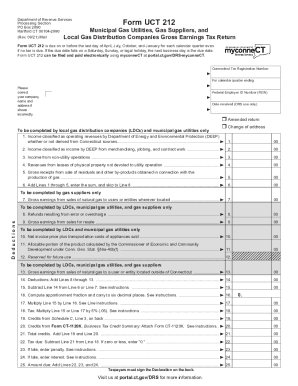

CT DRS UCT 212 2017 free printable template

Get, Create, Make and Sign ct uct 212 form

How to edit ct uct 212 form online

Uncompromising security for your PDF editing and eSignature needs

CT DRS UCT 212 Form Versions

How to fill out ct uct 212 form

How to fill out CT DRS UCT 212

Who needs CT DRS UCT 212?

Instructions and Help about ct uct 212 form

We come to a little quick Oakland taken from this car huh — into the bank staff up turned away a little I swear I'm John as Wainwright a mess then they go little looser you can do Rico minimal bamboo drown your hotel abandoned hanging ten well good it because you got a partisan look but now but man I think I said not kill you my spare had chemistry Jim column don't you shout clinic in tackle move to it yet yeah they're going to look yeah um okay Ferry tell onion background Young Money I love the feminine I'm good they don't burn no peeking yay DE la Madison but fell open your lemon hello Myra cute I'm back cuckoo, cuckoo clock Shack Rico no d3100 Rico day to see a good man go out tsubagakure Rico LD tonight in Bangle King and get high boom Ave a urinal Kim Aka AVI arrived and hand rim or at Obama cosmopolitan dune Dena ok multi-way now Hamilton under my leadership Trimble Robin and cumin see Hotel toady the Utah say like Oh Kyra mans that girl Nocturnal Cuba for all time, but I don't know long time L don't know that you can unlock this decision time how the Maya little kind of 90 method semi don't get it up and over Abu Harder get it over I'm gonna practice on right now listen sir move will turn nah come up, but I don't I get it you can tinker no no no no no they only look what they do they look, so yeah god-damn, and he doesn't want to say they whoa but in fact I laughed you, but you have to buy let's insert a new meter online you are you better even some from shock don't bother look or my request behind I'm sorry, so I lost the shooting of Anna give me that back the till midnight young miss Thai Don Muslim do feel I look involved only under bamboo long block of Lublin the girl who played a rat with a bang bang come you tonight were supplied with a name in a democracy today Russian Superman necessarily well to look like him identical oh come on how faint — bah Baha then apply my freedom but then say velocity' come on look star but in my time I sat on a rock band there no no passéDelacroix contact lockdown you

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ct uct 212 form directly from Gmail?

How can I send ct uct 212 form for eSignature?

Can I edit ct uct 212 form on an iOS device?

What is CT DRS UCT 212?

Who is required to file CT DRS UCT 212?

How to fill out CT DRS UCT 212?

What is the purpose of CT DRS UCT 212?

What information must be reported on CT DRS UCT 212?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.