Get the free Letter of Credit Policy and Standard Letter of Credit Format

Show details

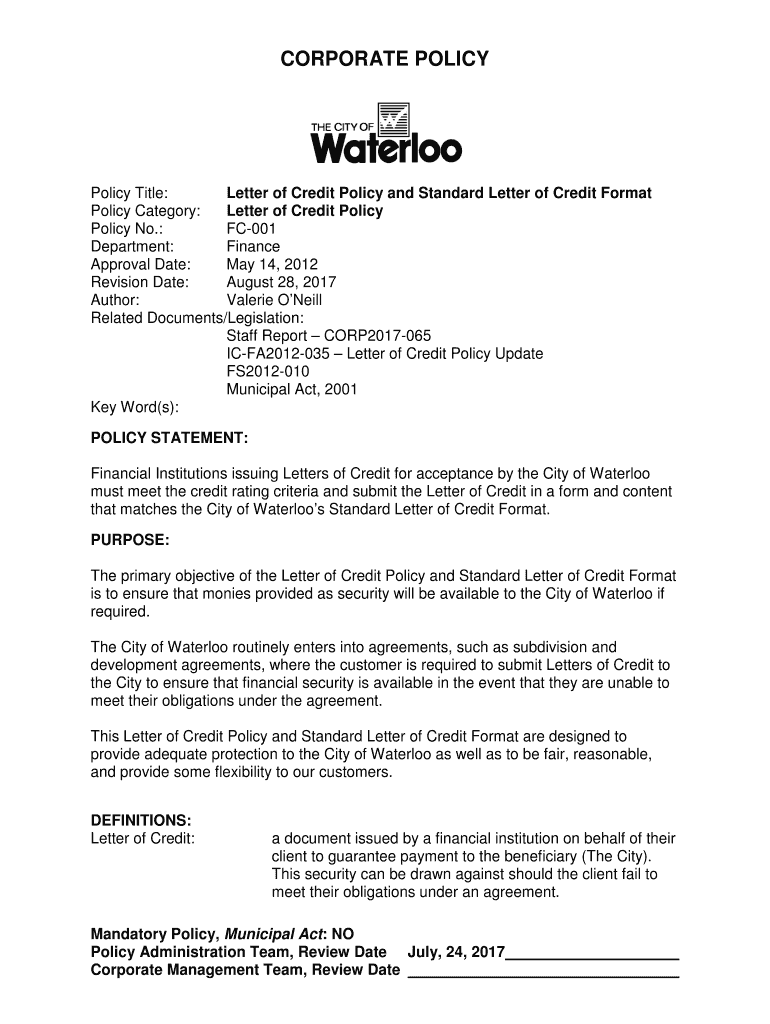

CORPORATE POLICYPolicy Title: Letter of Credit Policy and Standard Letter of Credit Format Policy Category: Letter of Credit Policy No.: FC001 Department: Finance Approval Date: May 14, 2012, Revision

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letter of credit policy

Edit your letter of credit policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letter of credit policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit letter of credit policy online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit letter of credit policy. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letter of credit policy

How to fill out letter of credit policy

01

Step 1: Start by gathering all the necessary information and documents required for the letter of credit policy.

02

Step 2: Clearly state the purpose of the policy and include all relevant details, such as the parties involved, the amount of coverage, and the designated beneficiary.

03

Step 3: Specify the terms and conditions of the policy, including the expiration date, payment terms, and any other relevant requirements.

04

Step 4: Provide a clear and concise description of the goods or services covered by the policy, including any applicable specifications or limitations.

05

Step 5: Include any necessary supporting documentation, such as invoices, bills of lading, or certificates of origin, to substantiate the policy.

06

Step 6: Review and double-check all the information provided in the policy to ensure accuracy and completeness.

07

Step 7: Submit the completed letter of credit policy to the appropriate party or institution for approval and processing.

08

Step 8: Follow up regularly to ensure the policy is processed in a timely manner and address any questions or concerns that may arise.

09

Step 9: Retain a copy of the policy for your records and be prepared to provide it when requested by relevant parties.

10

Step 10: Periodically review and update the policy as needed to reflect any changes in circumstances or requirements.

Who needs letter of credit policy?

01

Importers and exporters who engage in international trade often require letter of credit policies as a form of financial guarantee.

02

Banks and financial institutions also often need letter of credit policies to provide secure financing options for their clients.

03

Governments and regulatory bodies may require letter of credit policies to ensure compliance with trade regulations and protect against fraudulent activities.

04

Manufacturers and suppliers who want to mitigate the risk of non-payment or other financial losses may find letter of credit policies beneficial.

05

Large corporations and multinational companies often use letter of credit policies to facilitate complex trade transactions and reduce financial risks.

06

Small businesses that are new to international trade or have limited financial resources may rely on letter of credit policies to establish trust and secure payment.

07

Individuals or businesses involved in high-value transactions or dealing with unfamiliar trading partners may choose to use letter of credit policies to minimize financial risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify letter of credit policy without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including letter of credit policy. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the letter of credit policy form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign letter of credit policy and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit letter of credit policy on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as letter of credit policy. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is letter of credit policy?

Letter of credit policy is a document issued by a financial institution guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount.

Who is required to file letter of credit policy?

Any entity or individual involved in international trade transactions may be required to file a letter of credit policy.

How to fill out letter of credit policy?

To fill out a letter of credit policy, you must provide details of the transaction, including the amount, terms, and parties involved.

What is the purpose of letter of credit policy?

The purpose of a letter of credit policy is to ensure that both the buyer and seller in a transaction are protected and that payment is made in a timely manner.

What information must be reported on letter of credit policy?

Information such as the amount of the transaction, parties involved, terms of the agreement, and the financial institution issuing the letter of credit must be reported on the policy.

Fill out your letter of credit policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letter Of Credit Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.