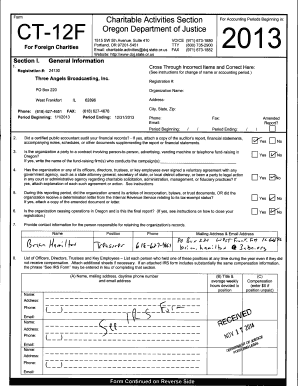

IRS 1094-C 2017 free printable template

Instructions and Help about IRS 1094-C

How to edit IRS 1094-C

How to fill out IRS 1094-C

About IRS 1094-C 2017 previous version

What is IRS 1094-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 1094 c 2017 form

How do I modify my [SKS] in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your [SKS] along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit [SKS] online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your [SKS] to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in [SKS] without leaving Chrome?

[SKS] can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

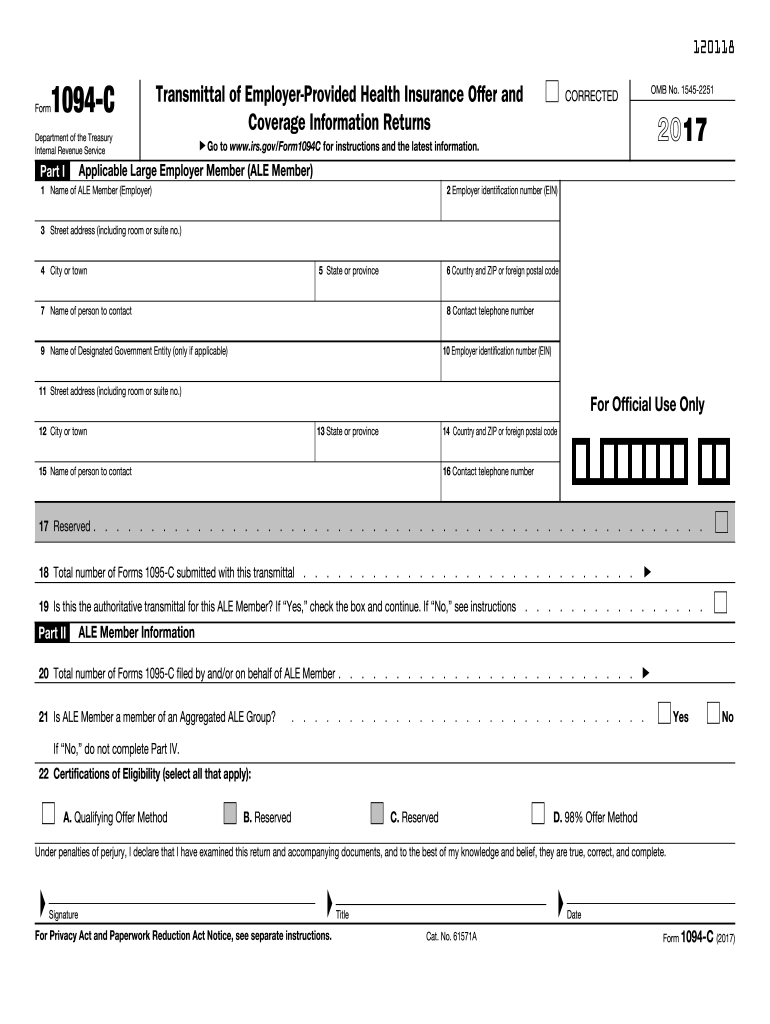

What is IRS 1094-C?

IRS 1094-C is a transmittal form used by applicable large employers to report information about their health insurance offerings to the IRS as part of the Affordable Care Act (ACA) requirements.

Who is required to file IRS 1094-C?

Applicable large employers, defined as those with 50 or more full-time equivalent employees, are required to file IRS 1094-C. This includes those who offer health insurance coverage to their employees.

How to fill out IRS 1094-C?

To fill out IRS 1094-C, you need to provide basic information about your business, including your name, Employer Identification Number (EIN), and the number of full-time employees. You also need to report information regarding the health coverage provided to employees.

What is the purpose of IRS 1094-C?

The purpose of IRS 1094-C is to provide the IRS with a summary of the health insurance coverage offered by an applicable large employer. This helps the IRS determine compliance with the ACA mandates.

What information must be reported on IRS 1094-C?

The information that must be reported includes the employer's identification information, a count of full-time employees, details about the health coverage offered, and any other relevant data that indicates compliance with ACA requirements.