Get the free Year-End Tax Planning Information Check List Year to Date bpayb bb

Show details

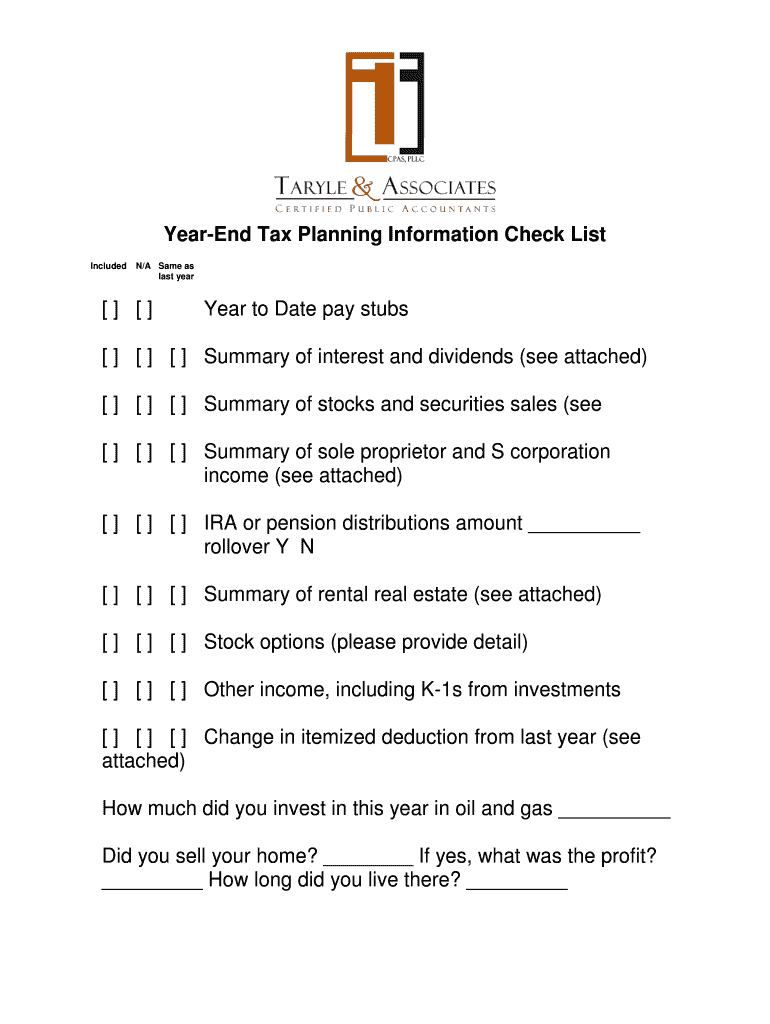

YearEnd Tax Planning Information Check List Included N/A Same as last year to Date pay stubs Summary of interest and dividends (see attached) Summary of stocks and securities sales (see Summary of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign year-end tax planning information

Edit your year-end tax planning information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your year-end tax planning information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing year-end tax planning information online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit year-end tax planning information. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out year-end tax planning information

How to fill out year-end tax planning information?

01

Start by gathering all relevant financial documents, such as income statements, expense reports, investment statements, and any other information related to your finances for the year. Organize them in a systematic way to make the process easier.

02

Review your income and expenses for the year to identify any potential deductions or credits that you may be eligible for. This may include business expenses, education expenses, medical expenses, or charitable contributions. Ensure that you have proper documentation to support these claims.

03

Consider optimizing your retirement savings by maximizing contributions to your retirement accounts, such as IRAs or 401(k)s. These contributions can provide tax benefits while helping you secure your financial future.

04

Analyze your investment portfolio and consider any capital gains or losses that you may have incurred during the year. You may want to coordinate with a financial advisor to determine the best tax strategies to minimize your tax liability while making the most of your investments.

05

Assess any changes in your personal circumstances that may affect your tax situation, such as marriage, divorce, birth of a child, or any other significant life events. These changes may have implications for your tax filing status, deductions, or credits.

06

Consider consulting with a tax professional or using tax preparation software to ensure accurate and efficient completion of your year-end tax planning information. They can help navigate through complex tax laws and maximize your deductions while minimizing errors.

Who needs year-end tax planning information?

01

Individuals who earn income and are required to file taxes need year-end tax planning information. Whether you are self-employed, an employee, or a retiree, understanding your tax obligations and opportunities for deductions can help you optimize your tax return.

02

Small business owners and entrepreneurs should also pay attention to year-end tax planning. Proper tax planning can help reduce the tax liability of your business and ease the burden of tax filing.

03

Investors with significant investments or those who frequently engage in buying and selling securities should consider year-end tax planning. Careful consideration of capital gains and losses can have a significant impact on your overall tax liability.

04

Families and individuals with complex financial situations, such as multiple sources of income, rental properties, or investments in foreign assets, may benefit from year-end tax planning to ensure compliance with tax laws and optimize their tax position.

05

Those who anticipate major life events or changes in the upcoming year, such as starting a business, taking on a new job, buying or selling property, or retiring, should proactively engage in year-end tax planning to ensure a smooth transition and optimal tax outcomes.

Remember, tax laws and regulations can vary between jurisdictions, so it is advisable to seek professional advice or consult local tax authorities for specific guidance related to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete year-end tax planning information online?

pdfFiller has made it simple to fill out and eSign year-end tax planning information. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit year-end tax planning information online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your year-end tax planning information to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the year-end tax planning information in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your year-end tax planning information in seconds.

What is year-end tax planning information?

Year-end tax planning information refers to the process of reviewing one's financial situation at the end of the year to determine the best ways to minimize tax liability for the current tax year.

Who is required to file year-end tax planning information?

Anyone who has income during the tax year is required to file year-end tax planning information.

How to fill out year-end tax planning information?

Year-end tax planning information can be filled out manually or with the help of a tax professional. It involves reviewing income sources, deductions, credits, and other financial information to determine the best tax-saving strategies.

What is the purpose of year-end tax planning information?

The purpose of year-end tax planning information is to reduce tax liability by taking advantage of tax deductions, credits, and other tax-saving strategies before the end of the tax year.

What information must be reported on year-end tax planning information?

Income sources, deductions, credits, and other financial information must be reported on year-end tax planning information.

Fill out your year-end tax planning information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Year-End Tax Planning Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.