Get the free TAX AND ACCOUNTING

Show details

Noncash Charitable

Donation Tracker

2016

CHERYL HAWKINS

TAX AND ACCOUNTING

Certified Public Accountant700 Seville Dr #204

Jordan, MN 55352

www.chawkins.tax

9522228272Fair Market Value Guide

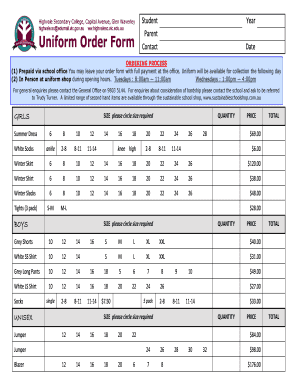

Men Clothing

Accessories.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax and accounting

Edit your tax and accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax and accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax and accounting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax and accounting. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax and accounting

How to fill out tax and accounting

01

Understand the tax and accounting requirements in your jurisdiction.

02

Gather all the necessary financial documents, including income statements, expense reports, and receipts.

03

Organize your financial records and create a system to keep track of income and expenses.

04

Determine the appropriate tax forms to complete based on your business structure or personal situation.

05

Fill out the tax forms accurately, including providing all required information and calculations.

06

Double-check all the information before submitting the tax forms.

07

Submit the completed tax forms to the relevant tax authorities on time.

08

Keep a copy of all the filled-out forms and supporting documents for future reference.

09

Consider seeking professional assistance from a tax advisor or accountant if needed.

Who needs tax and accounting?

01

Individuals who earn income from various sources, such as employment, investments, or self-employment.

02

Small business owners who need to comply with tax and accounting regulations.

03

Freelancers or independent contractors who receive income without traditional payroll deductions.

04

Corporations and businesses of all sizes that are required to maintain accurate financial records.

05

Non-profit organizations that receive donations and have financial obligations.

06

Anyone who wants to ensure compliance with tax laws and regulations to avoid penalties or legal issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax and accounting directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your tax and accounting and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit tax and accounting from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your tax and accounting into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send tax and accounting for eSignature?

When you're ready to share your tax and accounting, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

What is tax and accounting?

Tax and accounting are processes used by individuals and businesses to report financial information to the government and calculate the amount of taxes owed.

Who is required to file tax and accounting?

Individuals and businesses are required to file tax and accounting in order to comply with tax laws and regulations.

How to fill out tax and accounting?

Tax and accounting forms can be filled out manually or using accounting software, with accuracy and attention to detail being key.

What is the purpose of tax and accounting?

The purpose of tax and accounting is to track financial transactions, ensure compliance with tax laws, and provide information for decision-making.

What information must be reported on tax and accounting?

Income, expenses, deductions, credits, and other financial information must be reported on tax and accounting forms.

Fill out your tax and accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax And Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.