AU Insurance Commission RiskCover Risk Management Guidelines 2016-2025 free printable template

Show details

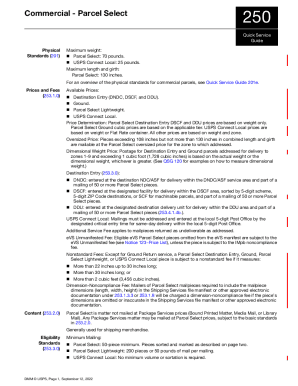

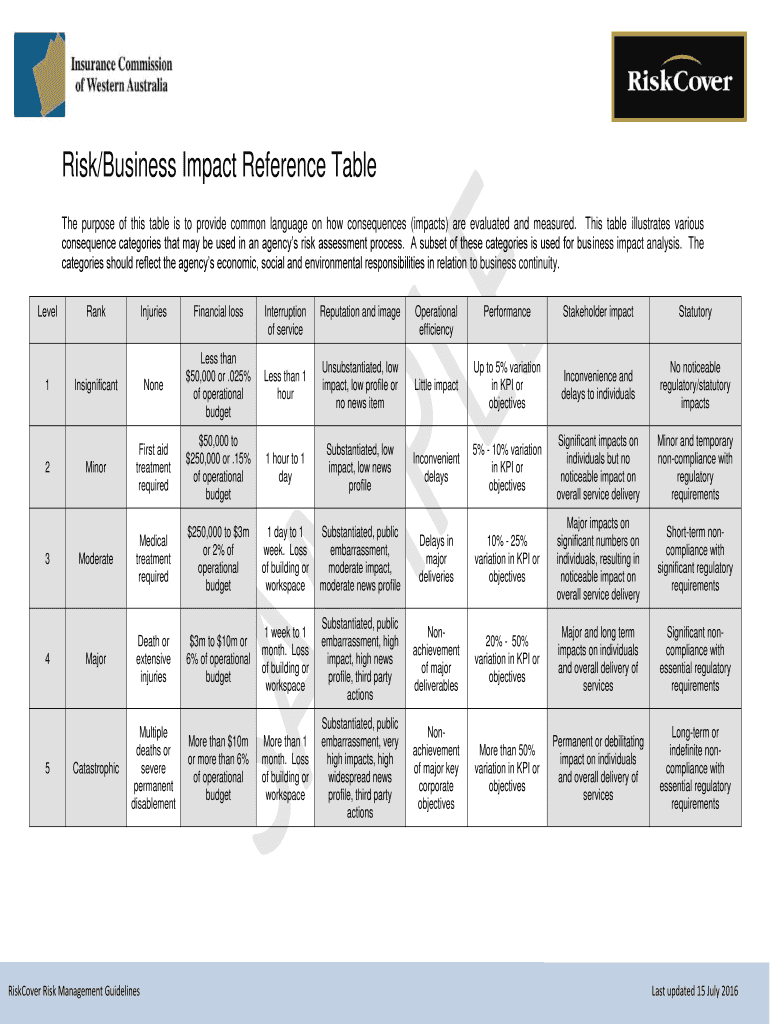

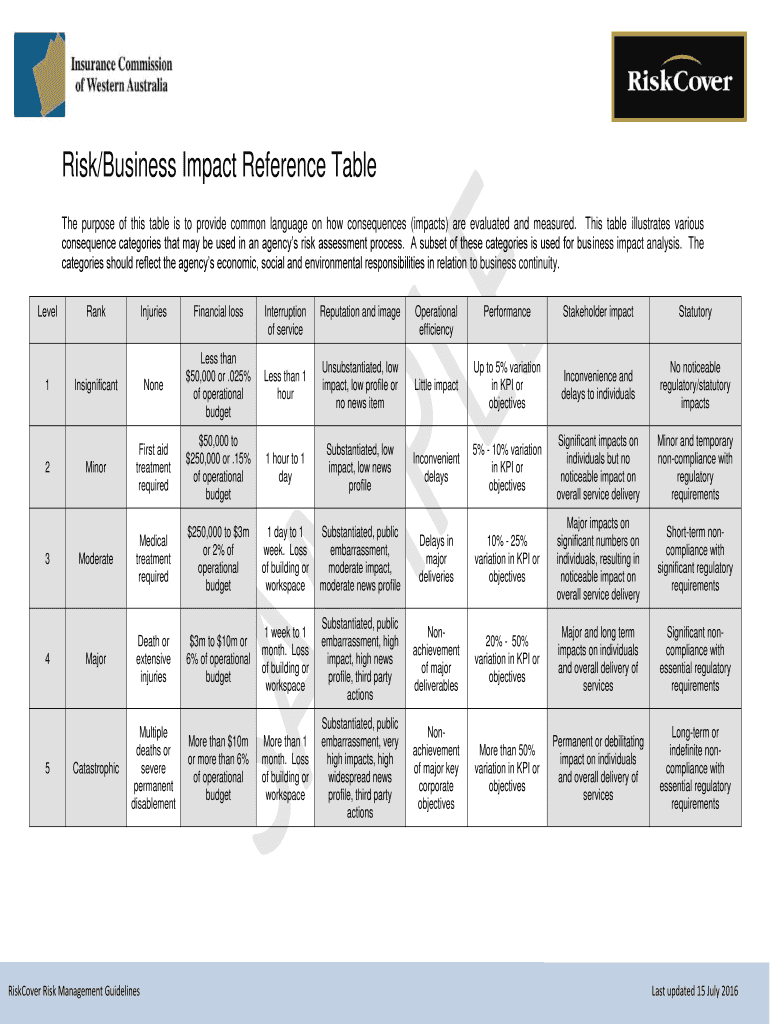

Risk/Business Impact Reference Table

The purpose of this table is to provide common language on how consequences (impacts) are evaluated and measured. This table illustrates various

consequence categories

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk impact consequences form

Edit your business impact reference table form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your number cost labor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mitigate summary evaluate online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit reference summary use form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk agencies form

How to fill out AU Insurance Commission RiskCover Risk Management Guidelines

01

Read the Risk Management Guidelines thoroughly to understand the overall framework.

02

Identify the specific risks associated with your organization or operations.

03

Gather relevant data to assess the frequency and impact of these risks.

04

Fill out the risk assessment forms provided in the guidelines with the identified risks.

05

Develop and document risk management strategies and controls for each identified risk.

06

Review and update the risk management plan regularly to reflect changes in the organization or operational environment.

07

Submit the completed documentation as per the guidelines' submission instructions.

Who needs AU Insurance Commission RiskCover Risk Management Guidelines?

01

Organizations participating in the AU Insurance Commission’s RiskCover program.

02

Risk management professionals tasked with assessing and mitigating risks.

03

Management teams responsible for compliance and organizational safety.

04

Any business or agency that falls under the jurisdiction of the AU Insurance Commission.

Fill

cost labor based

: Try Risk Free

People Also Ask about mission responsibility roles

What is an example of a business impact?

Business impact is the ongoing cost of disruptions caused by a negative event such as a disaster, crime, outage, shutdown, failure or political instability. This can be estimated as part of the process of recovery.

How do I create a BIA report?

How to Conduct a Business Impact Analysis? Proper Planning: Scope the Business Impact Analysis. Gathering Information: Schedule Business Impact Analysis Interviews. Analyze the Data Gathered: Execute BIA and Risk Assessment Interviews. Write the Report: Document and Approve Each Department-Level BIA Report.

How do you document a business impact analysis?

The BIA is composed of the following three steps: Determine mission/business processes and recovery criticality. Mission/business processes supported by the system are identified and the impact of a system disruption to those processes is determined along with outage impacts and estimated downtime.

What are the five elements of a business impact analysis?

For example, Gartner recommends 5 main impact areas to examine: Financial, Reputation, Regulatory and social, Production output, and Environmental.

What is an example of a BIA?

For example, a manufacturing company could create a BIA to measure how losing a key supplier would affect company operations and revenue. Simply put, a BIA identifies the operational and financial impacts of disruptions—like what would happen if your servers crashed or a global pandemic changed the market landscape.

What should a BIA include?

The BIA report should document the potential impacts resulting from disruption of business functions and processes. Scenarios resulting in significant business interruption should be assessed in terms of financial impact, if possible. These costs should be compared with the costs for possible recovery strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get injuries injury based?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the crises categories departments in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit business roles on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing impacts framework evaluate, you can start right away.

How can I fill out impact reference summary on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your impact reference table from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is AU Insurance Commission RiskCover Risk Management Guidelines?

The AU Insurance Commission RiskCover Risk Management Guidelines are a set of principles and frameworks designed to assist organizations in effectively managing risks associated with their operations and decision-making processes.

Who is required to file AU Insurance Commission RiskCover Risk Management Guidelines?

Organizations that participate in the AU Insurance Commission RiskCover program are required to file these guidelines as part of their risk management compliance and reporting obligations.

How to fill out AU Insurance Commission RiskCover Risk Management Guidelines?

To fill out the AU Insurance Commission RiskCover Risk Management Guidelines, organizations must follow the prescribed format, provide relevant information about their risk management practices, and ensure accuracy and completeness in their reporting.

What is the purpose of AU Insurance Commission RiskCover Risk Management Guidelines?

The purpose of the AU Insurance Commission RiskCover Risk Management Guidelines is to promote best practices in risk management, ensure compliance, and enhance the governance and accountability of organizations using the RiskCover program.

What information must be reported on AU Insurance Commission RiskCover Risk Management Guidelines?

The information that must be reported includes risk assessments, management strategies, mitigation plans, and any relevant incidents or claims associated with the organization's risk management activities.

Fill out your risk business form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Responsibility Roles is not the form you're looking for?Search for another form here.

Keywords relevant to impacts illnesses summary

Related to business summary use

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.