UK HMRC SA108 2017 free printable template

Show details

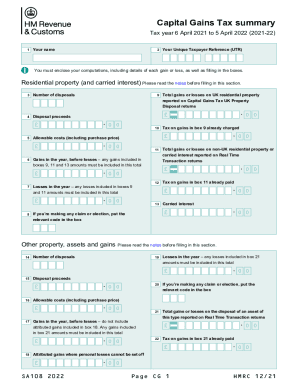

Capital gains summary

Tax year 6 April 2016 to 5 April 2017 (201617)

1Your name2Your Unique Taxpayer Reference (UTC)You must enclose your computations, including details of each gain or loss, as well

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK HMRC SA108

Edit your UK HMRC SA108 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC SA108 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC SA108 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK HMRC SA108. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC SA108 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC SA108

How to fill out UK HMRC SA108

01

Download the SA108 form from the HMRC website.

02

Read the form guidance notes carefully.

03

Fill in your personal details, including your name and Unique Taxpayer Reference (UTR).

04

Indicate the type of income you are declaring, such as property or foreign income.

05

Enter the details of your income sources as required in the relevant sections.

06

Calculate any allowable expenses and enter these in the designated area.

07

Total your income and expenses to arrive at the final figure.

08

Review the form for any errors and ensure all required sections are complete.

09

Submit the form online through your personal tax account or print and send it by post.

Who needs UK HMRC SA108?

01

Anyone who is self-employed or has income that is not taxed at source.

02

Individuals with rental income or foreign income that needs to be reported.

03

Those who need to claim certain reliefs or allowances related to their income.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to complete 28 rate gain worksheet?

The result will be a net long-term gain or loss. Remember, any long-term gains or losses from art, jewelry, antiques, precious metals, etc., which are termed "collectibles," are taxed at a 28 percent rate. You will need to complete the 28% Rate Gain Worksheet in the Schedule D Instructions.

Do you have to report all capital gains?

While all capital gains are taxable and must be reported on your tax return, only capital losses on investment or business property are deductible.

Do you need to fill in the capital gains summary page and provide computations?

You'll need to send computations for each asset or type of asset you sold or disposed of in support of the Capital Gains Summary.

How do you report capital gains to the IRS?

Capital gains and deductible capital losses are reported on Form 1040, Schedule D, Capital Gains and Losses, and then transferred to line 13 of Form 1040, U.S. Individual Income Tax Return. Capital gains and losses are classified as long-term or short term.

Do I need to complete capital gains pages?

If you make a taxable capital gain, you generally need to complete a Self Assessment tax return, so you need to keep relevant documents in connection with the gain or claim for losses or other reliefs. Essentially, you need records that, if necessary, will enable you to answer any HMRC queries.

How much do you have to make in capital gains to report to IRS?

The income thresholds that might make investors subject to the net investment income tax are: Single or head of household: $200,000. Married, filing jointly: $250,000. Married, filing separately: $125,000.

What documents do I need for capital gains tax?

What documents do you need for taxes if you sold a house? 1099-S form to report your capital gains. 1098 form as a record of your mortgage interest payments. Closing Statement, which is a receipt for your home sale. Records to determine your cost basis. Documents showing you had a work-related move.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK HMRC SA108 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your UK HMRC SA108 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for the UK HMRC SA108 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your UK HMRC SA108 in seconds.

How can I edit UK HMRC SA108 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing UK HMRC SA108.

What is UK HMRC SA108?

UK HMRC SA108 is a supplementary self-assessment form used for reporting income or losses from property, such as rental income, on an individual's tax return.

Who is required to file UK HMRC SA108?

Individuals who receive rental income or have property-related income that exceeds the tax-free allowance must file the UK HMRC SA108 form.

How to fill out UK HMRC SA108?

To fill out the UK HMRC SA108, you need to gather details about your rental income, allowable expenses, and complete the form accurately based on HMRC guidelines, submitting it alongside your self-assessment tax return.

What is the purpose of UK HMRC SA108?

The purpose of UK HMRC SA108 is to provide the HMRC with detailed information regarding income or losses from property, enabling the correct assessment of tax liabilities.

What information must be reported on UK HMRC SA108?

The UK HMRC SA108 requires reporting of total rental income, allowable expenses, property details, and any losses carried forward from previous tax years.

Fill out your UK HMRC SA108 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC sa108 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.