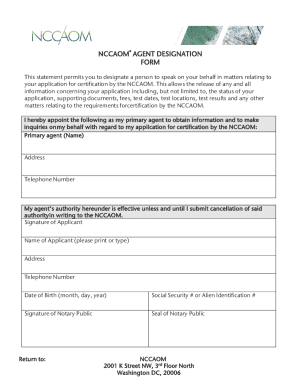

Get the free When someone borrows

Show details

SECTION 14+

When someone borrows

money from another, we

understand he or she has

an obligation to repay. A

study in the dictionary

will show you what this

really means. A definition

of obligation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign when someone borrows

Edit your when someone borrows form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your when someone borrows form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing when someone borrows online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit when someone borrows. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

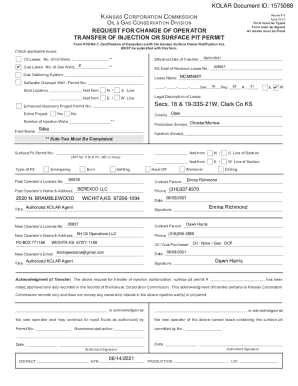

How to fill out when someone borrows

How to fill out when someone borrows

01

Start by gathering all necessary information about the borrower, such as their full name, contact details, and identification number.

02

Clearly state the purpose and terms of the loan in a written agreement, including the amount borrowed, the interest rate (if applicable), and the repayment schedule.

03

Make sure to include any collateral or security measures to protect your interests in case the borrower fails to repay the loan.

04

Fill out the borrower's information accurately in the designated fields of the loan application form.

05

Provide any additional details or instructions required by the lending institution or organization handling the loan process.

06

Double-check all information filled out and ensure its correctness before submitting the loan application.

07

Keep a copy of all documentation related to the loan transaction for future reference.

08

Follow up with the borrower to ensure they understand their responsibilities and obligations regarding the borrowed amount.

09

Maintain open communication with the borrower throughout the repayment period, addressing any concerns or issues promptly.

10

Monitor the repayment progress and take appropriate action if the borrower fails to meet the agreed-upon terms.

11

Keep records of all repayments received and update the loan status accordingly.

12

Once the borrowed amount is fully repaid, provide the borrower with a written confirmation or receipt as proof of completion.

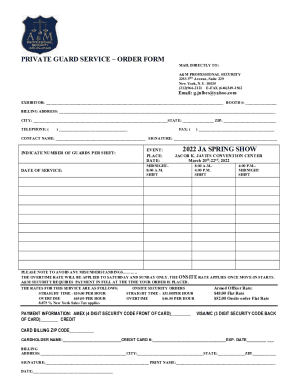

Who needs when someone borrows?

01

Individuals who require financial assistance but do not have the means to acquire it through traditional means may need to borrow.

02

Small business owners or entrepreneurs seeking capital to start or expand their ventures may also need to borrow.

03

Students pursuing higher education often rely on loans to cover tuition fees, accommodation, and other educational expenses.

04

Individuals facing unexpected or emergency expenses, such as medical bills or home repairs, may need to borrow to address these financial challenges.

05

People looking to make significant purchases, such as buying a car or a house, often rely on borrowing to fund these acquisitions.

06

Organizations or institutions in need of funds for various purposes, such as infrastructure development or project implementation, may opt for borrowing.

07

Governments or public entities may resort to borrowing to finance public investments or cover budget deficits.

08

Anyone who qualifies for a loan and finds it more feasible to repay the borrowed amount over a certain period rather than upfront may consider borrowing.

Fill

form

: Try Risk Free

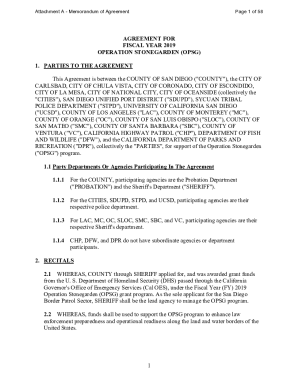

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send when someone borrows for eSignature?

When you're ready to share your when someone borrows, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete when someone borrows on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your when someone borrows. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit when someone borrows on an Android device?

You can make any changes to PDF files, like when someone borrows, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your when someone borrows online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

When Someone Borrows is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.