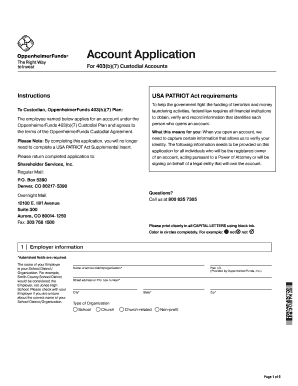

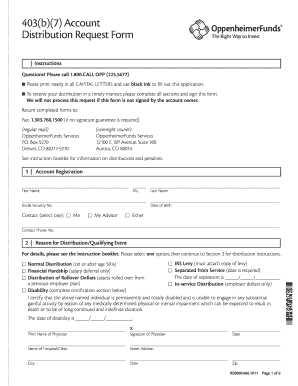

Get the free oppenheimer 403 b distribution form

Show details

403(b)(7) DISTRIBUTION FORM INSTRUCTION BOOKLET Not FDIC Insured May Lose Value Not Bank Guaranteed CONTENTS 2 Instructions 2 Eligible Distributions 3 Penalty Exempt Distributions 4 Additional Distribution

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oppenheimer 403 b distribution

Edit your oppenheimer 403 b distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oppenheimer 403 b distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oppenheimer 403 b distribution online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oppenheimer 403 b distribution. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oppenheimer 403 b distribution

How to fill out Oppenheimer 403(b) distribution:

01

Gather necessary information: Start by collecting all the relevant information required to fill out the Oppenheimer 403(b) distribution form. This may include your account details, personal information, and the amount you wish to withdraw.

02

Review the eligibility requirements: Ensure that you meet the eligibility criteria for making a distribution from your Oppenheimer 403(b) account. This typically includes reaching the age of 59 ½, retirement, or other qualifying events.

03

Obtain the distribution form: Contact Oppenheimer or visit their website to obtain the appropriate distribution form. Make sure you have the most up-to-date version.

04

Fill out personal details: Begin by providing your personal information accurately on the form. This may include your name, address, Social Security Number, and contact details. Be sure to double-check for any errors before proceeding.

05

Specify the distribution amount: Indicate the amount you wish to withdraw from your Oppenheimer 403(b) account. Ensure that the amount falls within the permissible limits set by the IRS.

06

Select the distribution option: Choose the type of distribution you prefer from the available options, such as lump sum, systematic withdrawal, or rollover to another retirement account. Pay close attention to the tax implications associated with each choice.

07

Consider tax withholding: Decide whether you would like to withhold any federal or state income taxes from your distribution. Consult with a tax professional if you are unsure about the appropriate withholding amount.

08

Provide beneficiary information: If you intend to designate a beneficiary for your Oppenheimer 403(b) account, make sure to fill out the beneficiary section accurately. This ensures that your funds are distributed according to your wishes in case of your passing.

09

Review and sign: Carefully review the completed form to ensure all the information provided is accurate. Finally, sign and date the form, indicating your consent and understanding of the terms and conditions.

Who needs Oppenheimer 403(b) distribution?

01

Employees in non-profit organizations: Oppenheimer 403(b) distributions are typically available to employees of non-profit organizations, such as educational institutions, hospitals, and charitable organizations. If you work in such an organization and have a 403(b) account with Oppenheimer, you may need to make distributions from it.

02

Individuals approaching retirement age: Individuals who are approaching the age of 59 ½ and are planning for retirement may need to consider taking distributions from their Oppenheimer 403(b) accounts. These distributions can provide financial support during retirement and help cover living expenses.

03

Those in need of financial flexibility: Oppenheimer 403(b) distributions can be utilized by individuals who require immediate access to funds for various personal reasons. Whether it's to cover medical expenses, education costs, or financial emergencies, these distributions offer flexibility and liquidity for specific financial needs.

04

Beneficiaries after the account holder's passing: In the unfortunate event of the account holder's death, their designated beneficiaries may need to consider an Oppenheimer 403(b) distribution. This allows the beneficiaries to receive the funds as per the account holder's intentions and potentially manage their own financial situations accordingly.

Note: It is essential to consult with a financial advisor or tax professional to ensure the proper understanding of the specific rules, regulations, and implications associated with Oppenheimer 403(b) distributions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit oppenheimer 403 b distribution straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing oppenheimer 403 b distribution right away.

How do I complete oppenheimer 403 b distribution on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your oppenheimer 403 b distribution, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit oppenheimer 403 b distribution on an Android device?

With the pdfFiller Android app, you can edit, sign, and share oppenheimer 403 b distribution on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your oppenheimer 403 b distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oppenheimer 403 B Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.