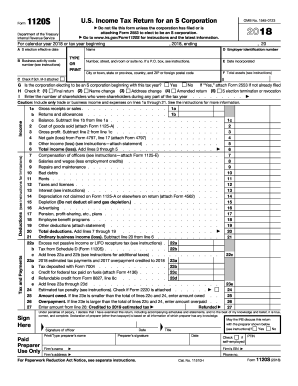

IRS 8582 2017 free printable template

Show details

Worksheet 1 For Form 8582 Lines 1a 1b and 1c See instructions. Current year Name of activity a Net income line 1a Prior years b Net loss Overall gain or loss c Unallowed loss line 1c d Gain e Loss Total. Enter on Form 8582 lines 1a 1b and 1c. Deductions line 2a unallowed deductions line 2b c Overall loss line 3b Worksheet 4 Use this worksheet if an amount is shown on Form 8582 line 10 or 14 See instructions. For Paperwork Reduction Act Notice see instructions. Cat. No. 63704F Form 8582 2017 Page...2 Caution The worksheets must be filed with your tax return. Keep a copy for your records. Form Department of the Treasury Internal Revenue Service 99 Passive Activity Loss Limitations See OMB No* 1545-1008 to Form 1040 or Form 1041. Go to www*irs*gov/Form8582 for instructions and the latest information* Name s shown on return Part I separate instructions. Attach Attachment Sequence No* 88 Identifying number 2017 Passive Activity Loss Caution Complete Worksheets 1 2 and 3 before completing Part...I. Rental Real Estate Activities With Active Participation For the definition of active participation see Special Allowance for Rental Real Estate Activities in the instructions. 1a Activities with net income enter the amount from Worksheet 1 column a. 1a b. 1b c Prior years unallowed losses enter the amount from Worksheet 1 1c d Combine lines 1a 1b and 1c. Commercial Revitalization Deductions From Rental Real Estate Activities 2a Commercial revitalization deductions from Worksheet 2 column a....2a 2b Worksheet 2 column b. c Add lines 2a and 2b. All Other Passive Activities 3a 3b c. 3c. 1d 2c 3d your return all losses are allowed including any prior year unallowed losses entered on line 1c 2b or 3c* Report the losses on the forms and schedules normally used. If line 4 is a loss and Line 1d is a loss go to Part II. Line 2c is a loss and line 1d is zero or more skip Part II and go to Part III. Caution If your filing status is married filing separately and you lived with your spouse at any...time during the year do not complete Part II or Part III. Instead go to line 15. Note Enter all numbers in Part II as positive amounts. See instructions for an example. Enter the smaller of the loss on line 1d or the loss on line 4. Enter 150 000. If married filing separately see instructions. Enter modified adjusted gross income but not less than zero see instructions Note If line 7 is greater than or equal to line 6 skip lines 8 and 9 enter -0- on line 10. Otherwise go to line 8. Subtract line...7 from line 6. Multiply line 8 by 50 0. 50. Do not enter more than 25 000. If married filing separately see instructions Enter 25 000 reduced by the amount if any on line 10. If married filing separately see instructions Enter the loss from line 4. Reduce line 12 by the amount on line 10. Total Losses Allowed Add the income if any on lines 1a and 3a and enter the total. instructions to find out how to report the losses on your tax return. Form or schedule and line number to be reported on see...instructions Total a Loss b Ratio c Special allowance d Subtract column c from column a Worksheet 5 Allocation of Unallowed Losses See instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8582

How to edit IRS 8582

How to fill out IRS 8582

Instructions and Help about IRS 8582

How to edit IRS 8582

To edit IRS 8582, first download the form in a compatible format. Utilize pdfFiller tools to add or modify any necessary fields. Ensure that all adjustments comply with IRS guidelines and save the edited form for submission.

How to fill out IRS 8582

To fill out IRS 8582, begin by entering your personal information at the top of the form, including your name, Social Security number, and tax year. Proceed to report any passive activity income or losses, providing accurate dollar amounts as instructed. Double-check all entries for accuracy before submission.

About IRS 8 previous version

What is IRS 8582?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8582?

IRS 8582 is the Tax Form used for reporting Passive Activity Loss Limitations. This form allows taxpayers to calculate losses from passive activities and determine how much of these losses can be deducted against other income.

What is the purpose of this form?

The primary purpose of IRS 8582 is to ensure that taxpayers accurately report passive activity losses in accordance with federal tax laws. By using this form, the IRS can verify that deductions taken are legitimate and within allowable limits.

Who needs the form?

Taxpayers who have participated in passive activities, such as rental properties or certain business ventures, must file IRS 8582 if they wish to claim losses from these activities on their income tax return. This includes individuals, estates, and trusts with qualifying passive income and losses.

When am I exempt from filling out this form?

You are exempt from filing IRS 8582 if you do not have any passive activity income, if all your passive losses are fully deductible without the need for adjustment, or if you qualify for special exempt categories. Always review the IRS guidelines to confirm your eligibility for exemption.

Components of the form

IRS 8582 consists of multiple sections, including a summary of passive income and losses, calculations to determine the deductible portion of losses, and spaces for reporting specific activity details. Each section must be completed carefully to ensure compliance with tax regulations.

What are the penalties for not issuing the form?

Failing to file IRS 8582 when required can result in substantial penalties from the IRS. Not only might you lose the ability to claim passive losses, but you may also face late filing fees and potential interest accrued on unpaid taxes.

What information do you need when you file the form?

When filing IRS 8582, gather all pertinent financial information related to your passive activities. This includes records of income, loss amounts, and any other supporting documents showing the nature of the activities and their classification as passive.

Is the form accompanied by other forms?

IRS 8582 may need to be submitted along with your main tax return filing, typically IRS Form 1040. Depending on your specific situation, you might also have to include additional forms, such as IRS Schedule E for rental income or losses.

Where do I send the form?

The completed IRS 8582 should be submitted with your income tax return. The mailing address depends on your specific tax situation and whether you are filing electronically or by mail. Consult the IRS guidelines for the correct address based on your filing method.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

So far so good. Not sure all what it has to offer.

Way above expectations. There were features I did not anticipate getting with this software.

See what our users say