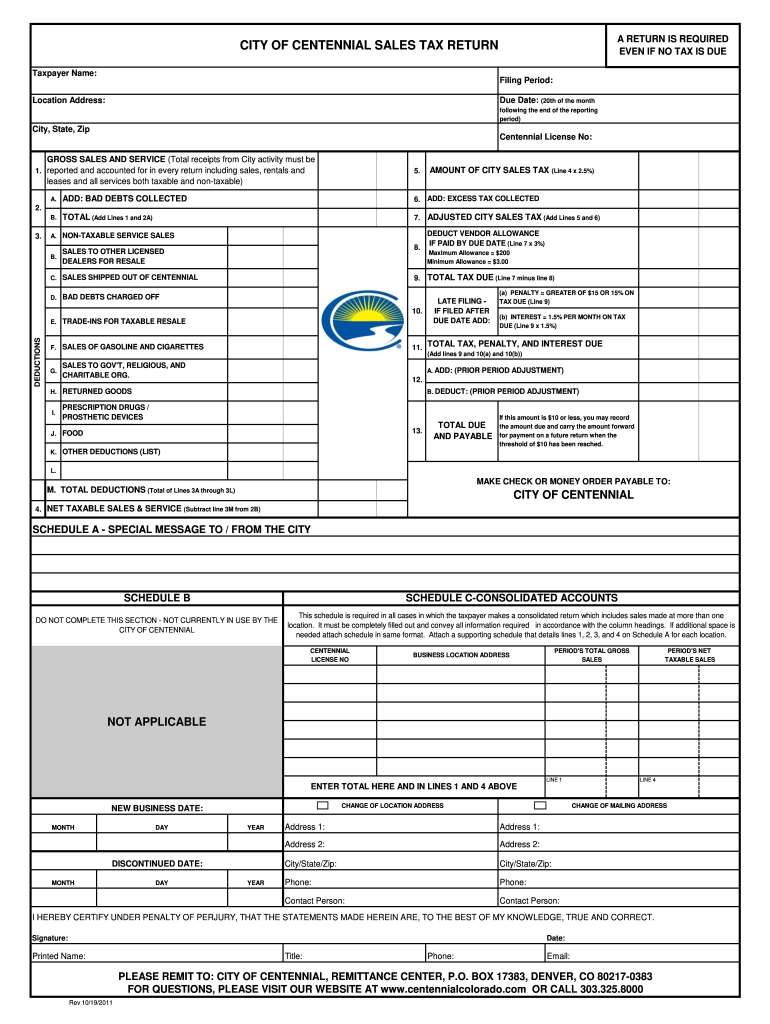

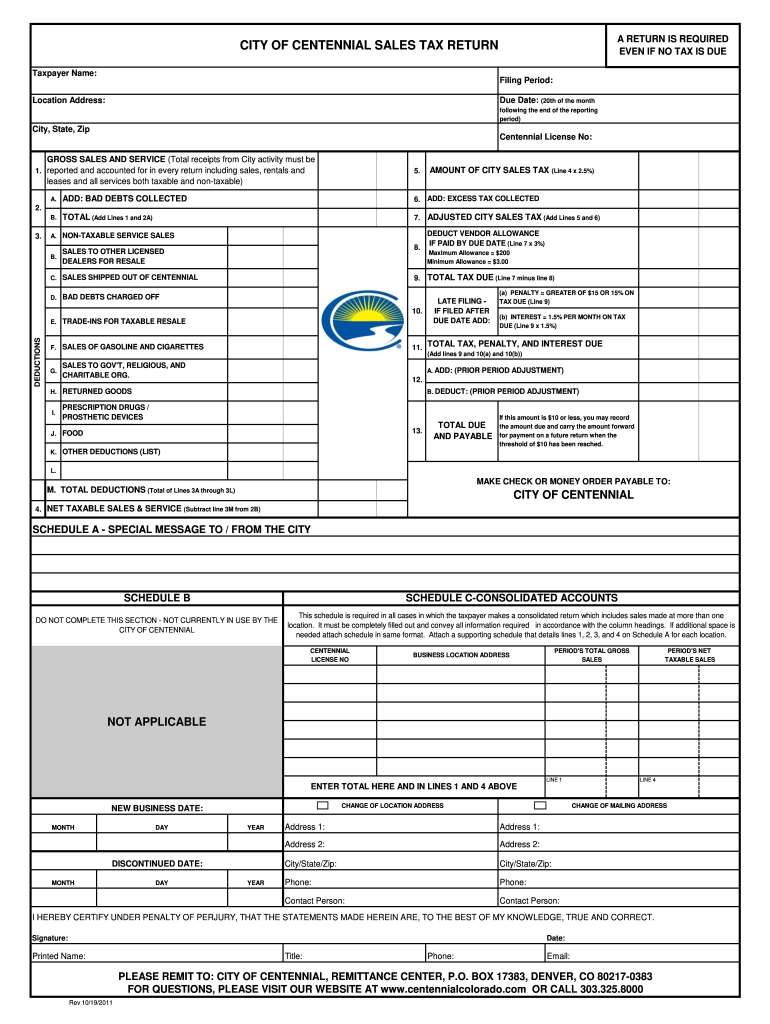

CO Sales Tax Return - Centennial City 2011 free printable template

Get, Create, Make and Sign CO Sales Tax Return - Centennial

How to edit CO Sales Tax Return - Centennial online

Uncompromising security for your PDF editing and eSignature needs

CO Sales Tax Return - Centennial City Form Versions

How to fill out CO Sales Tax Return - Centennial

How to fill out CO Sales Tax Return - Centennial City

Who needs CO Sales Tax Return - Centennial City?

Instructions and Help about CO Sales Tax Return - Centennial

BOOSTING PERFORMANCE USING CLIFTONSTRENGTHS AT THE CITY OF CENTENNIAL Paula Gibson Director Human Resources City of Centennial COI implemented Strengths first and then engagement almost in a sense to validate the work that we've done in Strengths so that you know specifically if people were able to ask the Q that at work I have the opportunity to do what I do best every day that's hard to for a manager to manage to it if they don't know what their staff does well and what they do well So they absolutely reinforce each other But again the Q12 gave a metric a hard metric that people could aspire to and grow from a baseline where we could see the actual process, and we've seen great success with both of those initiatives Why Centennial Uses CliftonStrengths Solutions Number one it gives us more knowledge about Strengths And we know that there really is an infinite variety of peoples talents, and so they show up in a variety of ways So the more intelligence around them that we can gather I think the more effective we can be Number two it gave me a construct for coaching So it helped me be a better coach in a variety of ways with the Gallup construct of here's what you want to think about when your coach is extremely valuable, and I think is quite unique The third is of course the Gallup name So it's the credibility aspect of it When I tell people I'm a Gallup-certified Strengths coach that immediately builds some trust in me that they assume I've gone through a program and that there has been a process that I had to meet a standard And so that helps me initiate the conversations We have some very, very specific business metrics and several areas we've seen our client promoter or client satisfaction scores conversations have some very, very specific business metrics and several areas we've seen our client promoter or client satisfaction scores go UPAE have seen our revenues increase because of for instance increased sales tax filings We received a million and a half dollar fund grant from the Bloomberg Philanthropic Association for Innovation And keep in mind this is local government we don't usually think of local government necessarily as being innovative And then one that I'm extremely proud of is that we are a Gallup Great Workplace Award winner for 2017 Which really just you know is almost the icing on the cake Learn more at cliftonstrengthsgallupcom

People Also Ask about

What is the sales tax in centennial co 80112?

How do I contact Centennial Co sales tax?

What is the sales tax in Arapahoe County Colorado?

What is the use tax in the city of Centennial Construction?

Does Centennial Colorado have a use tax?

Is there a use tax in Colorado?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CO Sales Tax Return - Centennial to be eSigned by others?

How do I make changes in CO Sales Tax Return - Centennial?

Can I create an electronic signature for signing my CO Sales Tax Return - Centennial in Gmail?

What is CO Sales Tax Return - Centennial City?

Who is required to file CO Sales Tax Return - Centennial City?

How to fill out CO Sales Tax Return - Centennial City?

What is the purpose of CO Sales Tax Return - Centennial City?

What information must be reported on CO Sales Tax Return - Centennial City?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.