Get the free IRA Transfer B - JP Morgan Funds

Show details

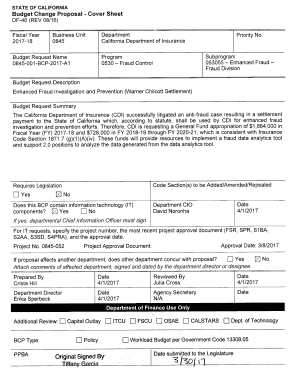

Print Form IRA Transfer B Page 1 of 3 TO Investor Services: 1-800-480-4111 Please write account number in box provided. Internet: www.jpmorganfunds.com Use this form to transfer your existing IRA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira transfer b

Edit your ira transfer b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira transfer b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira transfer b online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ira transfer b. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira transfer b

How to fill out ira transfer b:

01

Gather necessary documents: Before starting the process, make sure you have all the required paperwork such as the IRA transfer form, identification, and any other supporting documents specified by your IRA provider.

02

Complete the IRA transfer form: Fill out the necessary information on the IRA transfer form, including your personal details, previous IRA account information, and the details of the new IRA account you wish to transfer funds to.

03

Provide supporting documentation: Some IRA providers may require additional documentation to verify the transfer, such as a recent account statement or a letter of acceptance from the receiving IRA provider. Make sure to include these documents along with the transfer form.

04

Double-check the form: Carefully review the filled out transfer form to ensure accuracy and completeness. Mistakes or missing information could lead to delays or complications in the transfer process.

05

Submit the form: Once you are satisfied with the completed form, submit it to your current IRA provider. Follow their specific instructions on how to submit the form, whether it is through mail, fax, or electronically.

06

Confirm the transfer: After submitting the transfer form, reach out to both your old and new IRA providers to confirm that the transfer has been initiated and to inquire about any additional steps or documentation required.

07

Monitor the transfer: Keep track of the transfer process by regularly checking in with both your old and new IRA providers. They should be able to provide updates on the status of the transfer and any expected timelines.

08

Review the new IRA account: Once the transfer is complete, review your new IRA account to ensure that the funds have been successfully transferred. Check the account balance and any investments or holdings to confirm everything matches your expectations.

Who needs IRA transfer b:

01

Individuals changing jobs: If you are switching employers or leaving your current job, you may need to transfer your IRA funds to a new account.

02

Retirement account consolidation: Some individuals choose to consolidate their retirement accounts to simplify their finances. If you have multiple IRAs or retirement accounts, an IRA transfer can help you consolidate them into a single account.

03

Changing financial institutions: If you are unhappy with your current IRA provider, you may want to transfer your funds to a new financial institution that offers better services, lower fees, or investment options that align with your goals.

04

Beneficiaries of inherited IRAs: In some cases, individuals who inherit an IRA may need to transfer the funds to a different account in order to comply with specific IRA rules or to take advantage of certain tax advantages.

05

Individuals seeking better investment options: If your current IRA provider limits your investment choices or doesn't offer the types of investments you prefer, transferring your IRA to a new provider can give you access to a wider range of investment options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira transfer b?

IRA transfer B is a form used to transfer funds from one IRA account to another, usually between different financial institutions.

Who is required to file ira transfer b?

Any individual who wants to transfer funds from one IRA account to another is required to file IRA transfer B.

How to fill out ira transfer b?

IRA transfer B can be filled out by providing the required information such as account details, transfer amount, and reason for the transfer.

What is the purpose of ira transfer b?

The purpose of IRA transfer B is to facilitate the transfer of funds between IRA accounts in a tax-efficient manner.

What information must be reported on ira transfer b?

Information such as account numbers, transfer amount, and reasons for the transfer must be reported on IRA transfer B.

How can I get ira transfer b?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ira transfer b and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the ira transfer b form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ira transfer b and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit ira transfer b on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign ira transfer b right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your ira transfer b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Transfer B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.