Get the free Request to Reduce Tax Deductions at Source for Year(s) . Financial eligibility appli...

Show details

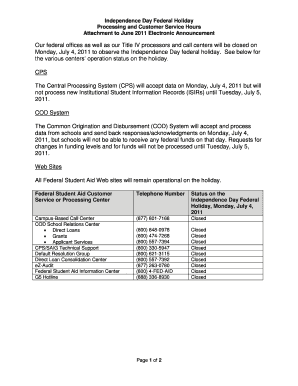

Clear Data Help Protected B when completed Request to Reduce Tax Deductions at Source for Year(s) Use this form to ask for reduced tax deductions at source for any deductions or non-refundable tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request to reduce tax

Edit your request to reduce tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request to reduce tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request to reduce tax online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request to reduce tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request to reduce tax

How to fill out a request to reduce tax:

01

Gather all necessary documents and information: Before filling out the request, make sure you have all the relevant documents and information required, such as tax returns, income statements, and any other supporting documents requested by the tax authority.

02

Understand the eligibility criteria: Familiarize yourself with the specific eligibility criteria for tax reduction. Different jurisdictions may have different rules and requirements, so ensure you meet the necessary qualifications before proceeding.

03

Complete the appropriate request form: Obtain the correct request form from the tax authority or download it from their website. Fill in all the required fields accurately and provide any additional information or explanations that may be needed to support your request.

04

Provide supporting documentation: Attach any relevant supporting documentation required by the tax authority to accompany your request. This may include financial statements, evidence of financial hardship, or proof of special circumstances that warrant a tax reduction.

05

Review and double-check the request: Thoroughly review the completed request form and all supporting documents to ensure accuracy and completeness. Any errors or missing information could delay the processing or approval of your request.

06

Submit the request: Once you are confident in the accuracy and completeness of your request, submit it to the relevant tax authority. Follow their guidelines for submission, whether it be through mail, online submission, or in-person delivery.

Who needs a request to reduce tax?

01

Individuals facing financial hardship: If a person is experiencing financial difficulties or undergoing a challenging situation, such as unemployment, medical bills, or significant life changes, they may consider filing a request to reduce their tax burden.

02

Small business owners: Small business owners who have faced financial setbacks or economic downturns may need to request a tax reduction to alleviate financial pressures and help keep their businesses afloat.

03

Non-profit organizations: Non-profit organizations that meet certain criteria may be eligible for tax exemptions or reductions. They may need to file a request with the tax authority to reduce their tax liabilities and allocate more funds towards their charitable activities.

04

Individuals or businesses affected by natural disasters: In the aftermath of a natural disaster, individuals or businesses may suffer significant financial losses. To assist in recovery efforts, tax authorities may offer tax reductions or extensions to affected taxpayers who submit a request.

05

Others meeting specific eligibility criteria: Depending on the jurisdiction, there may be additional categories of individuals or businesses that qualify for tax reduction based on specific eligibility criteria. These could include low-income earners, senior citizens, or those involved in certain industries targeted for tax relief.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is request to reduce tax?

Request to reduce tax is a formal application made to the tax authority to lower the amount of tax owed by an individual or entity.

Who is required to file request to reduce tax?

Any individual or entity who believes they are eligible for a tax reduction based on specific circumstances or criteria.

How to fill out request to reduce tax?

The request to reduce tax must be filled out accurately and completely, providing all necessary information and supporting documentation.

What is the purpose of request to reduce tax?

The purpose of request to reduce tax is to potentially lower the tax liability of an individual or entity, resulting in savings.

What information must be reported on request to reduce tax?

The request to reduce tax must include personal or business financial information, details of the tax reduction being sought, and any other relevant information requested by the tax authority.

How do I modify my request to reduce tax in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your request to reduce tax and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I sign the request to reduce tax electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your request to reduce tax and you'll be done in minutes.

How do I fill out request to reduce tax using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign request to reduce tax and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your request to reduce tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request To Reduce Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.