Get the free Audit, Fraud Detection, and Cash Recovery

Show details

Audit, Fraud Detection, and Cash Recovering Activate for Office Self Study Course By: Michelle Shan and Richard B. Lanka This Course is recommended for 8 hours of continuing education credit 2004

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit fraud detection and

Edit your audit fraud detection and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit fraud detection and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

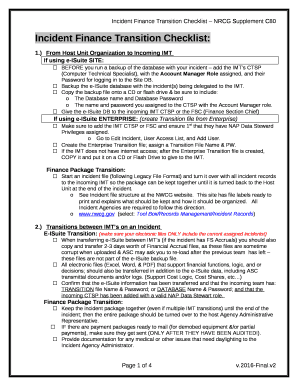

How to edit audit fraud detection and online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit audit fraud detection and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit fraud detection and

How to fill out audit fraud detection and

01

To fill out an audit fraud detection form, follow these steps:

02

Start by entering the relevant information about the company or individual being audited.

03

Include details about the specific transactions or financial activities being audited.

04

Provide any supporting documents or evidence related to the audit, such as financial statements, receipts, or bank records.

05

Clearly outline the objectives and scope of the audit fraud detection process.

06

identify the potential areas or red flags where fraud may have occurred.

07

Use appropriate auditing techniques and procedures to assess the likelihood of fraud, such as data analysis or interviews with relevant individuals.

08

Document your findings and observations throughout the audit process.

09

Prepare a comprehensive report summarizing the results of the audit fraud detection, including any identified instances of fraud or suspicious activities.

10

Communicate the findings to the relevant stakeholders, such as management or regulatory authorities.

11

Follow up on any recommendations or corrective actions proposed during the audit process.

Who needs audit fraud detection and?

01

Audit fraud detection is essential for various individuals and organizations, including:

02

- Companies of all sizes that want to ensure the integrity and transparency of their financial operations.

03

- Government agencies and regulatory bodies that oversee financial transactions and want to detect and prevent fraud.

04

- Auditors and accounting professionals responsible for evaluating financial statements and investigating fraudulent activities.

05

- Investors and shareholders who want to assess the credibility and reliability of financial information before making investment decisions.

06

- Non-profit organizations that rely heavily on public funding and need to maintain public trust and accountability.

07

- Law enforcement agencies involved in investigating financial crimes and prosecuting fraudsters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my audit fraud detection and directly from Gmail?

audit fraud detection and and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit audit fraud detection and from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your audit fraud detection and into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send audit fraud detection and for eSignature?

audit fraud detection and is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

What is audit fraud detection and?

Audit fraud detection is the process of identifying and investigating fraudulent activities within an audit report.

Who is required to file audit fraud detection and?

Audit fraud detection is typically required to be filed by the auditor or auditing firm conducting the audit.

How to fill out audit fraud detection and?

Audit fraud detection forms typically require detailed information on suspected fraudulent activities and findings from the audit.

What is the purpose of audit fraud detection and?

The purpose of audit fraud detection is to ensure the accuracy and integrity of audit reports and uncover any fraudulent activities.

What information must be reported on audit fraud detection and?

Information reported on audit fraud detection forms may include details of suspected fraud, relevant evidence, and recommended actions.

Fill out your audit fraud detection and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Fraud Detection And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.