Get the free YOUR GROSS PENSION (Before deductions)

Show details

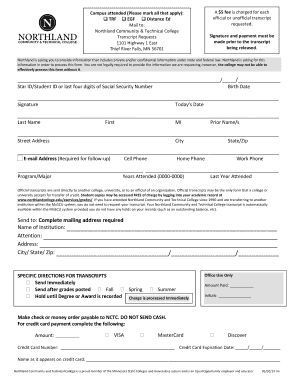

Your April 2017 Payslip Name:YOUR GROSS PENSION (Before deductions)Pension number:TaxableNational Insurance number:PAY Ref. Tax Contour DEDUCTIONS×Your percentage of Standard Lifetime Allowance used

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your gross pension before

Edit your your gross pension before form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your gross pension before form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing your gross pension before online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit your gross pension before. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your gross pension before

How to fill out your gross pension before

01

Gather all the necessary financial information such as bank statements, income statements, and investment statements.

02

Calculate your total gross income, which includes income from salary, rental properties, and any other sources.

03

Deduct any authorized deductions and exemptions from your gross income to arrive at your taxable gross income.

04

Determine the applicable tax rate for your taxable gross income using the tax bracket.

05

Calculate the amount of tax payable by multiplying the taxable gross income by the tax rate.

06

Ensure that you have the necessary forms and documents required by the pension provider.

07

Fill out the pension application form accurately, providing all the requested information.

08

Attach any supporting documents required by the pension provider, such as proof of age, marriage certificate, or dependent information.

09

Review the filled-out form and double-check for any errors or omissions.

10

Submit the completed pension application form along with the necessary documents to the pension provider.

11

Monitor the progress of your pension application and follow up with the pension provider if necessary.

12

Once approved, ensure that you receive regular updates and statements regarding your gross pension.

Who needs your gross pension before?

01

Individuals who are planning for retirement and want to ensure financial stability after retirement.

02

Employees who are eligible for a pension plan offered by their employer.

03

Self-employed individuals who want to set up their own pension plan.

04

Individuals who want to maximize their retirement benefits by optimizing their gross pension.

05

People who want to secure their financial future and have a reliable income stream during retirement.

06

Anyone who wishes to take advantage of tax benefits provided by contributing to a pension plan.

07

Individuals who want to enjoy a comfortable retirement and not solely rely on government-provided pensions.

08

Those who want to have control over their pension funds and investment choices.

09

People who want to leave a financial legacy for their loved ones by having a substantial gross pension before retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute your gross pension before online?

With pdfFiller, you may easily complete and sign your gross pension before online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit your gross pension before on an iOS device?

Create, modify, and share your gross pension before using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete your gross pension before on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your your gross pension before. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is your gross pension before?

Your gross pension before refers to the total amount of your pension income before any deductions or taxes.

Who is required to file your gross pension before?

Individuals who are receiving a pension income are required to report their gross pension before.

How to fill out your gross pension before?

You can fill out your gross pension before by reporting the total amount of your pension income on the appropriate tax forms.

What is the purpose of your gross pension before?

The purpose of reporting your gross pension before is to calculate your taxable income and determine the amount of taxes you owe.

What information must be reported on your gross pension before?

You must report the total amount of your pension income, including any additional sources of income related to your pension.

Fill out your your gross pension before online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Gross Pension Before is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.