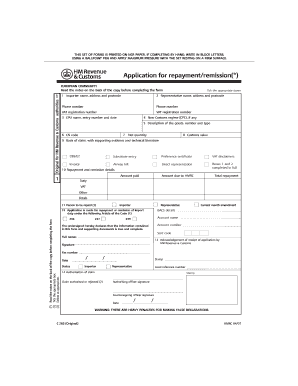

UK HMRC C&E1179 2017 free printable template

Show details

Claim for repayment or remission of Import duty, CAP charges,

ADD charges, VAT and Excise Duty paid on rejected importsWhen to use this form

Use this form to claim repayment or remission of customs

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC CE1179

Edit your UK HMRC CE1179 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC CE1179 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HMRC CE1179 online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK HMRC CE1179. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC C&E1179 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC CE1179

How to fill out UK HMRC C&E1179

01

Obtain the UK HMRC C&E1179 form from the HMRC website or your local tax office.

02

Fill in your details at the top of the form, including your name, address, and contact information.

03

Provide the necessary details about the goods being imported or exported, including descriptions and values.

04

Indicate the reason for the request by selecting the appropriate option from the provided list.

05

Fill in any relevant customs numbers or references related to your transaction.

06

Review the completed form for accuracy to ensure all required fields are filled out correctly.

07

Sign and date the form to validate your submission.

08

Submit the form to HMRC either online or by mailing it to the specified address.

Who needs UK HMRC C&E1179?

01

Individuals or businesses involved in the importation or exportation of goods to and from the UK.

02

Importers and exporters who need to provide information regarding their customs status.

03

Customs agents or brokers handling transactions on behalf of clients.

04

Organizations that need to claim back import VAT or seek relief from customs duties.

Fill

form

: Try Risk Free

People Also Ask about

What is National duty Repayment Centre C285?

The National Duty Repayment Centre (NDRC) is responsible for processing customs duty repayment applications made on Form C285. Recently there have been delays in processing customs repayments and a large part of this is due to the number of requests issued by NDRC for further information.

How much can I import without paying duty?

Up to $1,600 in goods will be duty-free under your personal exemption if the merchandise is from an IP. Up to $800 in goods will be duty-free if it is from a CBI or Andean country.

How can I get out of paying import charges?

If you want to avoid paying duty on shipped items and evade the high brokerage fees from courier companies, you have the choice to self-clear the imported products. Self-clearing can be as easy as collecting some documents about your shipment and making a trip to your local CBSA office.

What is a C285 form?

Use form C285 for CDS for declarations made on the Customs Declaration Service.

Can you get import duty refund?

If you return goods on which duties have been paid, or have been incorrectly charged VAT or customs duties a refund may be due: A claim for a refund can be made by the customer (as a private individual or an importer), the freight forwarder or an agent. Refunds claims must be made to HMRC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UK HMRC CE1179 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your UK HMRC CE1179 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find UK HMRC CE1179?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific UK HMRC CE1179 and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my UK HMRC CE1179 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your UK HMRC CE1179 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is UK HMRC C&E1179?

UK HMRC C&E1179 is a document used in the UK for the declaration of goods imported from outside the EU, specifically for trade involving hazardous materials or products.

Who is required to file UK HMRC C&E1179?

Businesses and individuals who import goods into the UK that fall under the category of hazardous materials or products are required to file UK HMRC C&E1179.

How to fill out UK HMRC C&E1179?

To fill out UK HMRC C&E1179, importers must provide accurate details about the goods being imported, including their classification, quantity, value, and any relevant safety or compliance aspects.

What is the purpose of UK HMRC C&E1179?

The purpose of UK HMRC C&E1179 is to ensure that hazardous materials are correctly assessed and comply with safety regulations during importation into the UK.

What information must be reported on UK HMRC C&E1179?

The information that must be reported on UK HMRC C&E1179 includes the description of the goods, their classification (as hazardous or non-hazardous), quantity, value, and compliance certifications.

Fill out your UK HMRC CE1179 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC ce1179 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.