Get the free ALL TOD ACCOUNTS ARE SUBJECT TO RECEIPT AND ACCEPTANCE BY MorganStanley SMITHBARNEY LLC

Show details

Save Platform Validation Rules (For MS Use only)Clear Former Internal Use Only

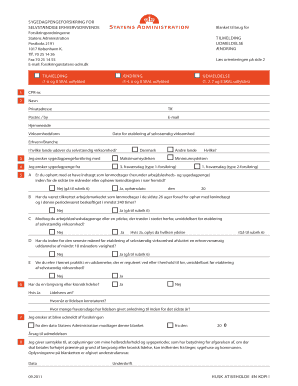

Branch No. Account No.FA/PWA No. Transfer on Death (TOD) Agreement

ALL TOD ACCOUNTS ARE SUBJECT TO RECEIPT AND ACCEPTANCE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all tod accounts are

Edit your all tod accounts are form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all tod accounts are form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit all tod accounts are online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit all tod accounts are. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all tod accounts are

How to fill out all tod accounts are

01

To fill out all tod accounts, follow these steps:

02

Start by gathering all the necessary information and documents related to the TOD accounts, such as the account holder's personal details, beneficiary information, and any specific requirements or guidelines provided by the financial institution.

03

Visit the financial institution's website or branch to access the TOD account application form. Ensure that you have a clear understanding of the terms and conditions associated with the TOD account.

04

Fill out the application form accurately and completely. Provide the account holder's name, address, contact information, and any other required personal details.

05

Provide the details of the designated beneficiaries for the TOD accounts. Include their names, addresses, contact information, and their relationship to the account holder.

06

Double-check all the information filled in the form to ensure its accuracy and completeness.

07

Submit the completed application form along with any required supporting documents specified by the financial institution. These may include identification proofs, proof of relationship with beneficiaries, and any legal documents if applicable.

08

Upon submission, the financial institution will review the application and may contact you for further verification or clarification if needed.

09

Once the application is approved, the TOD accounts will be set up, and you will receive confirmation from the financial institution. Make sure to review all the terms and conditions associated with the TOD accounts for better understanding.

10

Monitor the TOD accounts periodically and consider updating beneficiary details if there are any changes in circumstances.

11

In case of any doubts or queries related to the TOD accounts, reach out to the financial institution's customer support for assistance.

Who needs all tod accounts are?

01

All TOD accounts are suitable for individuals who want to manage their assets and ensure a smooth transfer of these assets to specific beneficiaries upon their demise.

02

The following individuals may find TOD accounts beneficial:

03

- Those who wish to avoid probate and the associated costs and delays.

04

- Individuals concerned about the privacy of their estate distribution beneficiaries.

05

- People who want to provide for their loved ones without the need for a will or trust.

06

- Those who desire to establish an easy and straightforward mechanism for asset transfer after their death.

07

- Individuals who want to maintain control over their assets during their lifetime but ensure a seamless transition to beneficiaries upon passing.

08

- Anyone who wants to simplify estate planning and reduce potential conflicts among beneficiaries.

09

It is advisable to consult with financial advisors or legal professionals to determine if TOD accounts align with your specific financial and estate planning goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out all tod accounts are using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign all tod accounts are and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit all tod accounts are on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share all tod accounts are on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete all tod accounts are on an Android device?

Use the pdfFiller Android app to finish your all tod accounts are and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is all tod accounts are?

All TOD accounts are Transfer on Death accounts, which are a type of account that allows the account owner to designate beneficiaries to receive the assets in the account upon the owner's death.

Who is required to file all tod accounts are?

Individuals who have TOD accounts are required to designate beneficiaries when opening the account.

How to fill out all tod accounts are?

To fill out a TOD account, the account owner must provide the necessary information about the beneficiaries, including their names, addresses, and relationship to the account owner.

What is the purpose of all tod accounts are?

The purpose of TOD accounts is to ensure that assets in the account pass directly to the designated beneficiaries without going through probate.

What information must be reported on all tod accounts are?

The information that must be reported on TOD accounts includes the names and contact information of the beneficiaries, as well as their relationship to the account owner.

Fill out your all tod accounts are online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Tod Accounts Are is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.