Get the free Tax Preparation Fees by the Forms

Show details

THE BIGGEST IN TAX SAVINGS COMPANY A Division Of: Plus Incorporated 17350 Temple Ave., Unit # 320 La Puerto, CA 917444636 Phone: (818) 2634623 Fax: (866) 5852682 Our tax office charges strictly by

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax preparation fees by

Edit your tax preparation fees by form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax preparation fees by form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax preparation fees by online

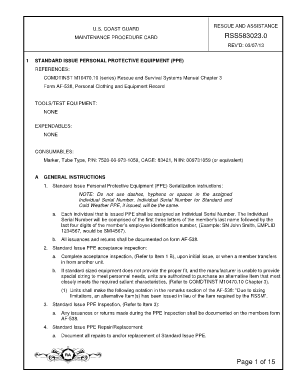

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax preparation fees by. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax preparation fees by

How to fill out tax preparation fees by:

01

Gather all necessary documents - Before starting to fill out your tax preparation fees, make sure you have all the relevant documents handy. This may include your W-2 forms, 1099 forms, receipts for deductions, and any other supporting documentation related to your income and expenses.

02

Identify your filing status - Determine your filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). This status will determine how you report your income and claim deductions or credits.

03

Calculate your taxable income - Calculate your taxable income by adding up all your sources of income, including wages, self-employment income, interest, dividends, and rental income. Subtract any deductions or exemptions you are eligible for to arrive at your taxable income.

04

Choose the appropriate tax form - Select the tax form that matches your filing status and complexity of your tax situation. The most common forms are Form 1040, Form 1040A, and Form 1040EZ, each with different eligibility criteria and varying levels of detail required.

05

Fill out the necessary sections - Complete the required sections of the chosen tax form. This includes providing personal information, reporting income, claiming deductions, and calculating your tax liability. Take your time and ensure accuracy as mistakes can lead to delays or potential audit triggers.

06

Determine your tax credits and deductions - Determine if you are eligible for any tax credits or deductions that can reduce your overall tax liability. This may include credits for education expenses, child and dependent care expenses, or deductions for mortgage interest, medical expenses, or charitable contributions.

07

Review and double-check your work - Before submitting your tax preparation fees, carefully review the form to ensure all information is accurate and complete. Double-check calculations and verify that you have included all required schedules, supporting documents, and signatures.

Who needs tax preparation fees by:

01

Individuals with complex financial situations - If you have multiple income sources, rental properties, investments, or self-employment income, you may benefit from using a tax professional to help navigate the complexities of tax preparation fees.

02

Small business owners - Business owners with pass-through entities, such as sole proprietorships, partnerships, or S corporations, often require professional assistance to accurately report business income, deductions, and comply with relevant tax laws.

03

Those with limited tax knowledge or time - Some individuals simply do not have the expertise or time to navigate the complexities of tax preparation fees on their own. Hiring a tax professional can provide peace of mind and ensure compliance with tax regulations.

04

Individuals with significant life events - Major life events like getting married, having children, buying a home, or retiring can have significant tax implications. Seeking professional help during these transitions can help maximize tax benefits and avoid costly mistakes.

05

Individuals facing tax issues or audits - If you have encountered tax issues in the past, been audited, or have concerns about potential tax liabilities, hiring a tax professional can provide valuable guidance, ensure proper compliance, and protect your interests.

Remember, this information is not exhaustive, and professional advice tailored to your specific circumstances is always recommended when dealing with tax preparation fees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax preparation fees by?

Tax preparation fees are typically charged by tax preparers for their services in helping individuals and businesses with their tax return preparation.

Who is required to file tax preparation fees by?

Anyone who seeks assistance from a tax preparer for their tax return preparation is required to pay tax preparation fees.

How to fill out tax preparation fees by?

Tax preparation fees are usually included as part of the total fee charged by the tax preparer. The individual or business simply needs to provide the necessary information and documents to the tax preparer.

What is the purpose of tax preparation fees by?

The purpose of tax preparation fees is to compensate tax preparers for their time and expertise in preparing accurate and compliant tax returns.

What information must be reported on tax preparation fees by?

The tax preparation fees must be reported as an expense on the individual's or business's tax return.

How can I send tax preparation fees by to be eSigned by others?

Once you are ready to share your tax preparation fees by, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete tax preparation fees by online?

pdfFiller makes it easy to finish and sign tax preparation fees by online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit tax preparation fees by on an iOS device?

Create, modify, and share tax preparation fees by using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your tax preparation fees by online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Preparation Fees By is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.