Get the free Foundations in Personal Finance - Chapter 7 Test

Show details

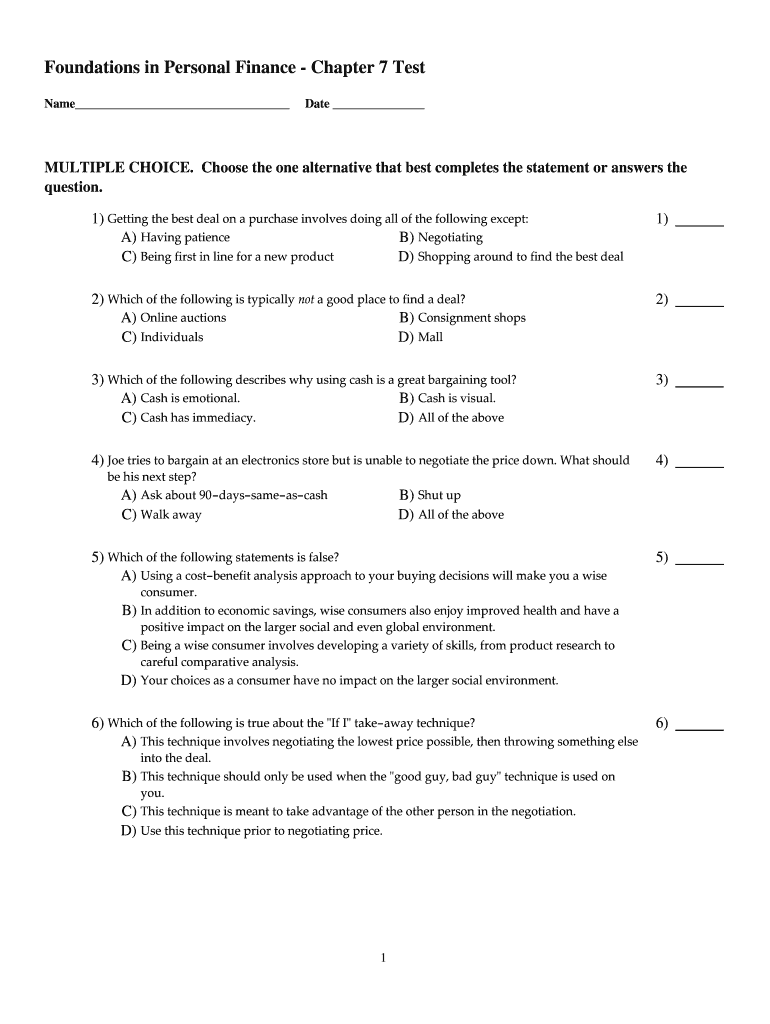

Foundations in Personal Finance Chapter 7 Test Name Date MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Gettingthebestdealonapurchaseinvolvesdoingallofthefollowingexcept:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foundations in personal finance

Edit your foundations in personal finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foundations in personal finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foundations in personal finance online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit foundations in personal finance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foundations in personal finance

How to fill out foundations in personal finance

01

Start by gathering all your financial documents, such as bank statements, pay stubs, credit card statements, and investment statements.

02

Create a budget by tracking your income and expenses. Determine your monthly income and allocate it towards necessary expenses, such as rent or mortgage, utilities, groceries, and transportation.

03

Prioritize saving by setting aside a percentage of your income for emergencies and future goals. Consider opening a separate savings account to make it easier to save.

04

Reduce debt by paying off high-interest credit cards and loans first. Make more than the minimum monthly payments to accelerate the repayment process.

05

Invest for the future by learning about different investment options, such as stocks, bonds, and mutual funds. Consult with a financial advisor if necessary.

06

Plan for retirement by contributing to retirement accounts, such as a 401(k) or an Individual Retirement Account (IRA). Take advantage of employer matching contributions if available.

07

Protect yourself and your assets with insurance policies, including health insurance, auto insurance, and homeowner's or renter's insurance.

08

Educate yourself about personal finance by reading books, attending seminars, or taking online courses. Stay informed about financial news and updates that may affect your money.

09

Review and adjust your financial plan regularly to accommodate any changes in your income, expenses, or goals.

10

Seek professional help if needed. A certified financial planner can provide personalized advice and guidance to help you achieve your financial goals.

Who needs foundations in personal finance?

01

Everyone can benefit from foundations in personal finance, regardless of their financial situation.

02

Individuals who want to gain control over their finances, reduce debt, save for the future, and achieve financial stability should learn about personal finance foundations.

03

People who want to make informed decisions about their money, understand the importance of budgeting, investing, and planning for retirement should also focus on personal finance foundations.

04

Whether you are just starting your career, planning for retirement, or going through a major life event, having a solid understanding of personal finance foundations can help you make better financial choices and secure a better financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my foundations in personal finance directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign foundations in personal finance and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the foundations in personal finance electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your foundations in personal finance.

How do I edit foundations in personal finance on an Android device?

You can edit, sign, and distribute foundations in personal finance on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is foundations in personal finance?

Foundations in personal finance is a course that teaches individuals about managing personal finances, budgeting, saving, investing, and other financial concepts.

Who is required to file foundations in personal finance?

Typically, students or individuals who are taking a course in personal finance are required to complete foundations in personal finance.

How to fill out foundations in personal finance?

Foundations in personal finance can be filled out by completing assignments, quizzes, exams, and other course requirements as specified by the instructor.

What is the purpose of foundations in personal finance?

The purpose of foundations in personal finance is to educate individuals on important financial concepts and skills to help them make informed decisions about their money.

What information must be reported on foundations in personal finance?

Information reported on foundations in personal finance may include budgeting exercises, investment scenarios, case studies, and other financial assessments.

Fill out your foundations in personal finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foundations In Personal Finance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.