Get the free Life Insurance and Annuities (A) Committee

Show details

Attachment

Life Insurance and Annuities (A) Committee

12/?/17

Draft: 8/31/17

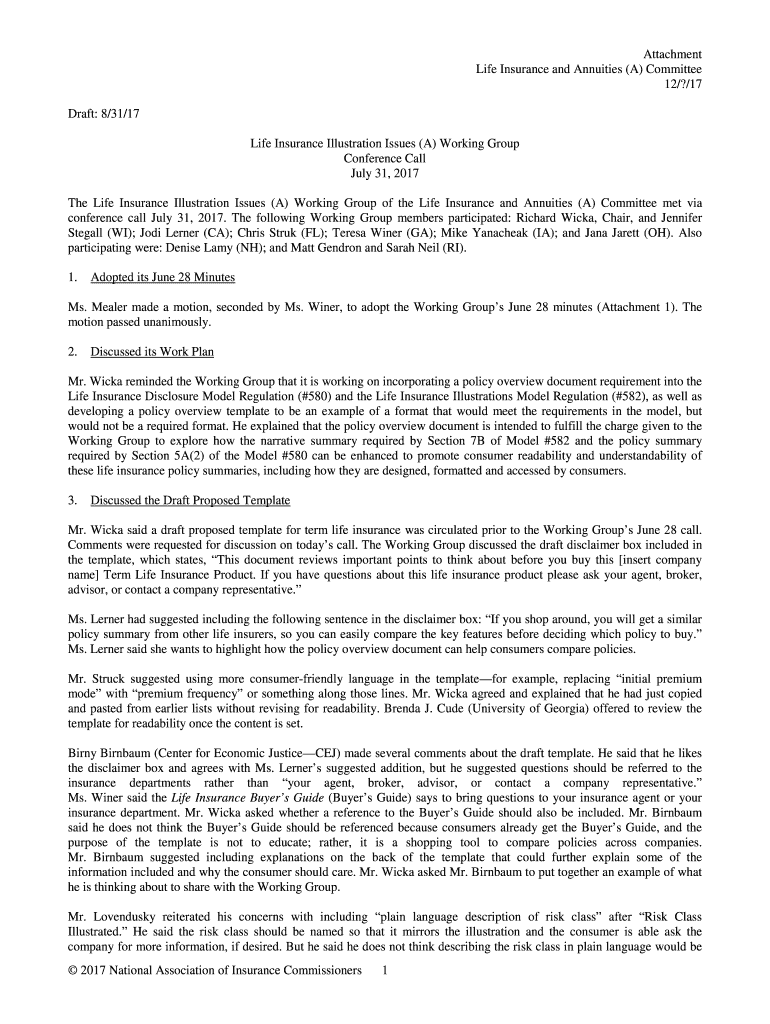

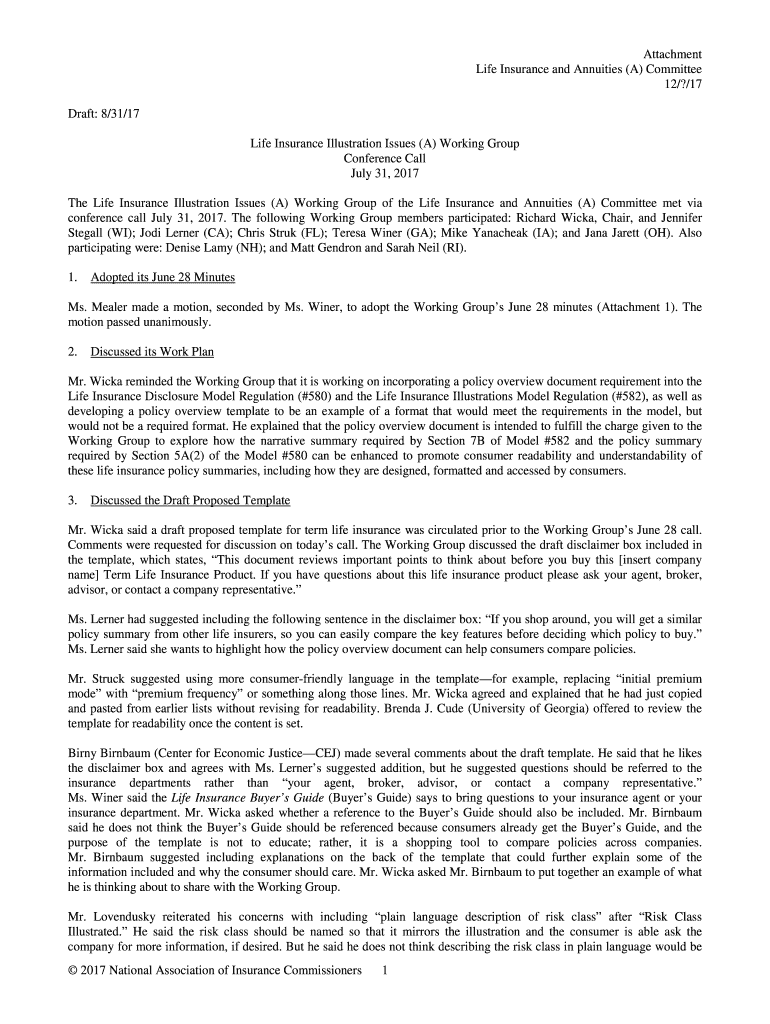

Life Insurance Illustration Issues (A) Working Group

Conference Call

July 31, 2017,

The Life Insurance Illustration Issues

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance and annuities

Edit your life insurance and annuities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance and annuities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance and annuities online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit life insurance and annuities. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance and annuities

How to fill out life insurance and annuities

01

Gather all your personal information, including your full name, date of birth, address, and contact details.

02

Research different life insurance and annuity options to find the best fit for your needs. Consider factors such as coverage amount, premium cost, and any additional benefits or riders.

03

Contact an insurance agent or company to request a quote or discuss your options. They will guide you through the application process and provide the necessary forms.

04

Provide accurate information about your health, lifestyle, and financial situation on the application form. This includes disclosing any pre-existing medical conditions or risky activities.

05

Review the terms and conditions of the policy or annuity contract before signing. Make sure you understand the coverage, premium payments, potential tax implications, and any limitations or exclusions.

06

Submit the completed application form along with any required supporting documents, such as medical records or financial statements.

07

Pay the initial premium or set up a payment plan as per the insurer's instructions.

08

Wait for the insurance company to review your application. They may request additional information or conduct a medical exam.

09

Once approved, carefully review the policy or annuity contract to ensure it matches the agreed-upon terms. Seek clarification from the insurer if anything seems unclear.

10

Make periodic premium payments to keep the life insurance or annuity policy active. Consider setting up automatic payments to avoid any lapses in coverage.

11

In the event of a claim or annuity payout, contact the insurance company promptly and provide any necessary documentation. Follow their instructions to ensure a smooth claims process.

Who needs life insurance and annuities?

01

Anyone with dependents or financial obligations should consider life insurance. This includes individuals who are married, have children, or support their aging parents.

02

Those who have outstanding debts, such as mortgages or student loans, can benefit from life insurance to ensure these obligations are taken care of in case of their untimely demise.

03

Individuals who run a business or are key income earners for their family should consider life insurance to protect their business and provide financial security for their loved ones.

04

Life insurance is also important for individuals who want to leave behind an inheritance or provide for specific financial goals, such as funding their children's education or covering funeral expenses.

05

As for annuities, individuals who are nearing retirement or have already retired can benefit from annuities to provide a consistent income stream during their retirement years.

06

Annuities can also be suitable for individuals who want to ensure a steady income for their surviving spouse or dependents after their death.

07

People who are concerned about outliving their savings or facing financial hardship in old age may find annuities helpful in providing a guaranteed income for life.

08

It is important to consult with a financial advisor or insurance professional to determine if life insurance or annuities are suitable for your specific needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my life insurance and annuities directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your life insurance and annuities and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete life insurance and annuities online?

pdfFiller has made filling out and eSigning life insurance and annuities easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit life insurance and annuities straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing life insurance and annuities.

What is life insurance and annuities?

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upon the death of an insured person. An annuity is a financial product that provides a stream of payments over a predetermined period.

Who is required to file life insurance and annuities?

Insurance companies are required to file life insurance and annuities with the appropriate regulatory authorities.

How to fill out life insurance and annuities?

Life insurance and annuities can be filled out by providing the necessary information about the policy holder, beneficiaries, coverage, and premium payments.

What is the purpose of life insurance and annuities?

The purpose of life insurance is to provide financial protection to the beneficiaries of the insured person in case of their death. Annuities serve as a source of income during retirement years.

What information must be reported on life insurance and annuities?

Information such as policy holder's details, beneficiary details, coverage amount, premium amount, and policy terms must be reported on life insurance and annuities.

Fill out your life insurance and annuities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance And Annuities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.