KY F1120 1999 free printable template

Show details

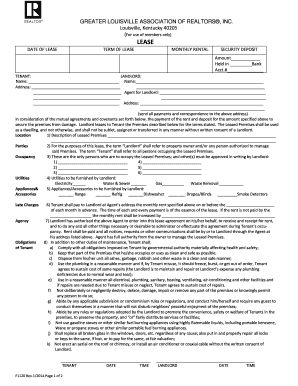

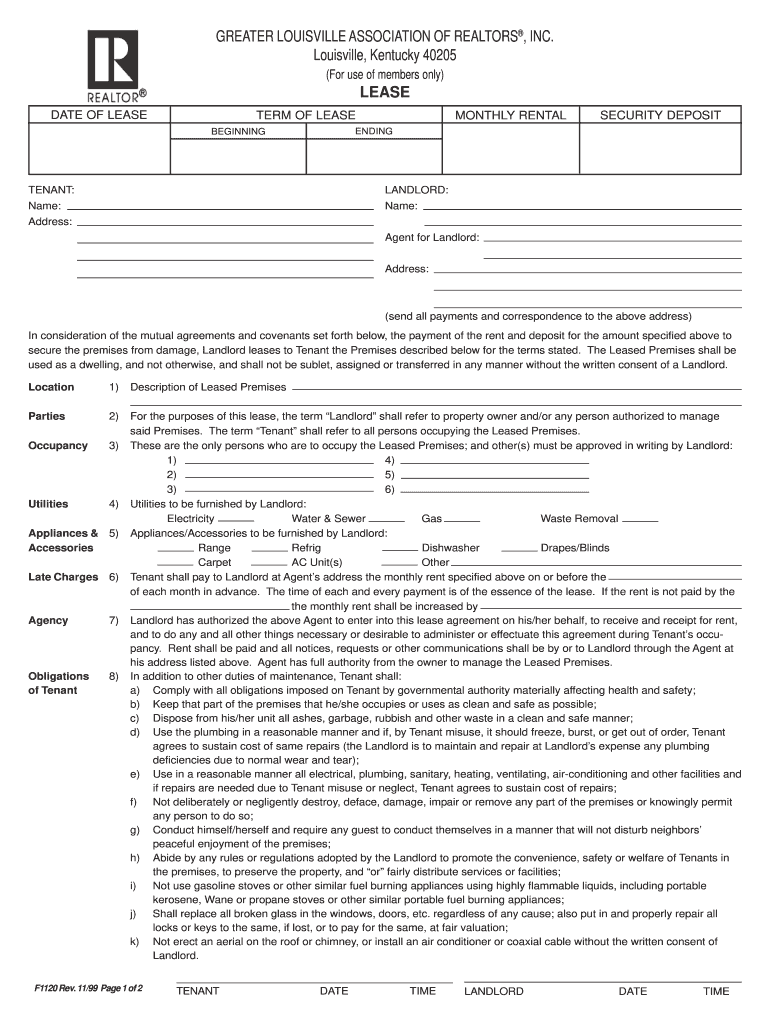

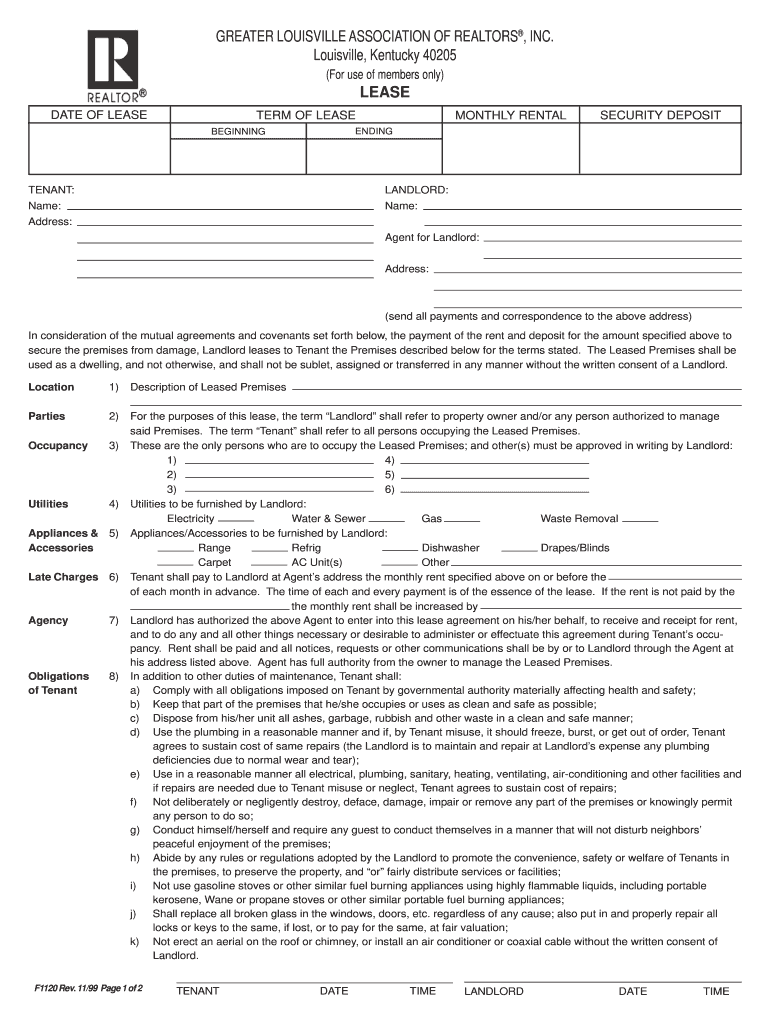

GREATER LOUISVILLE ASSOCIATION OF REALTORS, INC. Louisville, Kentucky 40205 (For use of members only) LEASE DATE OF LEASE TERM OF LEASE MONTHLY RENTAL SECURITY DEPOSIT ENDING BEGINNING TENANT: LANDLORD:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY F1120

Edit your KY F1120 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY F1120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY F1120 online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY F1120. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY F1120 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY F1120

How to fill out KY F1120

01

Begin with personal information: Enter your name, address, and social security number.

02

Input your business name and federal employer identification number (FEIN) if applicable.

03

Provide details of your business activity.

04

Fill out the income section: Record your gross receipts, returns, and allowances.

05

Deduct allowable expenses: Include all eligible business expenses.

06

Calculate your net income: Subtract total expenses from total income.

07

Complete the tax computation section based on your net income.

08

Sign and date the form before submission.

Who needs KY F1120?

01

Businesses operating in Kentucky that are required to report their income and pay income taxes.

02

Corporations registered in Kentucky.

03

Any entity wishing to declare their income to the Kentucky Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is another name for the standard form of lease?

This form is a residential tenancy agreement (standard lease). Landlords of most private residential rental units must use this form (standard lease) when they enter into a tenancy with a tenant.

How do I break a lease without penalty in Kentucky?

You may be able to legally move out before the lease term ends in the following situations. You Are Starting Active Military Duty. The Rental Unit Is Unsafe or Violates Kentucky Health or Safety Codes. Your Landlord Harasses You or Violates Your Privacy Rights.

What are the tenant laws in Kentucky?

Kentucky Tenant Responsibilities (KRS 383.605) Tenants must comply with any and all housing and building codes that address health and safety. Tenant must maintain cleanliness of the property. Tenants must dispose of trash in a safe manner. Tenants must keep plumbing as clean as their condition allows.

Does a lease need to be notarized in Kentucky?

No, a Kentucky Lease Agreement does not need to be notarized. As long as it's signed by both parties, it's legally binding and fully enforceable.

What is the lease to own law in Kentucky?

A Kentucky rent-to-own agreement is a rental lease that includes conditions whereby the tenant can purchase the landlord's property. This type of arrangement allows tenants to move into a potential home as a renter while they raise the necessary financial profile to become its owner.

Can someone live with you without being on the lease in Kentucky?

No, your landlord cannot evict you for having someone live with you who is not on the lease. There are no federal or state laws that prohibit a non-tenant from living with you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get KY F1120?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the KY F1120 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the KY F1120 form on my smartphone?

Use the pdfFiller mobile app to complete and sign KY F1120 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit KY F1120 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as KY F1120. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is KY F1120?

KY F1120 is a form used by corporations to report income, deductions, and other relevant tax information to the Kentucky Department of Revenue.

Who is required to file KY F1120?

Corporations that conduct business in Kentucky or derive income from Kentucky sources are required to file KY F1120.

How to fill out KY F1120?

To fill out KY F1120, gather necessary financial records, complete the form with accurate income and deduction information, and ensure all required schedules and attachments are included before submitting it to the Kentucky Department of Revenue.

What is the purpose of KY F1120?

The purpose of KY F1120 is to report a corporation's taxable income and calculate the state tax liability based on that income.

What information must be reported on KY F1120?

KY F1120 requires the reporting of the corporation's gross income, deductions for business expenses, tax credits, and other relevant financial details to determine the taxable income.

Fill out your KY F1120 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY f1120 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.