This form is for a Seller to authorize an attorney-in-fact to execute all documents and do all things necessary to convey a particular parcel of real estate for Seller.

Get the free Hawaii Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller

Show details

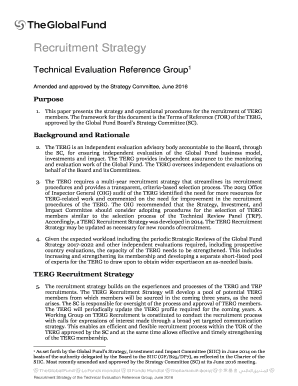

Prepared by, recording requested by and return to: Name: Company: Address: City: State: Phone: Fax: Zip: ----------------------Above this Line for Official Use Only--------------------- SPECIAL POWER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hawaii special or limited

Edit your hawaii special or limited form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii special or limited form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hawaii special or limited online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit hawaii special or limited. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hawaii special or limited

How to fill out Hawaii special or limited:

01

Gather the necessary information: Before filling out the Hawaii special or limited application, ensure you have all the required information at hand. This may include personal details, such as your full name, address, contact information, and Social Security number, as well as any relevant documentation or supporting materials.

02

Understand the eligibility criteria: Review the eligibility requirements for the Hawaii special or limited program. This may vary depending on the specific program you are applying for. Make sure you meet all the specified qualifications before proceeding with the application.

03

Complete the application form: Fill out the Hawaii special or limited application form accurately and thoroughly. Provide all the requested information in the designated fields. Double-check your responses to ensure they are correct and error-free.

04

Attach supporting documents, if necessary: If there are any supporting documents or additional paperwork required for the application, make sure to gather and attach them. This may include proof of income, identification documents, or any other relevant paperwork specified in the application instructions.

05

Review and proofread: Before submitting the application, take the time to review every section and ensure all information is correct and complete. Carefully proofread the entire application to catch any potential errors or omissions.

Who needs Hawaii special or limited:

01

Individuals with specific needs: The Hawaii special or limited program is designed to assist individuals who have specific needs or circumstances. This may include individuals with disabilities, low-income individuals, elderly individuals, or individuals facing other challenges that require special support.

02

Residents of Hawaii: The Hawaii special or limited program is specifically tailored to residents of Hawaii. If you are a resident of Hawaii and meet the eligibility criteria for a specific program, you may benefit from the assistance provided through the Hawaii special or limited initiative.

03

Those seeking financial or social support: The Hawaii special or limited program offers financial and social support to individuals who qualify. If you are in need of assistance in areas such as healthcare, housing, food, transportation, or other essential services, you may consider applying for the Hawaii special or limited program to access the support you require.

Fill

form

: Try Risk Free

People Also Ask about

What is a durable power of attorney in Hawaii?

A Hawaii durable power of attorney form can be used to grant authority to another person expected to handle financial affairs, property, and assets. It is read the form carefully to make sure the powers that are being given to the agent. It is important that the agent appointed someone that can be trusted.

Does a durable power of attorney need to be notarized in Hawaii?

Notarization Requirement While Hawaii does not technically require you to get your POA notarized, notarization is strongly recommended. Under Hawaii law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuine—meaning your POA is more ironclad.

What is a medical and durable power of attorney in Hawaii?

A Hawaii (HI) Medical Powers of Attorney (MPOA) gives you the power to determine who will make health care decisions for you if you can no longer do so due to illness or injury. The person you choose is called an agent and only gets to make choices for your healthcare if you are physically unable to do so.

What is a special power of attorney for closing on real estate Illinois?

An Illinois real estate power of attorney form is designed for the specific purpose of enabling an attorney-in-fact to close on a sale, purchase, or refinance a property. The selected representative will be able to sign on behalf of the principal and collect any applicable funds.

What is a durable general power of attorney in Hawaii?

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself.

Who can use special power of attorney?

A Special Power of Attorney is normally executed when the principal is unable to manage his affairs & decide on his own and will need an agent to act on his behalf. However, it may also be executed even if the principal is not incapacitated and just wishes to appoint an agent to manage his affairs.

How do I get a special power of attorney in Hawaii?

Steps for Making a Financial Power of Attorney in Hawaii Create the POA Using a Statutory Form, Software, or Attorney. Sign the POA in the Presence of a Notary Public. Store the Original POA in a Safe Place. Give a Copy to Your Agent or Attorney-in-Fact. File a Copy With the Land Records Office.

Does a power of attorney need to be notarized in Hawaii?

Notarization Requirement While Hawaii does not technically require you to get your POA notarized, notarization is strongly recommended. Under Hawaii law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuine—meaning your POA is more ironclad.

Does power of attorney end at death in Hawaii?

You should select someone you trust to serve as your agent. Unless you specify otherwise, generally the agent's authority will continue until you die or revoke the power of attorney or the agent resigns or is unable to act for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get hawaii special or limited?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific hawaii special or limited and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my hawaii special or limited in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your hawaii special or limited and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit hawaii special or limited on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing hawaii special or limited.

What is hawaii special or limited?

Hawaii special or limited refers to specific forms of taxation and regulations that apply to certain businesses or entities operating in Hawaii, often tailored for unique business structures or circumstances.

Who is required to file hawaii special or limited?

Entities such as partnerships, limited liability companies (LLCs), or any businesses that meet specific criteria set by the state of Hawaii may be required to file for special or limited tax treatment.

How to fill out hawaii special or limited?

To fill out Hawaii special or limited forms, businesses must gather necessary financial records, complete the required sections of the form, and submit it along with any supporting documentation as specified by the Hawaii Department of Taxation.

What is the purpose of hawaii special or limited?

The purpose of Hawaii special or limited filing is to ensure that certain businesses comply with state tax laws while benefiting from unique provisions designed for their circumstances, thereby fostering a favorable business environment.

What information must be reported on hawaii special or limited?

Businesses must report financial data, ownership information, specific deductions or credits claimed, and any other information mandated by the Hawaii tax authorities.

Fill out your hawaii special or limited online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hawaii Special Or Limited is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.