required to file SAR amp IRD.

How to fill out sa r amp ird?

SAR amp IRD forms can be filled out electronically or manually, following the guidelines provided by the regulatory authorities.

What is the purpose of sa r amp ird?

The purpose of SAR amp IRD is to help detect and prevent money laundering, terrorist financing, and other illegal activities.

What information must be reported on sa r amp ird?

Information such as suspicious activities, large cash transactions, and interest earned on accounts must be reported on SAR amp IRD.

Fill out your sa r amp ird online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sa R Amp Ird is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.