Get the free Banking SARFAESI Act, Asset Reconstruction

Show details

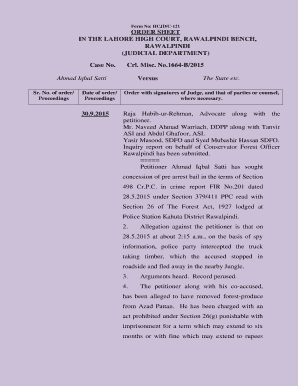

Rural Economy Articles Study plans Downloads Forum Banking SURFACES Act, Asset Reconstruction Company (ARC), Security Receipts (SR), RIB, DRT, Central Registry Economy2 years Ago111 Comments Bharat

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign banking sarfaesi act asset

Edit your banking sarfaesi act asset form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your banking sarfaesi act asset form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit banking sarfaesi act asset online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit banking sarfaesi act asset. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out banking sarfaesi act asset

How to fill out banking sarfaesi act asset

01

Read and understand the provisions of the Banking SARFAESI Act.

02

Identify the assets covered under the Act.

03

Gather all the necessary documents and information related to the asset.

04

Prepare the necessary legal notices as per the Act.

05

Issue the legal notices to the concerned parties.

06

Proceed with the necessary actions for recovery of outstanding dues.

07

Follow the legal process and guidelines mentioned in the Act for asset realization.

08

Ensure compliance with all the statutory requirements.

09

Monitor and supervise the progress of asset realization.

10

Complete all the necessary formalities and paperwork to finalize the asset realization.

Who needs banking sarfaesi act asset?

01

Banks and financial institutions who have non-performing assets (NPAs) need the Banking SARFAESI Act asset.

02

Creditors who are looking to recover their outstanding dues from defaulting borrowers can utilize the provisions of the Act.

03

Any entity or individual involved in the process of asset recovery and realization can benefit from the implementation of the Act.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my banking sarfaesi act asset in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your banking sarfaesi act asset along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit banking sarfaesi act asset in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your banking sarfaesi act asset, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the banking sarfaesi act asset electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your banking sarfaesi act asset in seconds.

What is banking sarfaesi act asset?

The banking sarfaesi act asset refers to assets that can be seized or sold by banks under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act) to recover unpaid dues.

Who is required to file banking sarfaesi act asset?

Banks and financial institutions are required to file banking sarfaesi act asset in case of default by borrowers.

How to fill out banking sarfaesi act asset?

Banks need to provide details of the asset, borrower, outstanding dues, and other relevant information in the prescribed format while filling out banking sarfaesi act asset.

What is the purpose of banking sarfaesi act asset?

The purpose of banking sarfaesi act asset is to enable banks to recover unpaid dues by selling or seizing assets of defaulting borrowers.

What information must be reported on banking sarfaesi act asset?

Details such as asset description, borrower information, outstanding dues, security interest, and actions taken by the bank must be reported on banking sarfaesi act asset.

Fill out your banking sarfaesi act asset online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Banking Sarfaesi Act Asset is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.