Get the free No Balance Transfer Fees

Show details

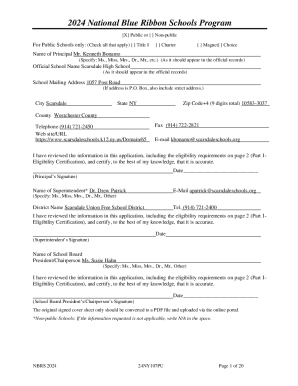

Securitybankcard. com Plus Enjoy Introductory AGNCONS 7/17 VISA Gold or Platinum You ll enjoy SECURITY BANKCARD CENTER INC. Consumerfinance. gov/learnmore. FEES Transaction Fees Either 4 or 4 of the amount of each cash advance whichever is greater. 9 Introductory APR for 6 months. 16. 4 for VISA Gold accounts or 13. 4 for VISA Platinum Annual Percentage Rate APR for Purchases Balance Transfers and Cash Advances accounts based on your creditworthiness. This APR will vary with the market based...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no balance transfer fees

Edit your no balance transfer fees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no balance transfer fees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit no balance transfer fees online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit no balance transfer fees. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no balance transfer fees

How to fill out no balance transfer fees

01

Gather all the necessary documents such as your credit card statements, your current balance, and any promotional offers related to balance transfers.

02

Research different credit card companies and banks that offer no balance transfer fees.

03

Compare the terms and conditions of each option to ensure you are getting the best deal.

04

Choose the credit card company or bank that offers the most favorable terms and conditions.

05

Contact the chosen credit card company or bank to inquire about their balance transfer process.

06

Follow their instructions to fill out the necessary forms and provide the required information.

07

Submit your completed forms along with any supporting documents that may be required.

08

Wait for the approval of your balance transfer request.

09

Once approved, verify that the balance transfer is successfully completed and that no fees have been charged.

10

Monitor your new credit card or bank account to ensure that the transferred balance reflects correctly.

11

Make timely payments on your new credit card or bank account to avoid any additional charges or fees.

Who needs no balance transfer fees?

01

Individuals who have high-interest credit card debt and want to save money on interest charges.

02

People who wish to consolidate multiple credit card balances into a single account for convenience and simplicity.

03

Those who are looking to pay off their credit card debt faster by taking advantage of promotional balance transfer offers.

04

Individuals who are planning to make a large purchase and want to avoid paying interest for a certain period of time.

05

Anyone who wants to take advantage of better terms and conditions offered by a different credit card company or bank.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my no balance transfer fees directly from Gmail?

no balance transfer fees and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit no balance transfer fees on an Android device?

You can edit, sign, and distribute no balance transfer fees on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete no balance transfer fees on an Android device?

Use the pdfFiller mobile app to complete your no balance transfer fees on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is no balance transfer fees?

No balance transfer fees refers to a credit card feature where no additional fees are charged when transferring a balance from one card to another.

Who is required to file no balance transfer fees?

Consumers who are interested in transferring their credit card balance to a card with no balance transfer fees are required to file.

How to fill out no balance transfer fees?

To fill out no balance transfer fees, consumers need to select a credit card that offers this feature and follow the instructions provided by the card issuer.

What is the purpose of no balance transfer fees?

The purpose of no balance transfer fees is to encourage consumers to transfer their credit card balances without incurring additional costs.

What information must be reported on no balance transfer fees?

Consumers may need to report their current credit card balance, the amount they wish to transfer, and any associated fees when applying for a no balance transfer fees promotion.

Fill out your no balance transfer fees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Balance Transfer Fees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.