R-1331 2013-2025 free printable template

Show details

R-1331 (8/13) Boat Registration Tax Payment Certification Louisiana Department of Revenue Louisiana Department of Wildlife and Fisheries Please print or type. Failure to complete this certificate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign r 1331 form

Edit your r 1331 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your r 1331 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit r 1331 form online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit r 1331 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out r 1331 form

How to fill out R-1331

01

Gather all necessary documents and information related to the form.

02

Start by entering your personal details in the designated fields.

03

Fill out the sections requiring financial information accurately.

04

Provide any relevant identification numbers as required.

05

Review all entries for clarity and accuracy.

06

Sign and date the form at the designated area.

07

Submit the completed form as per the instructions provided.

Who needs R-1331?

01

Individuals or businesses required to report specific information for regulatory compliance.

02

Entities seeking to apply for benefits or permits that require the R-1331 form.

03

Those involved in reporting financial information to relevant authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is year to date income on W-2?

Year-to-date earnings, as it appears on an employee's payroll records, includes the gross amount of all actual payments made to or on behalf of the employee. It does not include payments that have been earned but not yet paid, such as a bonus that is normally paid in a later period towards the end of the year.

How many years is a W-2?

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

When should I get my W-2 this year?

January 31st is the deadline to distribute Forms W-2 to employee(s).

What is a W-2 at the end of the year?

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck.

What date is W-2 available?

January 31st is the deadline to file W-2s using Business Services Online or to submit paper Form W-2. If this date falls on a Saturday, Sunday, or legal holiday, the deadline will be the next business day. January 31st is the deadline to distribute Forms W-2 to employee(s).

What day does W-2 come out 2023?

Regarding the W-2 Form Deadline for federal income tax, your employer should issue W-2 Forms to you no later than Jan. 31, 2023. If you don't receive your W-2 by the W-2 Form Deadline, ask your employer for it.

Do you have to fill out a W-2 for every job?

Any worker who is as an employee (rather than a contractor, for example) must receive Form W-2, no matter how much or little he works or how he is paid, such as through salary, wages or bonuses. The W-2 is the only primary document that holds both the Social Security number and the Medicare wages paid for a tax year.

What is year on W-2 form?

How come? Your W-2 does not reflect your fiscal year salary; it reflects taxable, calendar year wages. The fiscal dates that your W-2 covers are from 12/16/21 – 6/30/22 (13 pay periods) and 07/01/22 – 12/15/22 (11 pay periods).

How often should I get a W-2?

You should receive a W-2 Form every year from your employer, who will prepare the document for you. You should only receive a W-2 Form if you are an employee.

Do you fill out a W-2 every year?

Employees can fill out a new W-4 if their personal or financial situation changes and they want to adjust their withholding allowances as a result. W-2 form: You must file a W-2 for every employee, every year, no later than Jan. 31. The W-2 reflects data from the previous year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my r 1331 form directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your r 1331 form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for the r 1331 form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your r 1331 form.

How do I complete r 1331 form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your r 1331 form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

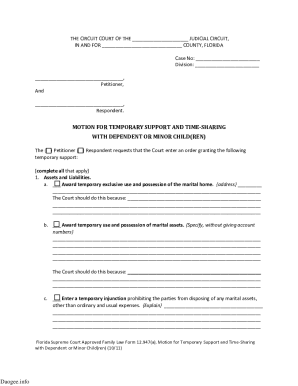

What is R-1331?

R-1331 is a specific form used for reporting certain financial or administrative information, typically required by a governmental or regulatory body.

Who is required to file R-1331?

Entities required to file R-1331 generally include businesses, organizations, or individuals who meet specific criteria set by the regulatory authority overseeing the form.

How to fill out R-1331?

To fill out R-1331, follow the instructions provided with the form, which typically entail providing personal or organizational details, financial data, and any additional information requested in the designated sections.

What is the purpose of R-1331?

The purpose of R-1331 is to collect essential data for regulatory compliance, assessment, or oversight, ensuring that entities adhere to necessary legal and financial requirements.

What information must be reported on R-1331?

Information reported on R-1331 usually includes identification details of the filer, financial statements, operational data, and any other specific disclosures required by the governing authority.

Fill out your r 1331 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

R 1331 Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.