Get the free Retiree benefit planning for employees

Show details

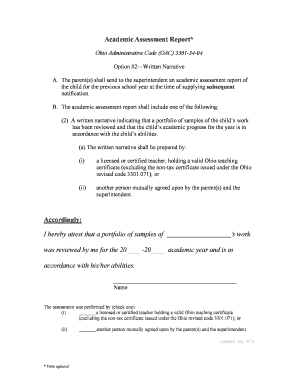

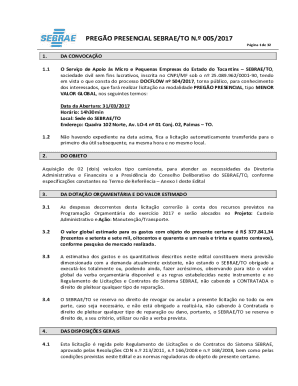

Retirement Planning Retiree benefit planning for employees hired or vested prior to 10/1/2012Agenda General retirement planning/types of plans Working in retirement The universities retirement plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retiree benefit planning for

Edit your retiree benefit planning for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retiree benefit planning for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retiree benefit planning for online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit retiree benefit planning for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retiree benefit planning for

How to fill out retiree benefit planning for

01

Gather all necessary documents such as retirement account statements, Social Security statements, and any other relevant financial information.

02

Determine your retirement goals and objectives, including factors such as desired lifestyle, travel plans, and healthcare needs.

03

Evaluate different sources of retirement income, such as pensions, 401(k)s, IRAs, and Social Security, and understand their eligibility requirements and potential benefits.

04

Assess your current financial situation, including your income, expenses, and debts, to determine how much you can contribute towards retirement savings.

05

Calculate your expected retirement expenses, considering factors such as housing, healthcare, daily living expenses, and potential long-term care needs.

06

Create a retirement budget that takes into account your income sources, expenses, and savings targets.

07

Consider potential risks and uncertainties, such as inflation, market fluctuations, and healthcare costs, and develop strategies to mitigate these risks.

08

Review and update your beneficiary designations for retirement accounts and pensions to ensure they align with your wishes.

09

Consult with a financial advisor or retirement planning professional to get personalized guidance and advice.

10

Regularly monitor and review your retirement plan, making adjustments as needed based on changes in your financial situation, goals, or market conditions.

Who needs retiree benefit planning for?

01

Individuals who are nearing retirement age and want to ensure a comfortable and financially secure retirement.

02

Employees who have access to retirement benefits through their employer but need assistance in maximizing the potential benefits.

03

Business owners and self-employed individuals who need to plan for their own retirement and potentially offer retiree benefits to their employees.

04

Individuals with significant retirement savings or assets who want to optimize their retirement income and minimize tax implications.

05

Anyone who wants to have a clear understanding of their retirement goals, options, and strategies to achieve them.

06

Employees who have various retirement accounts and need help consolidating and managing their retirement assets.

07

Individuals who want to protect their retirement savings from potential risks and uncertainties.

08

Families with dependents who want to ensure financial security for their loved ones during retirement.

09

Individuals who want to make informed decisions about when to start claiming Social Security benefits and how to maximize their benefits.

10

Individuals who want to leave a legacy or charitable contributions as part of their retirement planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit retiree benefit planning for from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your retiree benefit planning for into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send retiree benefit planning for for eSignature?

retiree benefit planning for is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my retiree benefit planning for in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your retiree benefit planning for and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is retiree benefit planning for?

Retiree benefit planning is for preparing for and managing the benefits that retirees will receive during their retirement years.

Who is required to file retiree benefit planning for?

Employers who offer retirement benefits to their employees are required to file retiree benefit planning.

How to fill out retiree benefit planning for?

Retiree benefit planning can be filled out by gathering information on retirement benefits offered, projected retiree demographics, and funding sources.

What is the purpose of retiree benefit planning for?

The purpose of retiree benefit planning is to ensure that retirees receive the benefits they are entitled to and that the employer can manage the costs associated with providing these benefits.

What information must be reported on retiree benefit planning for?

Information such as retirement benefit options, eligibility criteria, funding status, and projected costs must be reported on retiree benefit planning.

Fill out your retiree benefit planning for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retiree Benefit Planning For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.