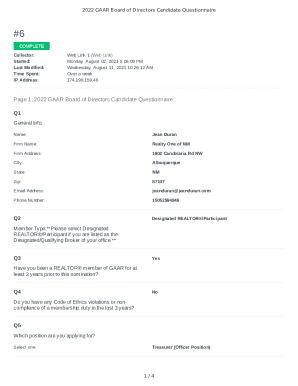

Get the free every payday

Show details

It's like another pay check

every payday!

Every payday you have a chance to win the

St. Josephs Healthcare Foundation 50/50

Payday Payouts draw.

Fill out the form below and return it to Liz March

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign every payday

Edit your every payday form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your every payday form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit every payday online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit every payday. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out every payday

How to fill out every payday

01

To fill out every payday, follow these steps:

02

Gather all the necessary financial documents, such as your time card or timesheet, tax forms, and any other relevant paperwork.

03

Calculate your gross income by multiplying your hourly wage or salary by the number of hours you worked during the pay period.

04

Subtract any pre-tax deductions, such as contributions to retirement plans or healthcare premiums, from your gross income to determine your taxable income.

05

Determine the amount of federal and state income taxes you owe by referencing the appropriate tax tables or using an online tax calculator.

06

Subtract any post-tax deductions, such as social security or Medicare taxes, from your taxable income to calculate your net income.

07

Take note of any additional withholdings, such as for student loans or child support, and subtract them from your net income.

08

Calculate any overtime pay or bonuses separately and add them to your net income.

09

Double-check all the calculations to ensure accuracy.

10

Fill out the specified sections on your employer's payroll or timekeeping system with the calculated amounts.

11

Review the completed payday form for any errors or missing information before submitting it to your employer.

12

Keep a copy of the filled-out payday form for your records.

13

If you have any questions or concerns, consult with your employer's HR department or payroll administrator for assistance.

Who needs every payday?

01

Every payday is essential for:

02

- Employees who receive a salary or wages from an employer.

03

- Freelancers or independent contractors who invoice clients for their work.

04

- Anyone engaged in contractual work or temporary employment.

05

- Individuals with multiple income sources who need to track and manage their earnings.

06

- Those who have specific financial obligations or responsibilities that require regular income reporting.

07

- Individuals who need to meet legal or tax requirements by providing accurate and timely income information.

08

- People who want to maintain financial discipline and keep track of their earnings versus expenses.

09

- Individuals who rely on consistent income to cover living expenses, bills, and financial goals.

10

- Those who need to budget and plan their finances effectively.

11

- Employees or workers seeking to verify that they are being paid accurately and fairly.

12

- People who want to stay organized and have a clear record of their earnings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my every payday in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your every payday and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit every payday online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your every payday to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete every payday on an Android device?

Use the pdfFiller app for Android to finish your every payday. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is every payday?

Every payday refers to the day on which employees receive their wages or salaries from their employers.

Who is required to file every payday?

Employers are required to file every payday to report the wages or salaries paid to their employees.

How to fill out every payday?

Every payday can be filled out using the necessary forms provided by the employer or through an online payroll system.

What is the purpose of every payday?

The purpose of every payday is to accurately report the wages or salaries paid to employees and ensure compliance with labor laws.

What information must be reported on every payday?

The information reported on every payday includes the employee's name, hours worked, rate of pay, and total wages earned.

Fill out your every payday online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Every Payday is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.