Get the free form 8009 a

Show details

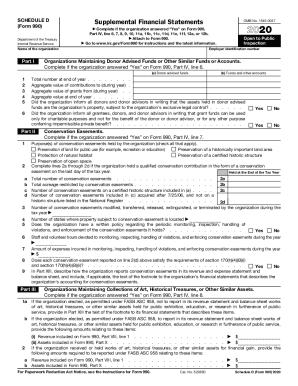

QUITCLAIM DEED (INDIVIDUAL OR CORPORATION) STANDARD NY BTU FORM 8009 CAUTION: THIS AGREEMENT SHOULD BE PREPARED BY AN ATTORNEY AND REVIEWED BY ATTORNEYS FOR SELLER AND PURCHASER BEFORE SIGNING. THIS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8009 a

Edit your form 8009 a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8009 a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8009 a online

Use the instructions below to start using our professional PDF editor:

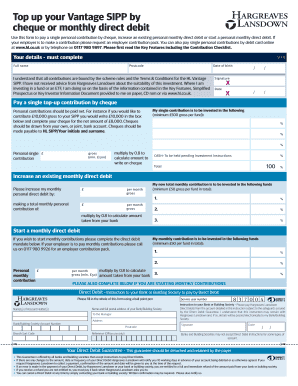

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 8009 a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8009 a

To fill out form 8009 a, follow these steps:

01

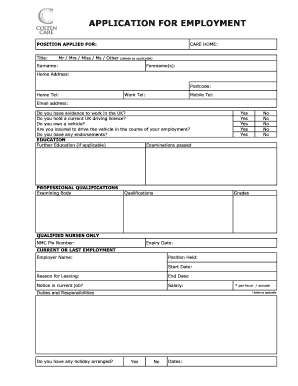

Start by gathering all the necessary information and documents required for filling out the form. This may include personal identification details, financial information, or any relevant supporting documents.

02

Access the form either online or in its physical format. Ensure that you have a clear and legible copy of the form before proceeding.

03

Begin filling out the form by entering your personal details such as your name, address, contact information, and any other information requested in the designated fields.

04

Review the instructions or guidelines provided with the form to understand the specific requirements for each section. Carefully input the required data in the appropriate fields following the provided instructions.

05

Pay attention to any specific formatting guidelines or restrictions mentioned in the form. This could include provisions for capitalization, use of abbreviations, or specific date formats.

06

Double-check your entries for accuracy and completeness before moving on to the next section. Ensure that all the required fields have been filled in and there are no errors or omissions.

07

If any sections or questions do not apply to your situation, mark them as "N/A" (not applicable) or provide a brief explanation if necessary.

08

Attach any supporting documents, if required, ensuring that they are clearly labeled and organized to correspond with the relevant sections of the form.

09

Once you have completed filling out the form, carefully review it one more time to verify that all the information provided is correct and accurate.

Who needs form 8009 a?

Form 8009 a may be required by individuals or entities who fall under specific circumstances or legal obligations. The exact need for this form can vary depending on the specific situation or jurisdiction. It is recommended to refer to the relevant authorities, regulatory bodies, or legal professionals to determine who specifically needs to fill out form 8009 a.

Fill

form

: Try Risk Free

People Also Ask about

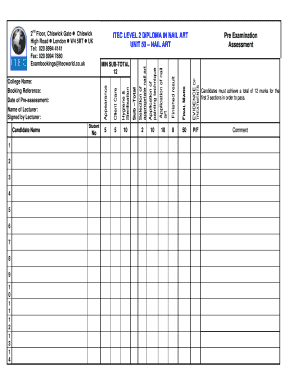

What is form 8809 for 1099?

Filing Form 8809 gives you more time to complete critical information returns like Form 1099-NEC and Form W-2. You can extend your information return's deadline 30 days by filing IRS Form 8809. If you need more time, you may be able to submit an additional Form 8809 before the 30-day period ends.

What is 8809 form used for?

Internal Revenue Service (IRS) Form 8809, “Application for Extension of Time to File Information Returns,” is a form used by businesses and individuals to request an extension of the due date to file any of the following federal tax forms: W-2. W-2G.

Do I have to pay taxes if I fill out a w9?

Do I have to pay taxes if I fill out a W-9? Yes, you will have to pay taxes if you fill out a W-9 form. However, the IRS and your employer usually won't withhold taxes from W-9 earnings. That means you'll need to plan ahead for your tax bill so you don't get surprised in April.

Why did the IRS send me a letter about EIC?

We sent you a letter (notice) because our records show you may be eligible for the EITC but didn't claim it on your tax return. First, find out if you qualify for EITC by following the steps shown in your notice. You can find out more about What You Need to Do and What we Will Do by using one of the links below.

What is a form 8009 A?

Form 8009-A explain your entry online 14 of your Amended return and send supporting forms or schedules. When filing a Form 1040-X, you need to explain any changes you have made in Part III of the return.

What is the purpose of form 8809?

Internal Revenue Service (IRS) Form 8809, “Application for Extension of Time to File Information Returns,” is a form used by businesses and individuals to request an extension of the due date to file any of the following federal tax forms: W-2. W-2G.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 8009 a online?

With pdfFiller, you may easily complete and sign form 8009 a online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the form 8009 a in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your form 8009 a right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete form 8009 a on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form 8009 a. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is form 8009 a?

Form 8009-A is a tax form used by certain organizations to report specific financial information to the IRS.

Who is required to file form 8009 a?

Organizations that meet specific criteria as defined by the IRS, typically those that receive federal funds or are involved in certain tax-exempt activities, are required to file Form 8009-A.

How to fill out form 8009 a?

To fill out Form 8009-A, individuals or organizations should follow the instructions provided by the IRS, ensuring that all required information is accurately documented and submitted by the deadline.

What is the purpose of form 8009 a?

The purpose of Form 8009-A is to provide the IRS with necessary financial data and to ensure compliance with tax laws related to the reporting of federal funds.

What information must be reported on form 8009 a?

Form 8009-A typically requires organizations to report details such as financial transactions, funding sources, expenditures, and any other relevant financial data as specified by the IRS.

Fill out your form 8009 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8009 A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.