CA CDTFA-230-D 2017-2025 free printable template

Show details

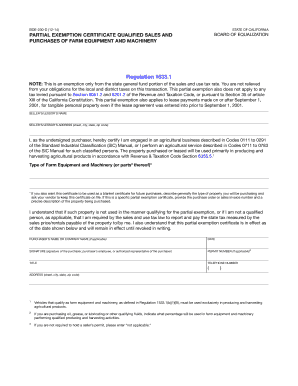

STATE OF CALIFORNIACDTFA230D REV. 2 (817)PARTIAL EXEMPTION CERTIFICATE QUALIFIED SALES AND

PURCHASES OF FARM EQUIPMENT AND MACHINERYCALIFORNIA DEPARTMENT OF

TAX AND FEE ADMINISTRATIONRegulation 1533.1

NOTE:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cdtfa 230 d 2017-2025

Edit your cdtfa 230 d 2017-2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cdtfa 230 d 2017-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cdtfa 230 d 2017-2025 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cdtfa 230 d 2017-2025. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-230-D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cdtfa 230 d 2017-2025

How to fill out CA CDTFA-230-D

01

Download Form CDTFA-230-D from the California Department of Tax and Fee Administration (CDTFA) website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your name, business name (if applicable), and address in the appropriate sections.

04

Provide your California seller's permit number if you have one.

05

Indicate the type of business you operate by checking the relevant boxes.

06

Include details about the transactions or exemptions for which you are requesting a refund or adjustment.

07

Calculate any amounts due based on the instructions provided.

08

Sign and date the form to certify that the information is accurate.

09

Submit the completed form to the CDTFA either by mail or online as instructed.

Who needs CA CDTFA-230-D?

01

Businesses or individuals seeking a refund or adjustment of sales and use tax in California.

02

Those who have overpaid taxes due to errors or specific exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do I get sales tax exemption certificate in California?

You can register for a California seller's permit online through the CDTFA. To apply, you'll need to provide the CDTFA with certain information about your business, including but not limited to: Business name, address, and contact information.

Do I need a California resale certificate?

Issuing a resale certificate allows you to buy items you will sell in your business operations without paying amounts for tax to your suppliers. Generally, if you make three or more sales in a 12-month period, you are required to hold a seller's permit.

What is a California tax exemption certificate?

Summary. A sales tax exemption certificate allows a buyer to make tax-free purchases. The purchaser must provide the seller with a completed exemption certificate. Items covered by the exemption certificate are then exempt from sales and use tax. The seller keeps the exemption certificate.

Who needs to fill out a California resale certificate?

Issuing a resale certificate allows you to buy items you will sell in your business operations without paying amounts for tax to your suppliers. Generally, if you make three or more sales in a 12-month period, you are required to hold a seller's permit.

Does California have a sales tax exemption certificate?

If you are selling to a customer who has an exempt status, you must collect a California Sales Tax Exemption certificate and keep it on file. If you are audited, you will be expected to produce this as proof that you sold an exempt item.

What is a BOE-230 form?

A form BOE-230, General Resale Certificate, can be issued by purchasers when purchasing goods they will resell in the regular course of their business operations. Generally, resale certificates are used: When purchasing finished items for resale.

What qualifies as an agricultural exemption in California?

Purchases of farm equipment and machinery (including repair and replacement parts) for use by a qualified person and primarily used in producing and harvesting agricultural products, are subject to a partial exemption from tax.

Does Wyoming accept out of state resale certificates?

HOW TO USE OR ACCEPT A WYOMING RESALE CERTIFICATE. There are reciprocity laws in place governing the use of resale certificates interchangeably between states. So, if you are located in one state and need to purchase items (from a supplier or vendor) for resale from another state then you can do so.

How to fill California resale certificate form?

Resale Certificates The name and address of the purchaser. The purchaser's seller's permit number (unless they are not required to hold one1). A description of the property to be purchase. An explicit statement that the described property is being purchased for resale. The date of the document.

How to fill Wyoming resale certificate?

Common details listed on the Wyoming resale certificate include the name (company or individual) and address of the buyer, a descriptive detail of the goods being purchased, a reference that this merchandise is intended to be resold and the accurate Wyoming sales tax number.

How do I get a reseller's permit in Wyoming?

How do you register for a sales tax permit in Wyoming? You can apply online at the Wyoming Internet Filing System for Business. You can also apply on paper and mail or fax in the Wyoming Sales/Use Tax Application. You can call (307) 777-5200 for assistance completing the application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cdtfa 230 d 2017-2025?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the cdtfa 230 d 2017-2025. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in cdtfa 230 d 2017-2025 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing cdtfa 230 d 2017-2025 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete cdtfa 230 d 2017-2025 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your cdtfa 230 d 2017-2025. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is CA CDTFA-230-D?

CA CDTFA-230-D is a form used by the California Department of Tax and Fee Administration (CDTFA) for reporting and remitting certain taxes and fees associated with businesses operating in California.

Who is required to file CA CDTFA-230-D?

Any business that is engaged in activities that require the payment of specific taxes or fees to the CDTFA must file form CA CDTFA-230-D.

How to fill out CA CDTFA-230-D?

To fill out CA CDTFA-230-D, you must provide your business information, including the reporting period, total taxes due, and any applicable exemptions or credits. Instructions are included on the form to guide you through the process.

What is the purpose of CA CDTFA-230-D?

The purpose of CA CDTFA-230-D is to ensure that businesses accurately report and pay the taxes and fees owed to the state of California, facilitating compliance with state tax regulations.

What information must be reported on CA CDTFA-230-D?

The information that must be reported on CA CDTFA-230-D includes the business name, address, reporting period, total taxes and fees calculated, and any exemptions or deductions being claimed.

Fill out your cdtfa 230 d 2017-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cdtfa 230 D 2017-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.