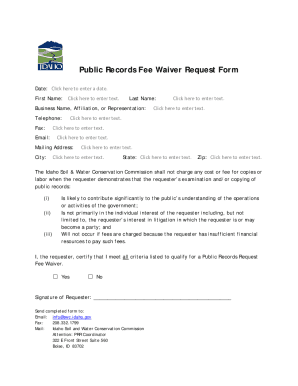

Get the free Audit (DEA)

Show details

Employees

SystemofRetirement

TexasDependent Eligibility

Audit (DEA)

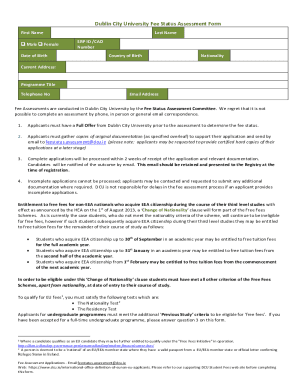

FREQUENTLY ASKED QUESTIONS1. Why is the Employees Retirement

System of Texas (ERS) conducting a

dependent eligibility audit?

As

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit dea

Edit your audit dea form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit dea form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit dea online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit audit dea. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit dea

How to fill out audit dea

01

Step 1: Gather all necessary financial documents and information

02

Step 2: Understand the purpose and requirements of the audit dea

03

Step 3: Review and analyze the financial statements

04

Step 4: Ensure compliance with the applicable accounting standards and regulations

05

Step 5: Complete the necessary forms and provide accurate information

06

Step 6: Submit the audit dea to the appropriate authority

07

Step 7: Cooperate with auditors and provide any additional requested documentation or explanations

08

Step 8: Review the audit dea findings and address any identified issues

09

Step 9: Make necessary adjustments to improve financial management and controls

10

Step 10: Maintain proper recordkeeping and documentation for future audits

Who needs audit dea?

01

Businesses and organizations required by law to undergo financial audits

02

Companies seeking to enhance transparency and build trust with stakeholders

03

Entities preparing for mergers, acquisitions, or IPOs

04

Government agencies ensuring compliance with financial regulations

05

Investors and shareholders evaluating the financial health and performance of a company

06

Lenders and financial institutions assessing creditworthiness

07

Non-profit organizations receiving public funding or grants

08

Entities involved in legal disputes requiring financial examination

09

Any business or organization interested in improving financial management and internal controls

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send audit dea for eSignature?

Once your audit dea is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit audit dea in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing audit dea and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete audit dea on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your audit dea from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is audit dea?

Audit DEA stands for Audit Data Envelopment Analysis. It is a process used to evaluate the efficiency and performance of organizations.

Who is required to file audit dea?

Businesses and organizations looking to assess their productivity and performance are required to file audit DEA.

How to fill out audit dea?

Audit DEA can be filled out by collecting data on inputs and outputs, calculating efficiency scores, and identifying areas for improvement.

What is the purpose of audit dea?

The purpose of audit DEA is to help organizations identify inefficiencies, set performance benchmarks, and improve overall productivity.

What information must be reported on audit dea?

Information such as input data, output data, efficiency scores, and recommendations for improvement must be reported on audit DEA.

Fill out your audit dea online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Dea is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.