Get the free Financing SMEs in Cyprus: no stone left unturned? - ACCA

Show details

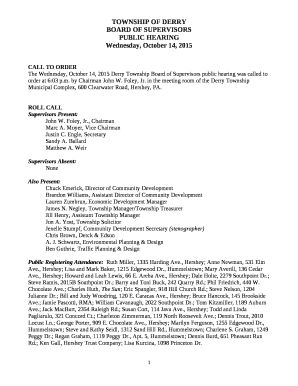

ACCOUNTANTS FOR BUSINESS Financing SMEs in Cyprus: no stone left unturned? About CCA (the Association of Chartered Certified Accountants) is the global body for professional accountants. We aim to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financing smes in cyprus

Edit your financing smes in cyprus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financing smes in cyprus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financing smes in cyprus online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financing smes in cyprus. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financing smes in cyprus

How to fill out financing SMEs in Cyprus:

01

Identify the financing needs: The first step in filling out financing for SMEs in Cyprus is to determine the specific needs of your business. Assess the financial requirements for various aspects such as working capital, equipment acquisition, expansion plans, or any other areas that need funding.

02

Research the available financing options: Cyprus offers various financing options for SMEs, such as bank loans, venture capital, angel investors, crowdfunding, grants, and government-backed schemes. Conduct thorough research to understand the eligibility criteria, terms and conditions, interest rates, and repayment options for each option.

03

Prepare a comprehensive business plan: To apply for financing in Cyprus, it is crucial to have a solid business plan in place. Include detailed information about your company's background, market analysis, financial projections, management team, and growth strategies. This will help lenders or investors understand the viability and potential of your business.

04

Gather necessary documentation: Different financing sources may require specific documentation, so it is essential to gather all the required paperwork beforehand. This may include financial statements, tax returns, bank statements, legal documents, business licenses, and permits. Ensure that all documents are up to date and accurately reflect your business's financial health.

05

Complete the financing application: Once you have selected the financing option and gathered all the necessary documents, proceed to fill out the application form. Pay attention to every detail and provide accurate information. Any errors or inconsistencies could cause delays in the approval process.

06

Evaluate financing offers: If you receive multiple financing offers, carefully compare them based on interest rates, repayment terms, collateral requirements, additional fees, and any other relevant factors. Assess the overall cost of borrowing and choose the option that best suits your business needs and financial capabilities.

Who needs financing SMEs in Cyprus:

01

Startups: Entrepreneurs and new businesses in Cyprus often require financing to kickstart their operations, invest in infrastructure, and launch their products or services. Financing options can provide the necessary capital to cover initial expenses and support growth.

02

Small and Medium-Sized Enterprises (SMEs): Existing SMEs in Cyprus often seek financing for various purposes such as expanding their operations, purchasing new equipment, hiring additional staff, or diversifying their product range. Access to financing can help SMEs capitalize on growth opportunities and improve competitiveness.

03

Established businesses: Even well-established businesses may require financing in Cyprus. This could be for purposes like investing in research and development, upgrading technology or machinery, expanding into new markets, or acquiring competitors. Financing can provide the necessary funds to support business growth and innovation.

In conclusion, filling out financing for SMEs in Cyprus involves understanding your specific financing needs, researching available options, preparing a comprehensive business plan, gathering necessary documentation, completing the application, and evaluating financing offers. Financing SMEs is essential for startups, existing SMEs, and established businesses in Cyprus seeking capital to support their growth and development.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financing smes in cyprus?

Financing SMEs in Cyprus refers to providing financial support and assistance to small and medium-sized enterprises in the country.

Who is required to file financing smes in cyprus?

Small and medium-sized enterprises in Cyprus are required to file for financing in order to receive funding and support.

How to fill out financing smes in cyprus?

To fill out financing for SMEs in Cyprus, businesses need to provide detailed information about their financial needs and plans.

What is the purpose of financing smes in cyprus?

The purpose of financing SMEs in Cyprus is to help these businesses grow and develop by providing them with the necessary financial resources.

What information must be reported on financing smes in cyprus?

Businesses need to report financial statements, business plans, and other relevant information when applying for financing in Cyprus.

How can I send financing smes in cyprus to be eSigned by others?

Once you are ready to share your financing smes in cyprus, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in financing smes in cyprus?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your financing smes in cyprus to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit financing smes in cyprus on an Android device?

You can make any changes to PDF files, like financing smes in cyprus, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your financing smes in cyprus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financing Smes In Cyprus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.