NEFE High School Financial Planning Program Task: Investment FAQs 2013-2025 free printable template

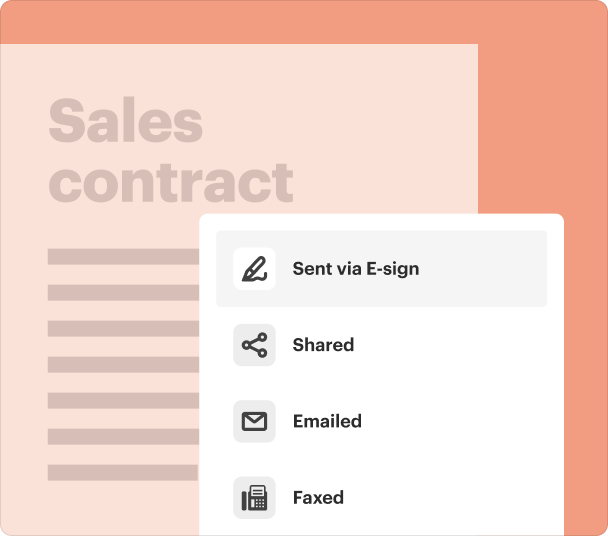

Fill out, sign, and share forms from a single PDF platform

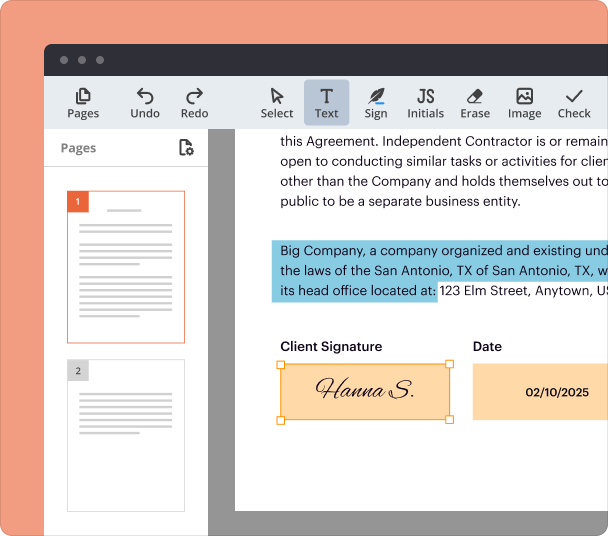

Edit and sign in one place

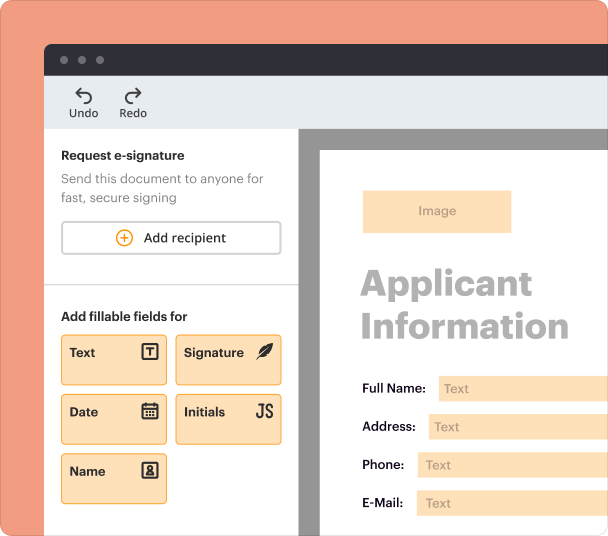

Create professional forms

Simplify data collection

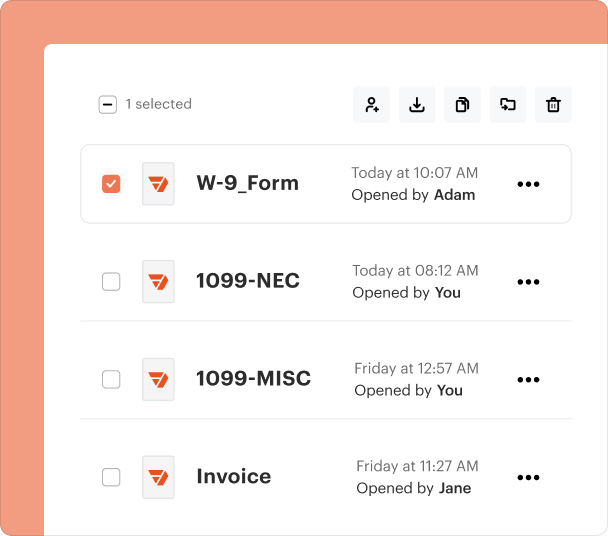

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to Fill Out the NEFE High School Financial Form

Filling out the NEFE High School Financial Form is a key step in understanding personal finance and budgeting. This guide provides actionable steps and resources to help students successfully complete the form while gaining valuable financial knowledge.

What is the NEFE High School Financial Form?

The NEFE High School Financial Form is an integral part of the National Endowment for Financial Education (NEFE) program, which aims to enhance financial literacy among high school students. Understanding this form is crucial as it serves to familiarize students with personal finance concepts, budgeting, and financial goal setting.

-

The NEFE program is designed to provide high school students with essential financial education that they can use in real-life scenarios, helping them make informed financial decisions.

-

The financial form assists students in assessing their financial situation, setting goals, and learning how to budget effectively.

-

The form introduces important finance concepts such as income, expenses, savings, and investments, fostering financial literacy.

How can you complete the form step-by-step?

Completing the NEFE financial form requires careful attention to detail. Start by filling out identifying information before moving on to financial aspects such as your financial goals and budgeting needs.

-

Accurately provide personal details, including your full name, address, and contact information.

-

Identify what you hope to achieve financially, such as saving for college or a new car.

-

List your income sources and monthly expenses to develop an effective budget.

-

Double-check all fields, and ensure you have signed and dated the form appropriately.

Which interactive tools are available on pdfFiller?

pdfFiller offers several interactive tools designed to enhance the form-filling experience. Utilizing these tools can streamline the process and increase collaboration among students.

-

pdfFiller allows users to modify the form as necessary, making it easier to update information or correct mistakes.

-

The platform provides electronic signature solutions that are legally compliant, ensuring your submissions are valid.

-

Students can work together on the form through pdfFiller, sharing insights and inputs in real time.

How can group research activities enhance learning?

Organizing students into small groups for research activities can significantly enhance their understanding of financial concepts. Assigning specific topics related to the NEFE curriculum fosters collaboration and deeper learning.

-

Students can be assigned different financial topics, allowing them to explore and present key concepts, such as stocks or insurance.

-

Setting clear research objectives helps students focus and structure their discussions effectively.

-

Students should document their findings and share insights through classroom presentations, enhancing peer learning.

What resources can help leverage investment education?

Accessing comprehensive educational materials is essential for enhancing investment knowledge. Resources integrated into the NEFE curriculum can guide students through key investment topics.

-

NEFE provides various websites and guides that help clarify complex investment concepts, making them accessible to students.

-

Encouraging students to use independent research fosters critical thinking and personal investment strategies.

How to engage in financial literacy discussions?

Fostering discussions on financial education is a vital aspect of the learning process. Engaging students in dialogue can uncover insights and encourage advocacy in promoting financial literacy.

-

Facilitating discussions about the lessons learned from filling out the NEFE form can enhance understanding.

-

Students can be encouraged to advocate for financial literacy within their communities, helping to spread awareness.

-

Using findings from group presentations can enrich the collective knowledge and facilitate deeper conversations.

What are the compliance requirements in financial education?

Understanding compliance aspects in financial education is essential for both educators and students. Financial literacy legislation varies across states, outlining specific educational requirements.

-

Familiarize yourself with the guidelines prescribed for financial education in your state to ensure compliance.

-

Each state may have different financial education requirements, making it crucial to understand them for effective teaching.

-

Organizations like the Consumer Financial Protection Bureau (CFPB) play a significant role in overseeing financial education standards.

Frequently Asked Questions about Nefe High School Financial Planning Program

What is the NEFE program?

The NEFE program is designed to improve financial literacy among high school students by providing a structured financial education curriculum. It emphasizes essential money management skills that students can use in their everyday lives.

How does the financial form help students?

The financial form helps students assess their financial situation, set goals, and learn how to budget. By engaging with the form, students gain practical skills that will benefit them in their future financial decision-making.

Can pdfFiller help with other forms?

Yes, pdfFiller can assist with many different document types beyond the NEFE financial form. With its editing and eSigning features, it's a comprehensive tool for managing various PDFs seamlessly.

What topics can students research together?

Students can explore a variety of finance-related topics such as investments, savings plans, budgeting strategies, and credit management. This collaborative research promotes deeper learning and fosters teamwork.

Why is financial literacy important?

Financial literacy is crucial as it empowers individuals to make informed financial decisions, thereby promoting economic stability. It equips students with the necessary skills to navigate financial challenges they will face in adulthood.

pdfFiller scores top ratings on review platforms