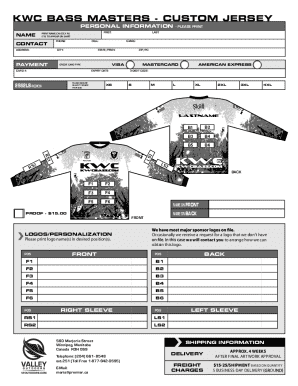

Get the free for Payroll Service Companies

Show details

RD-EFT PO BOX 11895 CHARLESTON WV 25339-1895 Or Fax to 304 558-8604 West Virginia Requirements for the TXP Addenda Record TXP Banking Convention and Addenda Record Format Field Name Data Elements Separators Position Field Size Start End Segment Identifier TXP Separator Taxpayer ID Numeric Tax Type Code See Tax Type Table Tax Period End Date YYMMDD Numeric Payment Amount Type Terminator Tax Type Tax Type Codes Tax Type Withholding 01170 Contents Here is a properly formatted TXP addenda record...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for payroll service companies

Edit your for payroll service companies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for payroll service companies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for payroll service companies online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit for payroll service companies. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for payroll service companies

How to fill out for payroll service companies

01

Step 1: Gather all necessary employee information such as names, addresses, social security numbers, and tax withholding information.

02

Step 2: Determine the pay periods and pay dates for your company.

03

Step 3: Calculate the gross wages for each employee based on their hourly rate or salary.

04

Step 4: Deduct any applicable taxes, such as federal and state income taxes, Social Security, and Medicare.

05

Step 5: Calculate any additional deductions, such as health insurance premiums or retirement contributions.

06

Step 6: Subtract the total deductions from the gross wages to calculate the net pay.

07

Step 7: Generate a payroll summary report detailing the wages, deductions, and net pay for each employee.

08

Step 8: Issue paychecks or initiate direct deposit for employees.

09

Step 9: Keep accurate records of all payroll transactions for tax and legal purposes.

10

Step 10: Stay updated with changes in payroll regulations and tax laws to ensure compliance.

Who needs for payroll service companies?

01

Small businesses without dedicated HR departments who want to outsource their payroll processing.

02

Startups and entrepreneurs who want to focus on their core business activities rather than handling payroll.

03

Companies with a large number of employees who need help navigating complex payroll processes.

04

Organizations that want to ensure accurate and timely payroll processing to avoid penalties and legal issues.

05

Businesses looking to streamline their payroll operations and reduce administrative costs.

06

Companies operating in multiple states or countries with varying payroll laws and regulations.

07

Businesses that want to provide their employees with direct deposit and electronic pay stubs.

08

Companies seeking expertise in handling payroll taxes and ensuring compliance with tax regulations.

09

Businesses that prefer using professional payroll software and tools for efficiency and accuracy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit for payroll service companies from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like for payroll service companies, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send for payroll service companies to be eSigned by others?

for payroll service companies is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out for payroll service companies on an Android device?

Complete for payroll service companies and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is for payroll service companies?

Payroll service companies provide services related to payroll processing, tax preparation, and other payroll-related tasks for businesses.

Who is required to file for payroll service companies?

Payroll service companies are required to file payroll tax returns on behalf of their clients.

How to fill out for payroll service companies?

Payroll service companies fill out payroll tax returns using the information provided by their clients, including employee wages, deductions, and tax withholdings.

What is the purpose of for payroll service companies?

The purpose of payroll service companies is to help businesses streamline their payroll processes, ensure accurate tax filings, and compliance with payroll regulations.

What information must be reported on for payroll service companies?

Payroll service companies must report employee wages, tax withholdings, employer contributions, and other payroll-related information.

Fill out your for payroll service companies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Payroll Service Companies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.