Get the free Incorporating A Cash Basis Business: The Problem

Show details

Washington and Lee Law Review Volume 34 Issue 1Article 17111977Incorporating A Cash Basis Business: The Problem Of Section 357Follow this and additional works at: http://scholarlycommons.law.wlu.edu/wlulr

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign incorporating a cash basis

Edit your incorporating a cash basis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your incorporating a cash basis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

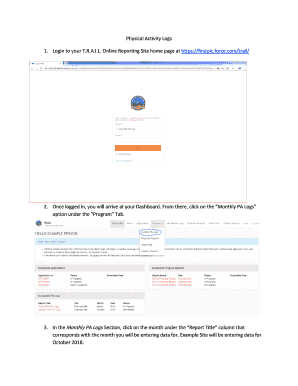

How to edit incorporating a cash basis online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit incorporating a cash basis. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out incorporating a cash basis

How to fill out incorporating a cash basis

01

Step 1: Determine if your business is eligible for cash basis accounting. Cash basis accounting is generally only available for small businesses with annual gross receipts under a certain threshold. Check your local tax laws or consult with a tax professional to see if your business qualifies.

02

Step 2: Gather all relevant financial records. This includes bank statements, invoices, receipts, and any other documents that track your business's cash flow.

03

Step 3: Separate your business and personal finances. It's important to maintain clear separation between your personal income and expenses and your business income and expenses. This will make it easier to accurately track and report your business's cash basis financials.

04

Step 4: Create a cash basis balance sheet. This should include all of your business's assets, liabilities, and equity as of a specific date. The cash basis balance sheet should only include transactions that have been paid with cash or cash equivalents.

05

Step 5: Prepare a cash basis income statement. This statement should show your business's revenue and expenses for a specific period, such as a month or a year. Only include revenue and expenses that have been received or paid in cash.

06

Step 6: Review and analyze your cash basis financial statements. Look for any trends or patterns in your business's cash flow and identify areas for improvement or cost-cutting.

07

Step 7: File your tax returns using cash basis accounting. When completing your tax returns, use your cash basis financial statements to report your income and expenses. Be sure to comply with all tax regulations and consult with a tax professional if needed.

08

Step 8: Regularly update and maintain your cash basis records. Keep track of all incoming and outgoing cash transactions and reconcile them with your financial statements to ensure accuracy and compliance.

09

Step 9: Stay informed about any changes to cash basis accounting regulations. Tax laws and regulations can change over time, so it's important to stay updated and adjust your accounting practices accordingly.

Who needs incorporating a cash basis?

01

Small businesses with relatively simple financial transactions and low annual gross receipts can benefit from incorporating a cash basis accounting method.

02

Sole proprietors, partnerships, and certain types of small corporations or limited liability companies (LLCs) may find cash basis accounting more suitable.

03

Cash basis accounting may be advantageous for businesses that primarily deal with cash transactions, such as retail stores, restaurants, or small service-based businesses.

04

Businesses that want to simplify their accounting process and avoid the complexities of accrual accounting may opt for cash basis accounting.

05

Cash basis accounting can provide a better reflection of a business's current cash flow and may be preferred for short-term financial analysis or cash management purposes.

06

However, it's important to consider the potential limitations of cash basis accounting, such as limited financial reporting capabilities and potential tax implications. Consulting with a tax professional or accountant is advised to determine the best accounting method for your specific business needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete incorporating a cash basis online?

With pdfFiller, you may easily complete and sign incorporating a cash basis online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in incorporating a cash basis?

The editing procedure is simple with pdfFiller. Open your incorporating a cash basis in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the incorporating a cash basis in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your incorporating a cash basis and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is incorporating a cash basis?

Incorporating a cash basis means accounting for income and expenses when they are actually received or paid, rather than when they are earned or incurred.

Who is required to file incorporating a cash basis?

Certain businesses, such as sole proprietorships and partnerships, may be required to file incorporating a cash basis if they meet certain criteria or if it is their chosen method of accounting.

How to fill out incorporating a cash basis?

To fill out incorporating a cash basis, businesses must record all cash receipts and payments, reconcile bank statements, and prepare financial statements using the cash method of accounting.

What is the purpose of incorporating a cash basis?

The purpose of incorporating a cash basis is to simplify accounting and provide a clear picture of a business's cash flow and liquidity.

What information must be reported on incorporating a cash basis?

Information such as cash receipts, cash payments, bank reconciliations, and financial statements must be reported on incorporating a cash basis.

Fill out your incorporating a cash basis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Incorporating A Cash Basis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.