Get the free TYPE OF MORTGAGE AN D TERMS OF LOAN

Show details

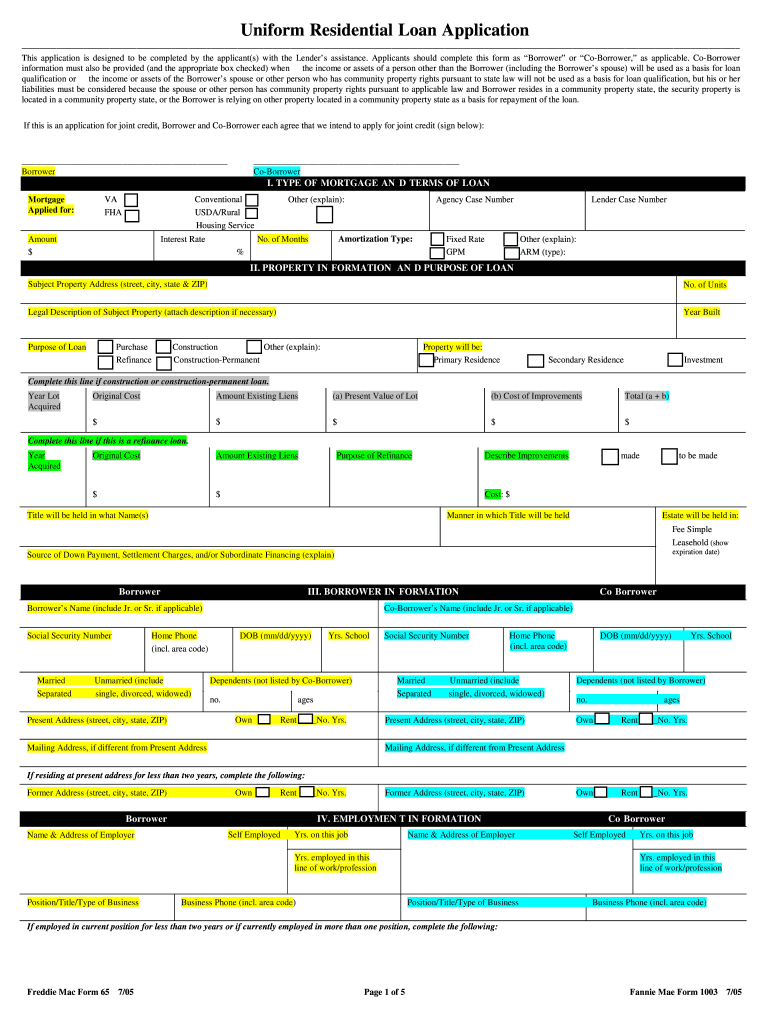

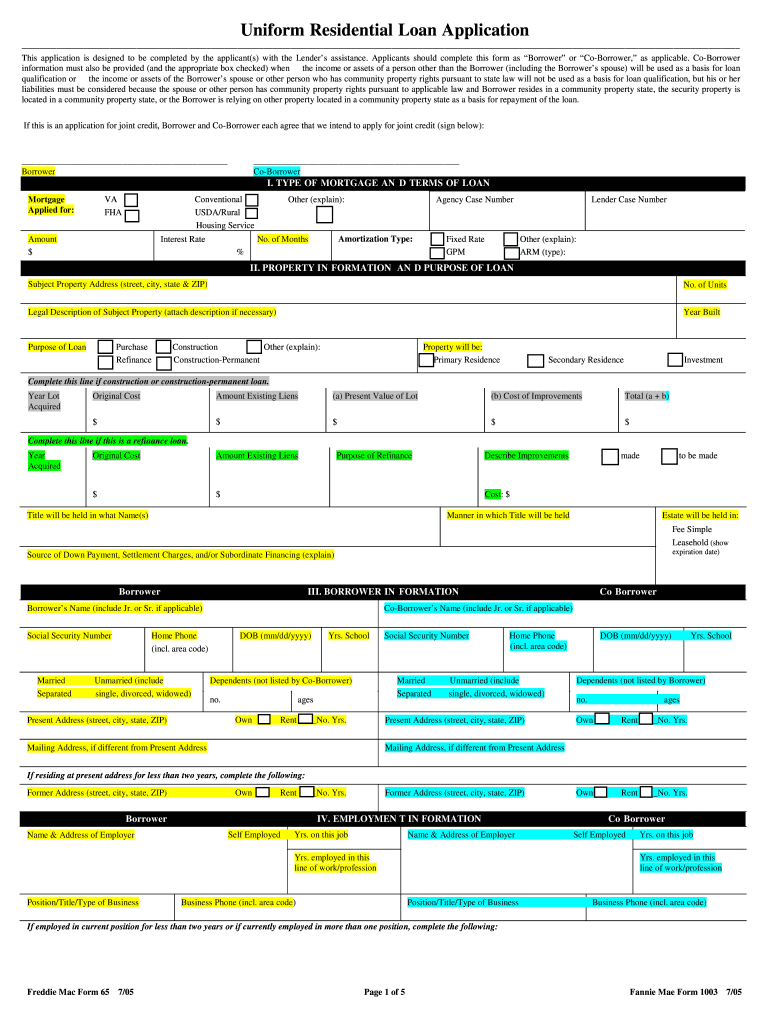

Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lenders assistance. Applicants should complete this form as Borrower or Borrower, as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign type of mortgage an

Edit your type of mortgage an form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your type of mortgage an form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit type of mortgage an online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit type of mortgage an. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out type of mortgage an

How to fill out type of mortgage an

01

Gather all the necessary documents required for applying for a mortgage, such as proof of income, identification, and bank statements.

02

Research and compare different types of mortgages available in the market to understand which one suits your financial needs and goals. This will help you determine the type of mortgage to fill out.

03

Contact a reputable mortgage lender or financial institution to discuss your options and start the application process.

04

Provide accurate and detailed information about your financial situation, including your income, assets, debts, and credit history. This information is crucial for the lender to assess your eligibility for the mortgage.

05

Fill out the mortgage application form with all the necessary information, ensuring to provide complete and accurate details.

06

Read and understand the terms and conditions of the mortgage agreement before signing it. If you have any doubts or questions, seek clarification from the lender.

07

Submit the filled-out mortgage application form along with all the required documents to the lender.

08

Cooperate with the lender throughout the mortgage approval process, which may involve providing additional documentation or answering any inquiries they may have.

09

Review the mortgage offer provided by the lender carefully, assessing factors such as interest rates, repayment terms, and any associated fees or charges.

10

If satisfied with the mortgage terms, accept the offer by signing the necessary documents and returning them to the lender.

11

Follow any further instructions provided by the lender, such as attending a mortgage closing meeting, completing additional paperwork, or arranging for a property appraisal.

12

Once the mortgage is approved and finalized, make sure to fulfill your repayment obligations on time to maintain a good credit standing.

Who needs type of mortgage an?

01

Individuals or families who are planning to purchase a property and require financial assistance to do so.

02

People who are looking to refinance their existing mortgage in order to obtain better terms, lower interest rates, or access equity in their property.

03

Borrowers who wish to take advantage of favorable mortgage programs or special offers provided by lenders.

04

Those who are experiencing a major life event, such as getting married, starting a family, or relocating, and need financial support to facilitate the transition.

05

Entrepreneurs or self-employed individuals who may face challenges in proving a stable income but require a mortgage for their property purchase.

06

Individuals with a good credit history and stable financial situation, who are looking to invest in real estate.

07

People who want to take advantage of tax benefits associated with mortgage interest deductions.

08

Homeowners who are considering renovating or improving their property and seek financing options.

09

Anyone who prefers to spread the cost of a property purchase over an extended period through regular mortgage payments rather than making a lump sum payment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my type of mortgage an directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your type of mortgage an and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out type of mortgage an using my mobile device?

Use the pdfFiller mobile app to complete and sign type of mortgage an on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit type of mortgage an on an iOS device?

Create, edit, and share type of mortgage an from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your type of mortgage an online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Type Of Mortgage An is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.