Get the free Salary Deferral Agreement - Roth

Show details

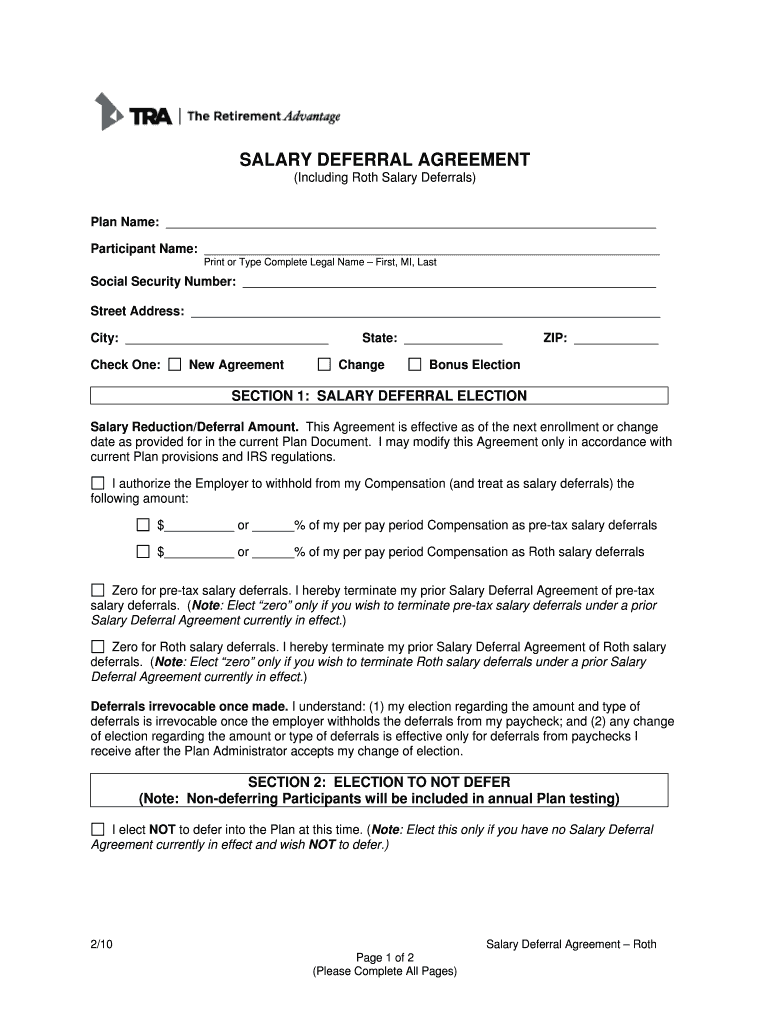

SALARY DEFERRAL AGREEMENT (Including Roth Salary Deferrals) Plan Name: Participant Name: Print or Type Complete Legal Name First, MI, Last Social Security Number: Street Address: City: Check One:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary deferral agreement

Edit your salary deferral agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary deferral agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary deferral agreement online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit salary deferral agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary deferral agreement

How to fill out a salary deferral agreement:

01

Review the agreement: Read through the entire salary deferral agreement to familiarize yourself with its terms and conditions. Take note of any specific deadlines or requirements.

02

Gather necessary information: Collect all the required information and documents to complete the agreement. This may include your personal information, employee identification, employer details, and any information related to the deferral amount or percentage.

03

Understand the deferral terms: Make sure you understand the terms and conditions related to salary deferral, such as the duration of the deferral period, any penalties or fees for early withdrawal, and the tax implications associated with deferred income.

04

Consult with a financial advisor or tax professional: If you have any questions or concerns about the salary deferral agreement, it's advisable to seek advice from a financial advisor or tax professional. They can provide guidance on the potential benefits and drawbacks of deferring your income and help you make an informed decision.

05

Complete the agreement accurately: Fill out the salary deferral agreement form accurately and legibly. Double-check all the information you provide to ensure its accuracy. If necessary, have someone else review the agreement before submission to ensure it is properly filled out.

06

Obtain necessary signatures: Once you have completed the agreement, make sure all required parties sign the document. This may include your employer's representative, yourself, and possibly a witness. Ensure that all signatures are obtained before moving forward with the deferral.

07

Keep a copy for your records: Make a photocopy or digital scan of the completed and signed salary deferral agreement for your records. It's important to have a copy for future reference or any potential disputes that may arise.

Who needs a salary deferral agreement?

A salary deferral agreement is typically used in situations where individuals wish to defer a portion of their salary or income to a future date. This agreement is commonly utilized by employees who have the option to participate in a deferred compensation plan offered by their employer. It can be particularly beneficial for those looking to save for retirement or wanting to delay receiving taxable income to potentially lower their overall tax liability. However, whether someone needs a salary deferral agreement will depend on their specific financial goals, employment situation, and eligibility for such plans. It is advisable to consult with a financial advisor or tax professional to determine if a salary deferral agreement is suitable for your circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the salary deferral agreement in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your salary deferral agreement in seconds.

Can I create an eSignature for the salary deferral agreement in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your salary deferral agreement right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit salary deferral agreement on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute salary deferral agreement from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is salary deferral agreement?

A salary deferral agreement is an arrangement where an employee agrees to defer a portion of their salary to a future date, usually retirement, in exchange for certain tax benefits.

Who is required to file salary deferral agreement?

Employers who offer salary deferral plans to their employees are required to file salary deferral agreements.

How to fill out salary deferral agreement?

To fill out a salary deferral agreement, both the employer and employee must agree on the terms of the deferral and sign the agreement.

What is the purpose of salary deferral agreement?

The purpose of a salary deferral agreement is to allow employees to save for retirement in a tax-efficient manner.

What information must be reported on salary deferral agreement?

The salary deferral agreement must include the amount of salary being deferred, the date the deferral begins, and any conditions or restrictions associated with the deferral.

Fill out your salary deferral agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Deferral Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.