Get the free Foreign Bank and Financial Accounts Worksheet - Rick Wagner Tax ...

Show details

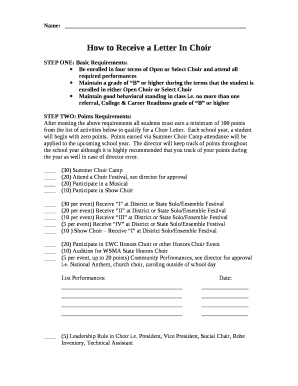

2013 Foreign Bank and Financial Accounts. FILER INFORMATION. U.S. Taxpayer identification ... City, State, Zip. INFORMATION ON FINANCIAL. ACCOUNT(S).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign bank and financial

Edit your foreign bank and financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign bank and financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foreign bank and financial online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit foreign bank and financial. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign bank and financial

How to fill out foreign bank and financial:

01

Start by gathering all the necessary documents required for opening an account or applying for financial services at a foreign bank. This may include identification documents, proof of address, and financial statements.

02

Research and identify the specific bank or financial institution where you want to open an account or seek services. Make sure they offer the services you require and understand any specific requirements for foreigners.

03

Contact the chosen bank or financial institution to inquire about the application process. They will provide you with the necessary forms and instructions on how to proceed.

04

Carefully fill out the application forms, ensuring that all information is accurate and complete. Pay special attention to providing your personal details, financial information, and any additional information required by the bank.

05

Double-check the documentation required to be submitted along with the application. This may include copies of identification documents, bank statements, and proof of income or employment.

06

Once you have completed the forms and gathered all the necessary documents, submit the application to the foreign bank or financial institution. Some banks may require you to apply online, while others may have physical branches where you can submit the application in person.

07

Wait for the bank or financial institution to process your application. This may take some time, so be patient and follow up if required.

Who needs foreign bank and financial:

01

Individuals who frequently travel or live abroad may benefit from having a foreign bank account. It allows them to conveniently manage their finances while overseas, including transferring funds, making payments, and accessing local currency.

02

Expatriates or international students who are temporarily residing in a foreign country may find it useful to have a local bank account. It simplifies financial transactions, such as receiving salary or stipends, paying bills, and accessing banking services in the local currency.

03

Businesses with global operations or those expanding into international markets often require foreign bank accounts to facilitate transactions, manage cash flow, and conduct business with overseas clients or suppliers.

04

Investors diversifying their portfolio internationally may need access to foreign financial services such as brokerage accounts, investment funds, or offshore banking to take advantage of different investment opportunities and jurisdictions.

05

Individuals seeking to take advantage of tax benefits or to protect assets through offshore banking or financial services may also consider establishing foreign accounts.

In summary, filling out foreign bank and financial applications requires gathering necessary documents, researching the chosen institution, completing application forms accurately, and submitting them along with the required documentation. Different individuals, including frequent travelers, expatriates, businesses, investors, and those seeking tax benefits or asset protection, may have various needs for foreign bank and financial services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is foreign bank and financial?

Foreign bank and financial refers to any financial account located outside of the country where the account holder resides.

Who is required to file foreign bank and financial?

Individuals and entities who meet the threshold requirements set by the government are required to file foreign bank and financial reports.

How to fill out foreign bank and financial?

Foreign bank and financial reports can be filled out electronically through the appropriate government agency's website or through paper forms that can be submitted by mail.

What is the purpose of foreign bank and financial?

The purpose of foreign bank and financial reporting is to prevent tax evasion and ensure compliance with reporting requirements for offshore accounts.

What information must be reported on foreign bank and financial?

Information such as the account holder's name, address, account number, and the maximum balance in the account during the reporting period must be reported.

How do I modify my foreign bank and financial in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your foreign bank and financial and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in foreign bank and financial?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your foreign bank and financial to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete foreign bank and financial on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your foreign bank and financial by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your foreign bank and financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Bank And Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.