Get the free Division of Accountancy - DBPR

Show details

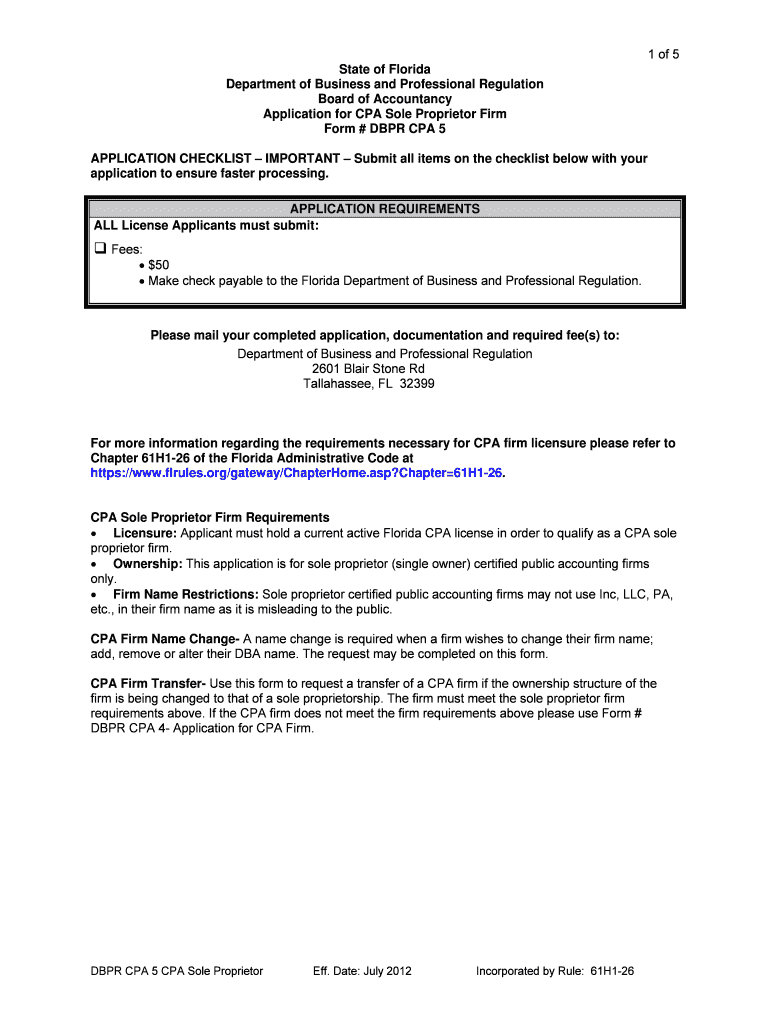

1 of 5 State of Florida Department of Business and Professional Regulation Board of Accountancy Application for CPA Sole Proprietor Firm Form # BPR CPA 5 APPLICATION CHECKLIST IMPORTANT Submit all

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign division of accountancy

Edit your division of accountancy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your division of accountancy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing division of accountancy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit division of accountancy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out division of accountancy

How to fill out division of accountancy

01

Start by gathering all necessary financial information such as income statements, balance sheets, and cash flow statements.

02

Review the division of accountancy form provided by your accountant or Division of Accountancy department.

03

Fill out the form accurately and completely, ensuring that all required fields are filled in.

04

Provide detailed information about your business, including the nature of your operations, any subsidiaries or affiliates, and any relevant legal entities.

05

Include information about your financial reporting practices and any specific requirements for your industry.

06

Attach any supporting documentation required by the form, such as audited financial statements or tax returns.

07

Double-check your form for any errors or omissions before submitting it to the Division of Accountancy.

08

Submit the completed form to the designated Division of Accountancy office either in person or through electronic means.

09

Keep a copy of the filled-out form for your records.

10

Follow up with the Division of Accountancy to ensure that your form has been received and processed correctly.

Who needs division of accountancy?

01

Individuals or businesses who require professional accounting services and want to ensure compliance with accounting regulations.

02

Companies preparing for audits or financial reviews that need to demonstrate transparency and accuracy in their financial reporting.

03

Start-ups or entrepreneurs who need assistance in setting up their accounting systems and processes.

04

Organizations seeking to apply for loans or secure financing, as lenders often require detailed financial information and division of accountancy filings.

05

Businesses involved in mergers and acquisitions, as accurate financial reporting is crucial during the due diligence process.

06

Government agencies or regulatory bodies that oversee financial reporting and compliance.

07

Non-profit organizations that need to provide transparent financial information to stakeholders and donors.

08

Individuals or businesses involved in legal disputes or litigation that require detailed accounting records as evidence.

09

Investors or shareholders who rely on accurate financial information to make informed investment decisions.

10

Any individual or business that wants to maintain proper financial records and ensure compliance with accounting standards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get division of accountancy?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific division of accountancy and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the division of accountancy in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your division of accountancy in minutes.

How do I edit division of accountancy on an iOS device?

Create, edit, and share division of accountancy from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is division of accountancy?

Division of accountancy is the process of dividing and allocating financial resources within an organization.

Who is required to file division of accountancy?

All organizations or companies that need to report their financial information are required to file division of accountancy.

How to fill out division of accountancy?

Division of accountancy can be filled out by providing detailed information about the financial transactions and allocations within the organization.

What is the purpose of division of accountancy?

The purpose of division of accountancy is to ensure transparency and accountability in the financial management of an organization.

What information must be reported on division of accountancy?

Information such as income, expenses, assets, liabilities, and equity must be reported on division of accountancy.

Fill out your division of accountancy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Division Of Accountancy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.