Get the free MLC Insurance Income Protection Initial Claim Form MLC Nominees Pty Limited ABN 93 0...

Show details

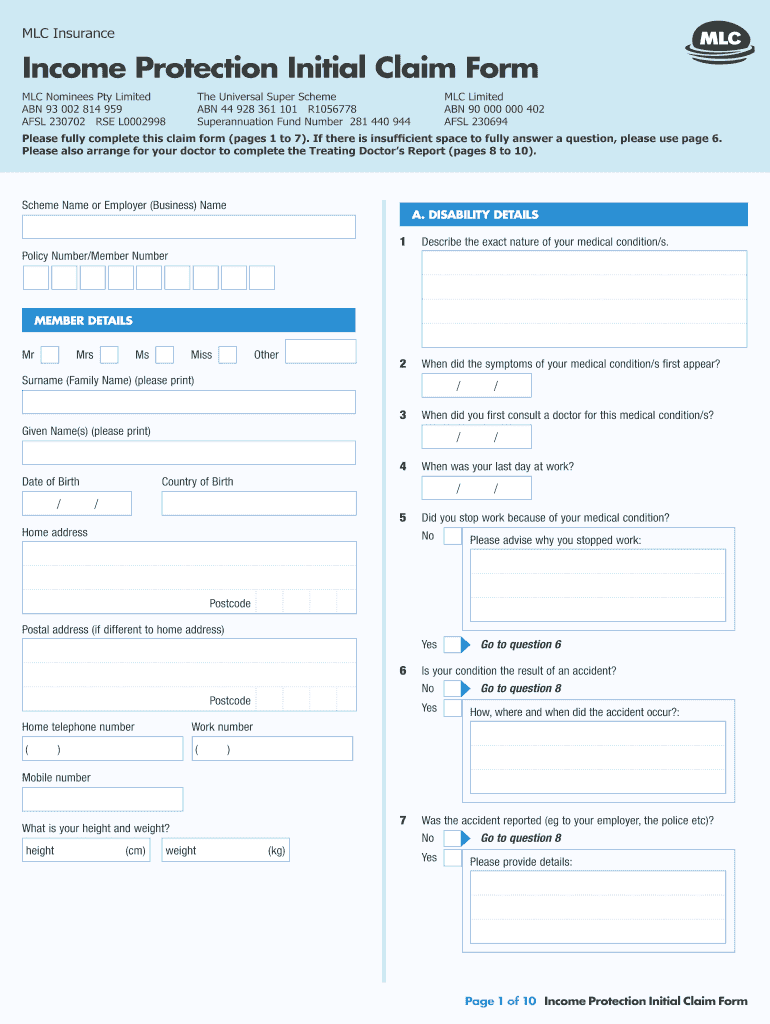

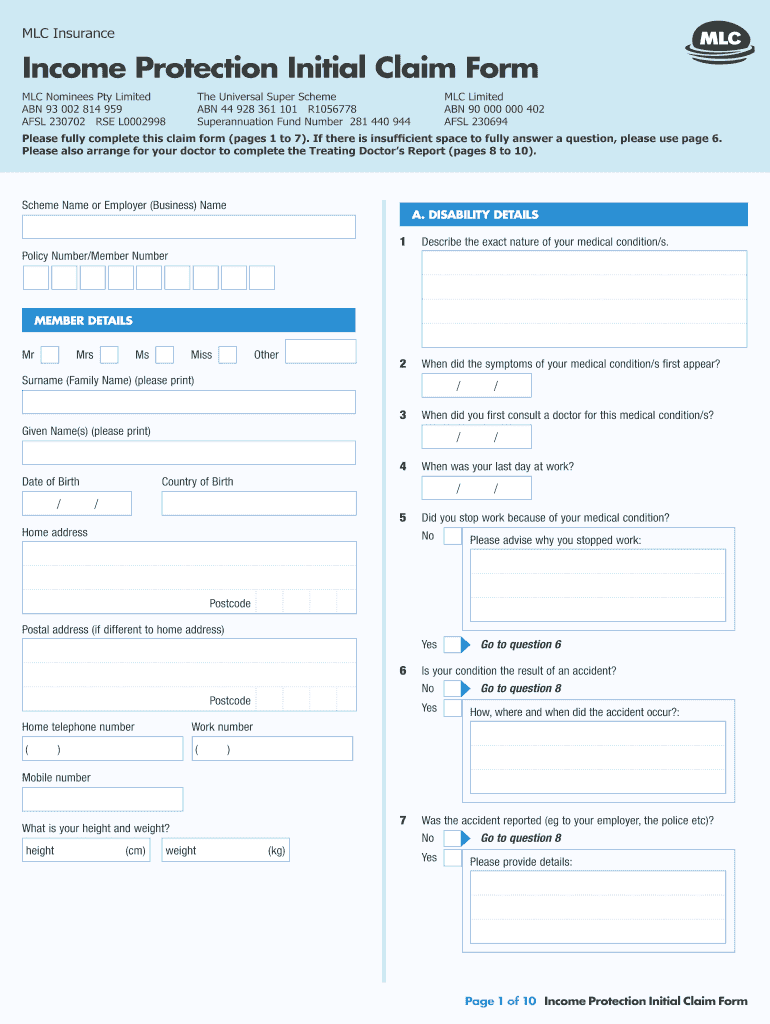

MLC Insurance Income Protection Initial Claim Form MLC Nominees Pty Limited ABN 93 002 814 959 ADSL 230702 RSE L0002998 The Universal Super Scheme ABN 44 928 361 101 R1056778 Superannuation Fund Number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mlc insurance income protection

Edit your mlc insurance income protection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mlc insurance income protection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mlc insurance income protection online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mlc insurance income protection. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mlc insurance income protection

How to fill out MLC Insurance income protection:

01

Start by gathering all the necessary information, such as personal details, employment information, and financial details.

02

Fill out the application form accurately and truthfully. Double-check all the information before submitting it.

03

Provide details about your occupation, including your job title, industry, and any hazardous activities involved.

04

Specify the waiting period and benefit period you desire for your income protection policy.

05

Indicate the amount of cover you need, considering factors like your income, expenses, and any existing insurance policies.

06

Disclose any pre-existing medical conditions or disabilities, as these may impact your eligibility or terms of coverage.

07

Consider additional options or benefits you may want to add to your income protection policy, such as cover for involuntary unemployment or rehabilitation benefits.

08

Review the terms and conditions of the policy carefully, ensuring you understand the coverage and any exclusions or limitations.

09

Sign and date the application form, and submit it to MLC Insurance along with any required supporting documents or payments.

Who needs MLC Insurance income protection:

01

Individuals who rely heavily on their income to support themselves and their dependents should consider MLC Insurance income protection. It provides a financial safety net in case of unexpected illness, injury, or disability that prevents them from working.

02

Anyone with ongoing financial obligations, such as mortgage or loan repayments, should consider income protection to ensure these obligations can be met even if they cannot work temporarily or long-term.

03

Professionals with physically demanding or high-risk occupations, where the risk of injury or disability is greater, should seriously consider income protection to safeguard their financial stability.

04

Self-employed individuals who do not have access to sick leave or workers' compensation benefits may find income protection particularly valuable to protect their income during periods of inability to work.

05

Individuals without substantial savings or emergency funds may find income protection essential to prevent financial hardship if unexpected circumstances prevent them from earning an income.

Remember, it is always advisable to consult with a financial advisor or insurance professional to determine the specific insurance needs and ensure the policy meets individual requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in mlc insurance income protection without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing mlc insurance income protection and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the mlc insurance income protection electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your mlc insurance income protection and you'll be done in minutes.

How do I fill out mlc insurance income protection on an Android device?

Complete mlc insurance income protection and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is mlc insurance income protection?

MLC Insurance Income Protection is a type of insurance that provides financial protection in case of loss of income due to illness or injury.

Who is required to file mlc insurance income protection?

Individuals who want to protect their income in case of illness or injury are required to file for MLC Insurance Income Protection.

How to fill out mlc insurance income protection?

To fill out MLC Insurance Income Protection, individuals need to provide relevant personal and financial information as well as details about their income and employment status.

What is the purpose of mlc insurance income protection?

The purpose of MLC Insurance Income Protection is to provide financial security and peace of mind in case of unexpected loss of income due to illness or injury.

What information must be reported on mlc insurance income protection?

Information such as personal details, financial information, income details, employment status, and details about the insurance coverage must be reported on MLC Insurance Income Protection.

Fill out your mlc insurance income protection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mlc Insurance Income Protection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.