Get the free Default Risk and Efficiency Nexus: Evidence from Banking Sector of Pakistan

Show details

Default Risk and Efficiency Nexus: Evidence from Banking Sector of Pakistan ALUM ZARA MMS143078 MS. Scholars research thesis submitted to the Department of Management & Social Sciences, Capital University

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign default risk and efficiency

Edit your default risk and efficiency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your default risk and efficiency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing default risk and efficiency online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit default risk and efficiency. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out default risk and efficiency

How to fill out default risk and efficiency

01

To fill out default risk, you need to assess the likelihood of a borrower defaulting on their loan.

02

First, gather information about the borrower's credit history, income, and financial statements.

03

Evaluate the borrower's credit score and creditworthiness.

04

Consider the borrower's debt-to-income ratio and their ability to make timely payments.

05

Assess any collateral or assets offered as security for the loan.

06

Analyze industry trends and economic indicators that may impact the borrower's ability to repay.

07

Summarize the findings and assign a default risk rating to the borrower.

08

To fill out efficiency, you need to measure how effectively resources are used.

09

Identify the input resources used in a process or operation.

10

Collect data on the output or results achieved from those resources.

11

Calculate the efficiency ratio by dividing the output by the input.

12

Benchmark against industry standards or previous performance to gauge efficiency.

13

Analyze the factors affecting efficiency and identify areas for improvement.

14

Develop and implement strategies to enhance efficiency based on the analysis.

15

Monitor and regularly evaluate efficiency to ensure ongoing improvements.

Who needs default risk and efficiency?

01

Banks and financial institutions need default risk assessment to make informed lending decisions and manage their loan portfolios.

02

Investors need default risk information to assess the creditworthiness of potential investments and manage risk in their portfolios.

03

Credit rating agencies need default risk assessment to provide credit ratings for companies and government entities.

04

Insurance companies need default risk assessment to determine premiums and assess risk levels for underwriting.

05

Regulatory authorities use default risk assessment to monitor and supervise financial institutions and ensure stability in the financial system.

06

Companies and corporations use default risk assessment to evaluate the creditworthiness of suppliers and business partners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my default risk and efficiency in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your default risk and efficiency along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I modify default risk and efficiency without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your default risk and efficiency into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I fill out the default risk and efficiency form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign default risk and efficiency and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

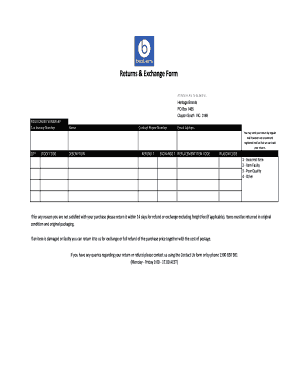

What is default risk and efficiency?

Default risk is the likelihood that a borrower will fail to make required payments. Efficiency refers to the ability to achieve a specific outcome with minimum wasted effort or expense.

Who is required to file default risk and efficiency?

Financial institutions and lenders are typically required to file default risk and efficiency reports with regulatory authorities.

How to fill out default risk and efficiency?

Default risk and efficiency reports are usually filled out by analyzing historical data, forecasting future trends, and assessing current market conditions.

What is the purpose of default risk and efficiency?

The purpose of default risk and efficiency reports is to assess the stability and performance of financial institutions and lenders, and to identify potential risks to the financial system.

What information must be reported on default risk and efficiency?

Information such as loan performance data, credit scores, loss reserves, and risk management strategies must be reported on default risk and efficiency reports.

Fill out your default risk and efficiency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Default Risk And Efficiency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.