Get the free Error Codes BTe-File TY2013 v1.0.xlsx - NYC.gov

Show details

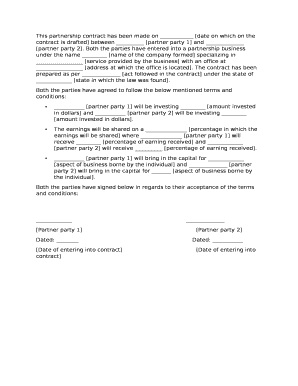

NYC Business Tax e-File Error Codes Category ErrorCode Error Description Parameter Value ? Composition Error P 106 The state schema version is missing in the return state element Composition Error

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign error codes bte-file ty2013

Edit your error codes bte-file ty2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your error codes bte-file ty2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit error codes bte-file ty2013 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit error codes bte-file ty2013. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out error codes bte-file ty2013

How to fill out error codes bte-file ty2013:

01

Make sure you have the necessary information: Before filling out the error codes bte-file ty2013, gather all the relevant information such as the error codes, their descriptions, and any specific instructions provided. This will help you accurately fill out the file.

02

Open the file: Locate the error codes bte-file ty2013 and open it using the appropriate software or program. Ensure that you have the necessary permissions and access rights to make changes to the file.

03

Navigate to the error codes section: Within the file, locate the section where you are required to input the error codes. This section may vary depending on the specific layout and format of the file.

04

Fill in the error codes: Input each error code in the designated fields or cells provided. It is important to enter them accurately to avoid any discrepancies or confusion.

05

Providing error code descriptions: Alongside each error code, provide a brief description or explanation of what the code represents. This will help users understand the nature of the error and its implications.

06

Check for any additional instructions: Review the file for any additional instructions or requirements related to the error code entries. Follow these instructions carefully to ensure proper completion of the form.

Who needs error codes bte-file ty2013?

01

Tax professionals: Tax professionals who are responsible for preparing and submitting tax returns may need error codes bte-file ty2013. These error codes help in identifying and rectifying any errors or issues that may arise during the filing process.

02

Government agencies: Government agencies that handle tax-related matters, such as the Internal Revenue Service (IRS), or equivalent authorities in different countries, may require error codes bte-file ty2013. They use these codes to ensure accuracy and consistency in tax reporting and processing.

03

Software developers: Developers of tax software or applications may also need error codes bte-file ty2013. These codes are essential for designing and programming software that can identify and handle different tax-related errors effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is error codes bte-file ty2013?

Error codes bte-file ty2013 are specific codes used to identify and report errors in tax year 2013 electronic filings.

Who is required to file error codes bte-file ty2013?

All taxpayers or entities who filed electronic tax year 2013 returns are required to report error codes bte-file ty2013 if any errors were encountered during the filing process.

How to fill out error codes bte-file ty2013?

To fill out error codes bte-file ty2013, taxpayers need to refer to the specific error code list provided by the tax authority and accurately report the corresponding error codes identified in their electronic tax year 2013 filings.

What is the purpose of error codes bte-file ty2013?

The purpose of error codes bte-file ty2013 is to help taxpayers and tax authorities identify and rectify errors in electronic tax year 2013 filings, ensuring accurate and compliant reporting.

What information must be reported on error codes bte-file ty2013?

Taxpayers must report specific error codes along with details of the errors encountered during the electronic filing of tax year 2013 returns on error codes bte-file ty2013.

How can I get error codes bte-file ty2013?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the error codes bte-file ty2013 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete error codes bte-file ty2013 online?

pdfFiller makes it easy to finish and sign error codes bte-file ty2013 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my error codes bte-file ty2013 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your error codes bte-file ty2013 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your error codes bte-file ty2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Error Codes Bte-File ty2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.