Get the free fms form 13 - fms treas

Get, Create, Make and Sign fms form 13

How to edit fms form 13 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fms form 13

How to fill out fms form 13:

Who needs fms form 13?

Instructions and Help about fms form 13

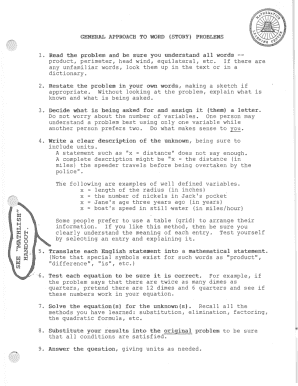

Welcome to s Kiki reduce YouTube channel guys today in this video I will show you how to transfer the PF balance from one company PA to another company so go here forum price and say ok member you an online service and the new window will get open and enter here your UN number and puzzle so first thing you need to orbit IVA activate your UN number and reset the password and update all the cave I see everything hope you know guys if you don't know check in the those videos all the videos are provided in our YouTube channel you can get to know about more about this UN account transfer and all in this video so log in with your number and password click here and see you have two PFR number select and copy the first PF number and click on online services and click on one UAN so the second option you need to click after that you can see here the details and here you need to select the previous employer and here is the member ID or even number anything you need to fill it, so we have copied or your first year number and select and click on get it details and select here the first and click on get OT P so ODP sent successfully it will come to the a and account registered mobile number, so you need to enter that OTP so entering here after that click Submit, so I have already submitted guys, so it will show you already submitted for making this video, so I'm trying second time, so it's showing already submitted so how darn it so click here tried claim status the third option here you can see the transwarp clamps so here you can see all the details on the form 13 printable clicks here download you will get the one form that is from 30 you need to download this form you need to sign it, and you have to submit at your previous employer previous HR you can see the details that online transfer claim form 13 revised in this all the details are peripheral you don't need to fill again everything is filled the first company and the second company details from which company Piaf account and which company to transfer everything is filled so Part B Part C everything you can see in the below you can see signature of the member did you need to hear I hear you need to do the signature and submit at your previous company means to edge HR you need to submit either by visiting your company or you can send it by courier to a company save this and download and take the printout of this and do the signature do what I said now and here you can see that claim status the transfer the tracking ID climbed type everything the previous account number and all so here you can see that previous P of Okinawa present P a number and here attention through the previous employer the company name other thing is mentioned so after that you need to check you need to track the claim by using you are given number that is I will show you the coming a video once your claim gets settled it will show you first submitted at portal ii the status is under process third is settled when it shows you the...

People Also Ask about

Why did I get a check from IRS Bureau of Fiscal Service?

What does the Department of Treasury Bureau of Fiscal Services do?

What comes from Bureau of the Fiscal Service?

What is the FMS of the US Treasury?

Is the Bureau of Fiscal Service real?

What is the mail from the Bureau of Fiscal Service?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fms form 13 in Gmail?

How do I fill out fms form 13 using my mobile device?

How can I fill out fms form 13 on an iOS device?

What is fms form 13?

Who is required to file fms form 13?

How to fill out fms form 13?

What is the purpose of fms form 13?

What information must be reported on fms form 13?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.