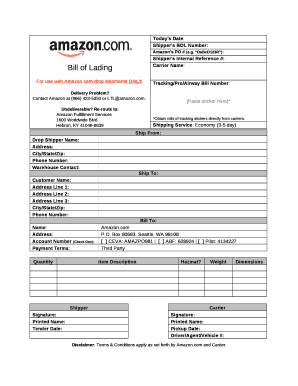

Get the free Amazon Web Services VAT Invoice

Show details

Amazon Web Services VAT Invoice Summary Invoice AWSUSINVGB2016403775 Number: Invoice Date: July 02, 2016, Total Amount: $77.97Account number:588429180883 Issued To: Jonathan Rid dell 38 (1F2) Temple

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign amazon web services vat

Edit your amazon web services vat form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your amazon web services vat form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit amazon web services vat online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit amazon web services vat. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out amazon web services vat

How to fill out Amazon Web Services VAT:

01

Visit the Amazon Web Services website and log in to your account.

02

Navigate to the "Billing and Cost Management" section.

03

Select "Tax Settings" from the menu.

04

Click on "Edit" next to the VAT registration information.

05

Provide your VAT registration number and any additional required information.

06

Save the changes and ensure that the VAT settings are updated.

Who needs Amazon Web Services VAT:

01

Businesses that are registered for VAT and use Amazon Web Services for their operations.

02

Individuals who offer taxable services or sell products through Amazon Web Services and are VAT registered.

03

Organizations that are required by law to collect and remit VAT on their Amazon Web Services usage.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an invoice from VAT?

Request a VAT invoice or receipt Sign in to Settings. Check that you've entered your tax ID number. If you haven't, enter it now. Click Activity. Click on the transaction you want an invoice for. At the bottom of the transaction details, click Download VAT invoice or Download VAT receipt. Click Save.

What is Amazon Web Services charge?

Pricing for AWS Support Plans | Starting at $29 Per Month | AWS Support.

Does Amazon Web Services charge VAT?

A valid VAT invoice will be available on the AWS console, to help you with your VAT accounting and compliance. In all other cases, there is no impact of this change on your taxes: Amazon Web Services EMEA SARL will charge you VAT in the same way as Amazon Web Services, Inc. charged you VAT.

Is AWS VAT registered?

AWS collects Tax Registration Numbers (“TRNs”) associated with Value Added Tax (“VAT”) in certain countries to determine your status, as a business (B2B) or private / non-business customer (B2C), as this is a key factor to determine AWS' liability to charge VAT on your service charges.

Does Amazon Web services charge VAT?

A valid VAT invoice will be available on the AWS console, to help you with your VAT accounting and compliance. In all other cases, there is no impact of this change on your taxes: Amazon Web Services EMEA SARL will charge you VAT in the same way as Amazon Web Services, Inc. charged you VAT.

How do I get a VAT invoice from Amazon?

Go to Your Orders. Find the relevant order and select Details. If an invoice with VAT is available for your order, you'll see an option to print or download it at the top left of the page.

How do I get a VAT receipt from Amazon app?

Go to My Amazon Prime then Update your payment method. Click on View all printable receipts. Select the receipt you want display and click on View Receipt and download it.

How do I find my VAT invoice?

0:17 1:08 How do I get a VAT Invoice? - YouTube YouTube Start of suggested clip End of suggested clip And cost management console. Let's get started from the home page of your billing. And costMoreAnd cost management console. Let's get started from the home page of your billing. And cost management console choose builds on the left-hand side of the screen choose.

What do you put on a VAT invoice?

4.1 Details to include on a VAT invoice the time of the supply. the date of issue of the document (where different to the time of supply) the name, address and VAT registration number of the supplier. the name and address of the person to whom the goods or services are supplied.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my amazon web services vat in Gmail?

amazon web services vat and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send amazon web services vat to be eSigned by others?

When your amazon web services vat is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete amazon web services vat on an Android device?

Use the pdfFiller mobile app and complete your amazon web services vat and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is amazon web services vat?

Amazon Web Services (AWS) VAT refers to the Value Added Tax applied to services provided by AWS. It is a consumption tax levied on the sale of goods and services in many countries.

Who is required to file amazon web services vat?

Businesses and individuals who use AWS services and are subject to VAT regulations in their respective countries are required to file AWS VAT.

How to fill out amazon web services vat?

To fill out AWS VAT, users typically need to gather transaction details, register for VAT with their local tax authorities, and complete any required VAT returns or forms provided by their government.

What is the purpose of amazon web services vat?

The purpose of AWS VAT is to ensure compliance with local tax laws, collect taxes on the services provided, and support government funding through tax revenues.

What information must be reported on amazon web services vat?

Information that must be reported on AWS VAT includes the total sales amount, the applicable VAT rate, the amount of VAT collected, and details of the purchases made.

Fill out your amazon web services vat online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Amazon Web Services Vat is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.