Get the free Saving your raise and bonus

Show details

Saving your raise and bonus A sign of maturity for children and adults when money is involved is delayed gratification. Every child who sees a cookie wants it right away. Parents who are concerned

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign saving your raise and

Edit your saving your raise and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your saving your raise and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit saving your raise and online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit saving your raise and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

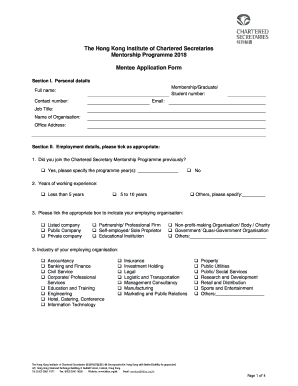

How to fill out saving your raise and

How to fill out saving your raise and

01

Start by reviewing your current expenses and financial goals.

02

Determine how much of your raise you want to save and set a specific savings goal.

03

Create a budget that includes your new income and allocate a portion towards savings.

04

Consider automating your savings by setting up automatic transfers to a separate savings account.

05

Prioritize paying off any high-interest debts before focusing on saving your raise.

06

Explore different saving options such as retirement accounts, investment accounts, or high-yield savings accounts.

07

Track your progress and make adjustments to your savings plan as needed.

08

Celebrate milestones and stay motivated by rewarding yourself for reaching savings goals.

09

Continue to educate yourself on personal finance and seek professional advice if necessary.

Who needs saving your raise and?

01

Anyone who wants to improve their financial situation and build wealth.

02

Individuals who receive a raise and want to make the most of their increased income.

03

Those who have specific financial goals such as saving for a down payment, emergency fund, or retirement.

04

People looking to pay off debt faster and reduce financial stress.

05

Individuals who want to create a stable financial foundation for the future.

06

Those who want to take control of their finances and achieve financial independence.

07

Anyone who wants to maximize their savings and make their money work for them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit saving your raise and from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your saving your raise and into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send saving your raise and to be eSigned by others?

Once your saving your raise and is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute saving your raise and online?

pdfFiller has made filling out and eSigning saving your raise and easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is saving your raise and?

Saving your raise and refers to setting aside a portion of your salary or income for future use or emergencies.

Who is required to file saving your raise and?

Saving your raise and is required by individuals who want to be financially responsible and plan for their future financial needs.

How to fill out saving your raise and?

To fill out saving your raise and, you can start by creating a budget, setting financial goals, and allocating a portion of your income to savings on a regular basis.

What is the purpose of saving your raise and?

The purpose of saving your raise and is to have financial security, achieve financial goals, and be prepared for unexpected expenses or emergencies.

What information must be reported on saving your raise and?

The information reported on saving your raise and includes the amount saved, the method of saving, the purpose of saving, and the timeline for achieving saving goals.

Fill out your saving your raise and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Saving Your Raise And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.