Get the free EMPLOYEES PROVIDENT FUNDS ORGANISATION

Show details

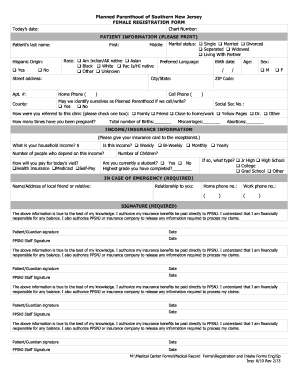

WWW.India.gov.in Mobile Number v EMPLOYEES PROVIDENT FUNDS Organization E () COMPOSITE CLAIM FORM (AADHAAR) (, 11 (v) v, E v

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employees provident funds organisation

Edit your employees provident funds organisation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employees provident funds organisation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employees provident funds organisation online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employees provident funds organisation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employees provident funds organisation

How to fill out employees provident funds organisation

01

Step 1: Obtain the employees provident funds organisation form from the respective department.

02

Step 2: Fill out the personal details section, including your full name, address, date of birth, and other required information.

03

Step 3: Provide your employment details, including the name of the organization you work for, your employee code, and designation.

04

Step 4: Fill out the contribution details section, indicating the amount you wish to contribute towards the employees provident funds organisation.

05

Step 5: Attach the necessary documents, such as your identity proof, address proof, and PAN card copy.

06

Step 6: Review the filled form and ensure all information is accurate and complete.

07

Step 7: Submit the filled form along with the required documents to the respective department. Keep a copy of the form for your records.

08

Step 8: Wait for the verification process to complete and receive the acknowledgement receipt.

Who needs employees provident funds organisation?

01

Employees who wish to secure their financial future and build a retirement corpus.

02

Employers who want to provide their employees with a retirement savings option.

03

Individuals who want to avail the tax benefits offered by the employees provident funds organisation.

04

Employees who want to enjoy the financial security provided by the employees provident funds organisation in the event of a job loss or medical emergency.

05

Workers in industries covered under the employees provident funds organisation Act.

Fill

form

: Try Risk Free

People Also Ask about

How to download provident fund form?

Log in to the portal by entering your UAN number and password and then click on 'Sign In'. Under 'Online Services', select the option ''Form-31, 19, 10C & 10D'. An auto-filled form will be displayed on your screen. Enter the last 4 digits of your bank account and verify it.

How can I get my provident fund statement online?

Once the UAN is enabled, follow these steps: Log on to the website of EPFO. Next, click on the option that states 'Member passbook' under the “Services” option. A login tab will open. You will be able to access your EPF account once you are done logging in.

Can I check my provident fund balance online?

Log into the EPFO website - As a registered member, you can go to the EPFO website and log in using your UAN and password. - You need to make sure that your UAN is activated. The UAN is provided by the EPFO but it has to be verified and activated by the employer.

How can I get my provident fund statement online?

How to Get PF Statement Online Visit the EPFO e-Sewa portal. Then, click on 'Activate UAN. Now will have to enter details of one out of Aadhar, PAN or UAN. You will also have to mandatorily enter other information – name, date of birth, mobile and email ID.

What is the difference between EPS and EPF?

To sum up the differences between EPF and EPS, EPF is a scheme where both an employer and an employee contribute part of the latter's salary. In contrast, only an employer contributes to EPS. We hope this article was of help to you!

How do I check my employer provident fund balance?

PF Balance Check Through a Missed Call Give a missed call to 9966044425 from your registered mobile number. After placing a missed call, you will receive an SMS with your PF details.

What is the structure of EPFO?

Structure of EPFO The Act and all its schemes are administered by a tri-partite board called the Central Board of Trustees (EPF). The board comprises representatives of the Government (both Central and State), employers, and employees. The board is chaired by the Ministry of Labour and Employment, Government of India.

How do I file a provident fund?

Steps to file monthly PF return online Login to EPFO Portal. Login to the EPFO portal using the credentials sent on your email Id upon successful sign up with Unified Shram Suvidha Portal. Download the ECR File. Enter wage details. Save as Text Document. Upload the ECR file. Generate TRRN and make payment.

What are the details of Employees Provident Fund?

The Employees' Provident Fund Scheme or EPF, introduced in India in 1952, is a retirement benefit scheme where, both the employer and the employee, contribute a certain sum every month till the employee is working. It not only provides tax benefits but also a relatively higher interest rate than other saving schemes.

How to fill provident fund nomination form?

How to Fill e-Nomination Online Login to the EPF member portal using your UAN and password. Select the “e-Nomination” option from the “Manage” section. Enter your “Permanent Address” and “Current Address” in your “Profile” and click on “Save”. Select whether you have a family or not.

How to fill e-nomination in EPFO step by step?

Here's a step-to-step guide on how to add a nominee to EPF account Visit the UAN EPFO website and log in. From the menu, select 'Manage' and 'e-Nomination'. In the family declaration, choose "Yes." Fill out the 'Add Family Details' section with details regarding your application.

How to fill employee nomination form?

How to Fill e-Nomination Online Login to the EPF member portal using your UAN and password. Select the “e-Nomination” option from the “Manage” section. Enter your “Permanent Address” and “Current Address” in your “Profile” and click on “Save”. Select whether you have a family or not.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my employees provident funds organisation directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your employees provident funds organisation and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit employees provident funds organisation online?

The editing procedure is simple with pdfFiller. Open your employees provident funds organisation in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the employees provident funds organisation in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your employees provident funds organisation in minutes.

What is employees provident funds organisation?

Employees' Provident Fund Organisation (EPFO) is a statutory body responsible for overseeing and regulating the provident fund and retirement benefits of employees in India.

Who is required to file employees provident funds organisation?

Employers in India are required to file the Employees' Provident Fund Organisation (EPFO) for their employees.

How to fill out employees provident funds organisation?

Employers can fill out the EPFO online by logging into the EPFO portal and providing the necessary details of their employees.

What is the purpose of employees provident funds organisation?

The purpose of EPFO is to ensure retirement savings for employees, provide financial security, and regulate the management of provident funds.

What information must be reported on employees provident funds organisation?

Employers must report details of the employees, their wages, provident fund contributions, and other related information on the EPFO.

Fill out your employees provident funds organisation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employees Provident Funds Organisation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.