Get the free conforming loans san diego

Show details

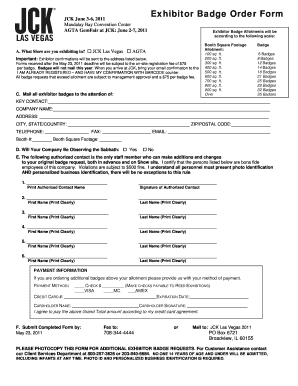

2017 Conforming Loan Limits

Southern California

In San Diego County, the Conforming loan limits are increasing from $580,750 to

$612,950 in 2017, that's more than $30,000!

1 Unit2 Units3 Units4 Units

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conforming loans san diego

Edit your conforming loans san diego form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conforming loans san diego form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit conforming loans san diego online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit conforming loans san diego. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conforming loans san diego

How to fill out conforming loans san diego

01

Gather all the necessary financial documents such as income statements, tax returns, and bank statements.

02

Contact a reputable lender in San Diego that offers conforming loans.

03

Schedule an appointment with the lender to discuss your financial situation and determine the loan amount you are eligible for.

04

Complete the loan application form provided by the lender.

05

Provide accurate information about your employment history, income, assets, and liabilities on the application form.

06

Submit all the required documents along with the application form.

07

Wait for the lender to review your application and conduct a thorough evaluation of your financial profile.

08

During the evaluation process, be prepared to provide any additional documents or information requested by the lender.

09

Once your application is approved, review the loan terms and conditions carefully.

10

Sign the loan agreement and any other required documents.

11

Coordinate with the lender to schedule the loan closing process.

12

Attend the loan closing meeting and bring any necessary funds for closing costs and down payment.

13

Carefully review all the loan documents before signing and ensure that all the details are accurate.

14

After signing the loan documents, wait for the lender to fund the loan.

15

Once the loan is funded, you will receive the agreed-upon loan amount to purchase your desired property.

16

Make sure to make timely payments on the loan amount according to the loan terms and conditions.

Who needs conforming loans san diego?

01

Homebuyers in San Diego who require a mortgage loan for purchasing a property.

02

Individuals who meet the eligibility criteria set by the conforming loan guidelines.

03

Borrowers who prefer a loan with lower interest rates and more flexible terms.

04

People who have a stable income and can demonstrate their ability to repay the loan.

05

Those who are looking to buy a property within the conforming loan limits set by the Federal Housing Finance Agency (FHFA).

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in conforming loans san diego without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing conforming loans san diego and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the conforming loans san diego in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your conforming loans san diego in minutes.

How do I edit conforming loans san diego straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing conforming loans san diego, you need to install and log in to the app.

What is conforming loans san diego?

Conforming loans in San Diego are mortgage loans that adhere to the guidelines set by Fannie Mae and Freddie Mac, including loan limits and borrower qualifications.

Who is required to file conforming loans san diego?

Lenders and financial institutions are required to file conforming loans in San Diego.

How to fill out conforming loans san diego?

To fill out conforming loans in San Diego, lenders need to gather all necessary financial and personal information from the borrower, including income, credit history, and employment status.

What is the purpose of conforming loans san diego?

The purpose of conforming loans in San Diego is to provide affordable financing options for home buyers that meet the standards set by Fannie Mae and Freddie Mac.

What information must be reported on conforming loans san diego?

Lenders must report detailed information about the loan amount, borrower's financial information, property details, and any other relevant data on conforming loans in San Diego.

Fill out your conforming loans san diego online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conforming Loans San Diego is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.