CO Sales Tax Return - Town of Parker 2016-2025 free printable template

Show details

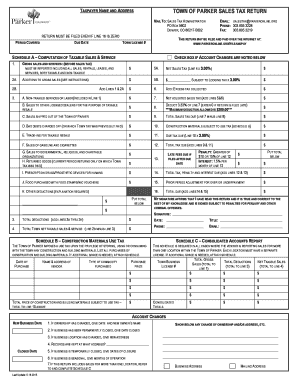

TOWN OF PARKER SALES TAX RETURNTAXPAYER NAME AND ADDRESSABLE TO: SALES TAX ADMINISTRATION PO BOX 5602 DENVER, CO 802175602 RETURN MUST BE FILED EVEN IF LINE 16 IS ZERO PERIOD COVERED DATEEMAIL: SALESMAN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign colorado sales tax return print form

Edit your colorado sales tax return form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado sales tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit colorado sales tax return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit colorado sales tax return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO Sales Tax Return - Town of Parker Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out colorado sales tax return

How to fill out town of parker sales

01

Prepare all the necessary documents including the sales form and any supporting documentation.

02

Ensure that you have all the required information about the transaction including the buyer and seller details, item details, and sale date.

03

Obtain the official Town of Parker sales form from the designated authorities or website.

04

Carefully fill out all the required fields in the sales form including the buyer's and seller's names, addresses, and contact information.

05

Provide accurate information regarding the item being sold, including its description, quantity, condition, and any applicable serial numbers.

06

Include any additional supporting documentation, such as invoices or receipts, if required.

07

Double-check all the provided information to ensure accuracy and completeness.

08

Submit the filled out sales form and supporting documentation to the appropriate Town of Parker department or office.

09

Pay any required fees or taxes associated with the sales form submission.

10

Keep a copy of the filled out sales form and supporting documentation for your records.

Who needs town of parker sales?

01

Individuals or businesses located within the jurisdiction of the Town of Parker who engage in sales transactions.

02

Sellers involved in the sale of goods or services within the Town of Parker.

03

Buyers who require proof of purchase or sales documentation for legal or tax purposes within the Town of Parker.

04

Any individual or entity requested by the Town of Parker authorities or regulatory bodies to provide sales documentation.

Fill

form

: Try Risk Free

People Also Ask about

What form is used for Florida use tax?

Once registered, you will be sent a Certificate of Registration (Form DR-11), a Florida Annual Resale Certificate for Sales Tax (Form DR-13), and tax return forms. If you are registered to pay use tax only, you will not receive a resale certificate.

What is Parker sales tax?

The minimum combined 2023 sales tax rate for Parker, Colorado is 8%. This is the total of state, county and city sales tax rates.

What is Parker City tax?

The 8% sales tax rate in Parker consists of 2.9% Colorado state sales tax, 1% Douglas County sales tax, 3% Parker tax and 1.1% Special tax. You can print a 8% sales tax table here. For tax rates in other cities, see Colorado sales taxes by city and county.

How do I report use tax in Florida?

Individuals: Individuals who owe use tax in Florida may report it on their annual income tax return. Businesses: With no sales tax permit: Should report on annual Florida income tax statement. With ongoing use tax to file: Should report per assigned Florida sales tax filing frequency.

What is the DR 1 form in Florida?

Registration Application for Secondhand Dealers and/or Secondary Metals Recyclers (Form DR-1S) – if you consign, buy or sell secondhand goods, or if you obtain, purchase or convert ferrous or nonferrous metals into raw material products.

What is the sales tax in 80134?

What is the sales tax rate for the 80134 ZIP Code? The estimated 2023 sales tax rate for 80134 is 5%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete colorado sales tax return online?

pdfFiller has made it easy to fill out and sign colorado sales tax return. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the colorado sales tax return in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your colorado sales tax return right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit colorado sales tax return on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing colorado sales tax return.

What is town of parker sales?

Town of Parker sales refer to the sales tax collected by businesses operating within the town limits of Parker, Colorado.

Who is required to file town of parker sales?

Businesses that operate within the town limits of Parker, Colorado are required to file town of Parker sales.

How to fill out town of parker sales?

Town of Parker sales can be filled out online through the town's official website or by using paper forms provided by the town government.

What is the purpose of town of parker sales?

The purpose of town of Parker sales is to generate revenue for the town government to support local services and infrastructure.

What information must be reported on town of parker sales?

Businesses must report the total amount of sales made within the town limits, as well as any applicable sales tax collected.

Fill out your colorado sales tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Sales Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.